What is Bank Reconciliation?

Bank reconciliation is important in accounting. It makes sure that the bank statement matches the company’s records. Bank statements show all the transactions made, while internal records track the company’s money activities. By comparing these two, any mistakes can be found.

This helps keep financial information accurate and transparent. It also helps catch fraud or errors and allows companies to make good decisions with reliable data.

What are the Important Terms for Bank Reconciliation?

Understanding key terms is essential. Let’s dive into some important terminology that you should know:

Outstanding Checks

These are checks that you have written and recorded in your checkbook but have not yet cleared the bank. They are still waiting to be cashed by the recipient.

Deposits in Transit

Deposits in transit refer to funds that you have deposited but haven’t been credited to your account yet. This could happen if you make a deposit near the end of the month, and it takes a couple of days for the bank to process it.

NSF Checks

NSF stands for “non-sufficient funds.” An NSF check is a check that bounces because there isn’t enough money in your account to cover it. This can happen if you mistakenly write a check for more than what’s available in your account.

Bank Service Charges

Bank service charges are fees the bank charges for various services they provide, such as monthly maintenance or overdraft fees. Bank service fees can affect your account balance and must be accounted for during reconciliation.

Reconciling Items

Reconciling items are discrepancies between your records and the bank statement. These errors can include mistakes made in handling cash or recording transactions incorrectly in a bank account, such as missing entries.

What is the Bank Reconciliation Statement?

Bank reconciliation statements play a crucial role in ensuring that your financial records match the bank’s records. It helps you identify any discrepancies or differences between the business’s internal records and the bank statement, specifically related to cash.

Components of a Typical Bank Reconciliation Statement

A typical bank reconciliation statement includes several essential components:

- Ending Balance: This is the balance shown on the bank statement for a specific period.

- Adjusted Bank Balance: This is the ending balance adjusted for any outstanding deposits or withdrawals the bank has not yet recorded.

- Ending Book Balance: This is the balance shown in your accounting books, reflecting all transactions recorded internally.

- Bank Charges and Credits: These are additional charges or credits made by the bank that may not have been recorded in your books yet.

- Outstanding Checks: These are checks you issued but haven’t cleared at the bank yet.

- Deposits in Transit: These are deposits you made but haven’t been credited to your account by the bank yet.

