› Business Loans › Bad Credit Business Loans

To learn more about how to get a business loan with bad credit, please continue reading:

Contrary to popular belief, a poor credit score is not always an indicator of irresponsibility. Many hard-working small business owners have poor credit for reasons beyond their control. It’s very common for a business owner to use personal finances to keep a business alive in its early years. And once your credit score takes a big hit, it takes a long time to build it back up. For these reasons, companies like United Capital Source have access to bad credit options for small business financing we like to call Bad Credit Business Loans.

These are the best business loans accessible for business owners with bad credit, but they lack fees and repayment terms that would further endanger your finances. Unlike traditional business loans, business loans for bad credit history are carefully structured so that small business owners can make loan