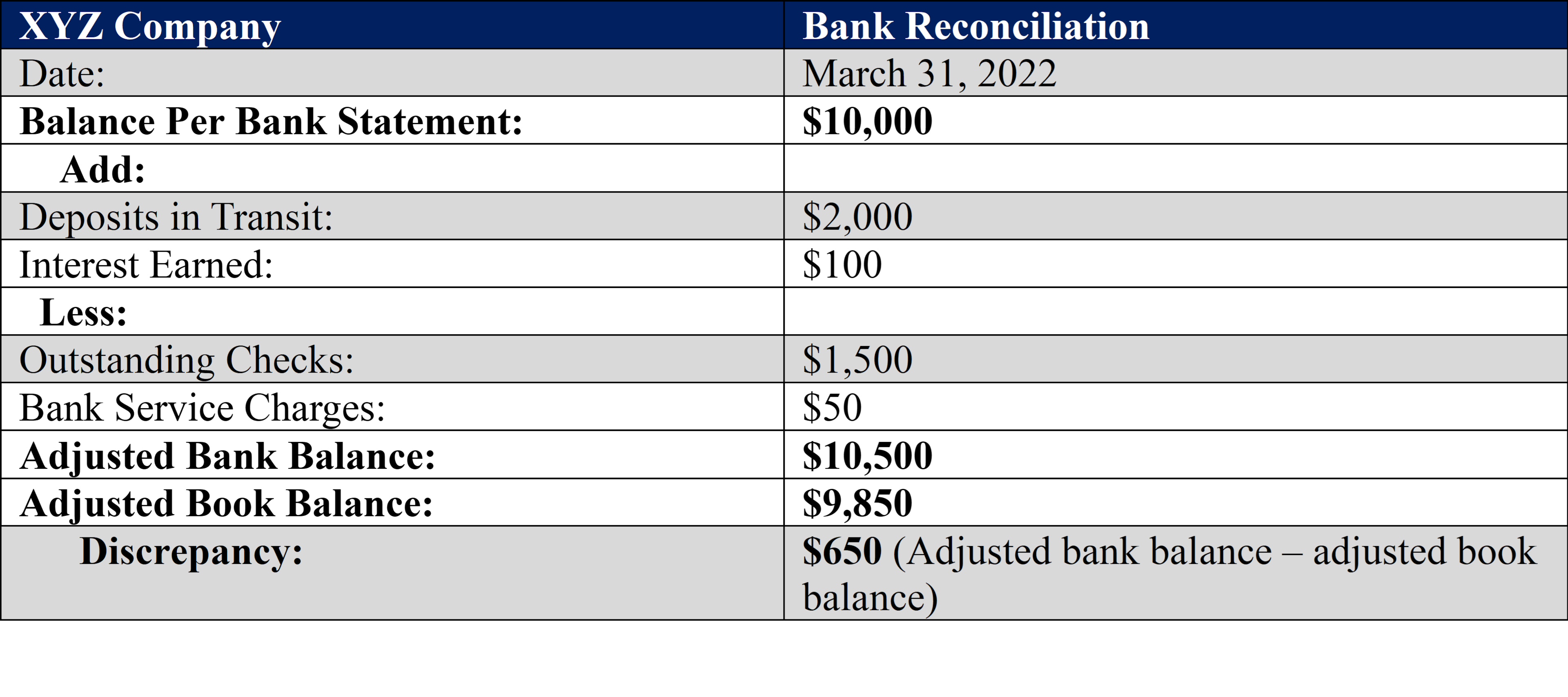

Example of a Bank Reconciliation Statement

Explanation of discrepancy:

There’s a $650 difference between the company’s bank account balance and book balance. Some cash deposits and checks haven’t been accounted for yet, which explains part of the difference. Adjustments are also made to the book balance, like adding interest earned and subtracting bank service charges. After all the adjustments, the bank balance is $10,500, and the book balance is $9,850. The $650 difference must be investigated and fixed by comparing the bank statement balance with the company’s records.

How do I conduct Bank Reconciliation?

Here are the important steps to take for bank reconciliation.

Step 1: Gathering Necessary Documents

The first step is to gather all the essential documents. These documents will help you compare your records with the bank’s and identify discrepancies. Here are some critical things to consider when gathering your paperwork:

- Bank Statements: Collect all your bank statements for the period you want to reconcile.

- Checkbooks: If you write checks for payments or expenses, have your checkbook handy. This allows you to cross-reference the checks issued with the cleared checks on your bank statement.

- Deposit Slips: If you make regular deposits into your account, keep track of these deposit slips.

- Receipts: Keep receipts for any company’s cash transactions or debit card purchases during the reconciliation period. These serve as evidence if there are any discrepancies between your records and those of the bank.

Step 2: Comparing Bank Statements with Internal Records

Now, compare your bank statements with your records. This ensures everything matches up and helps you find any mistakes that need to be considered.

Here are a few key points to keep in mind when comparing bank statements with internal records:

- Matching Transactions: Carefully review each transaction listed on the bank statement and find its corresponding entry in your financial records. Make sure all deposits and withdrawals are accounted for and correctly recorded.

- Highlighting Differences: Pay close attention to any differences between the two sets of records. These differences may include outstanding checks (checks that have been issued but not yet cleared by the bank), deposits that haven’t been credited, or unexpected bank charges. Further investigated discrepancies during the reconciliation process.

- Accuracy Check: Verify that the beginning balance on your bank statement matches the ending balance from the previous period’s reconciliation. If there is a discrepancy, it could indicate an error or omission in either your financial records or the bank’s reporting.

Step 3: Identifying and Investigating Discrepancies

To make sure your bank records are correct, it’s crucial to find and fix any mistakes. Here’s what you can do:

- Look for missing deposits or money taken out that wasn’t recorded. Check all transactions carefully.

- When you find a mistake, it’s really important to investigate it. It could mean someone made an error or even stole money from you. You can find any unauthorized charges or suspicious activity by looking closely at the differences between your records and the bank’s.

- Call your bank’s customer service if you need help figuring out a mistake. They can help fix problems with your account balance or transaction mistakes.

- Remember, keeping your bank records accurate is an ongoing job. Finding and fixing mistakes quickly ensures your money is safe and avoids problems later on.

Step 4: Adjusting the Cash Account Balance

You need to adjust your cash account balance when conducting a bank reconciliation. This means thinking about any checks or deposits that the bank hasn’t processed yet. If someone hasn’t cashed a check you wrote, you must subtract that money from your balance.

And if the bank hasn’t processed a deposit you made, you must add that money to your balance. These adjustments help you know how much money you really have in your accounts. It’s important for managing your money and keeping your financial records right.

Here are some key points about adjusting the cash account balance:

- Adjustments are made based on identified discrepancies between your records and the bank’s records.

- Examples of adjustments include recording outstanding checks or deposits not yet cleared by the bank.

- The goal is to accurately represent the actual cash balance after making these adjustments.

Step 5: Updating Internal Records and Bank Statement

It’s essential that you update the company’s records and the bank statement after finishing the bank reconciliation. This helps make sure they match up and show the correct transactions. Updating the records means making necessary changes in the accounting system to match what was reconciled.

Doing so lets the company know how much money it actually has. When the bank statement and internal records match, keeping track of payments and fixing any mistakes is easier.

Maintaining accurate financial records is vital for several reasons:

- Financial Reporting: Accurate records enable companies to generate reliable financial statements that provide insights into their performance and help make informed business decisions.

- Audit Compliance: Properly updated internal records facilitate smooth audits by providing a clear trail of financial transactions.

- Cash Flow Management: Accurate data allows businesses to monitor their cash flow effectively, ensuring they have sufficient funds for operational needs.

- Fraud Detection: Regularly updating internal records helps identify unauthorized or fraudulent activities within the company’s finances.

Frequently Asked Questions

Here are the most common questions about bank reconciliation for small businesses.

What are the Benefits of Bank Reconciliation?

Bank reconciliation helps prevent fraud and find mistakes or unauthorized transactions. When you compare your records with the bank statement, you can quickly find and fix any differences immediately. This stops any unauthorized transactions or mistakes from causing big money problems.

Doing regular bank reconciliation helps businesses make better decisions about their money. It shows exactly how much cash it has to make smart choices about spending and saving. It also helps businesses maintain a good relationship with the bank. Fixing any differences between your records and the bank statement shows that you are responsible and careful with your money. This helps the bank trust your business and keeps your relationship positive.

What are the common problems with Bank Reconciliations?

Bank reconciliations can be challenging and time-consuming, leading to various problems that individuals and businesses may encounter. Some common issues include data entry errors, timing differences, outstanding checks and deposits, overlooking bank fees and interest, reconciliation errors, dealing with multiple bank accounts and complex transactions, and a lack of accounting knowledge.

Data entry errors often occur due to manual input mistakes or software issues, leading to significant discrepancies. Timing differences can arise when transactions are recorded in the company’s books and the bank statement at different times.

Outstanding checks and deposits can create confusion during reconciliation. Bank fees and interest may be overlooked if not carefully accounted for. Reconciliation errors can still occur despite attention to detail, resulting in delays in financial reporting.

Businesses with multiple bank accounts or complex transactions face additional challenges. Lastly, a lack of accounting knowledge can hinder the reconciliation process.

Bank Reconciliation Pros & Cons

Pros:

- Helps identify errors and discrepancies in financial records.

- Ensures accuracy in financial reporting.

- Helps prevent fraud and unauthorized transactions.

- Provides a clear and up-to-date view of cash flow.

- Helps in detecting bank errors and resolving them promptly.

- Helps in identifying any missing or unrecorded transactions.

- Provides a systematic and organized approach to managing finances.

Cons:

- Can be time-consuming, especially for large businesses with numerous transactions.

- Requires attention to detail and accuracy to avoid missing any discrepancies.

- Can be challenging for individuals or businesses with limited accounting knowledge.

- May require additional resources or software to streamline the reconciliation process.

- Can be frustrating if there are frequent discrepancies or errors in bank statements.

- May lead to delays in financial reporting if reconciliation is not done promptly.

- Can be overwhelming for businesses with multiple bank accounts or complex financial transactions.

What if I don’t reconcile my bank accounts?

Neglecting to reconcile your bank accounts can lead to various problems down the line. You may miss errors or fraudulent activities on your statements, resulting in incorrect balances or even financial losses. Failing to reconcile can make it challenging to track expenses accurately or identify cash flow issues.

How often should I reconcile my bank account?

It is recommended to reconcile your company’s bank account at least every month. However, more frequent reconciliations may be necessary depending on the volume of transactions and the complexity of your finances. Regularly reviewing and updating your records will help ensure accuracy and provide timely insights into your financial situation.

Can I automate the Bank Reconciliation Process?

Yes! Many accounting software solutions offer automated features for bank reconciliation. These tools can streamline the process by automatically importing transaction data from your bank statements and matching them with internal records. Automation reduces manual effort while improving efficiency and accuracy.

What is Bank Reconciliation – Final Thoughts

You should now have a solid understanding of this vital financial process. Reconciling your bank statements with your internal records can ensure accuracy, detect discrepancies, and maintain control over your finances.

Bank reconciliation is like solving a puzzle – you gather the pieces, compare them, investigate any differences, make adjustments, and update your records to achieve balance. It’s essential for individuals and businesses alike to stay on top of their financial health.

Contact us if you have more questions about bank reconciliation or to apply for a small business loan. Our alternative funding experts can help you find the best financing options for your business goals.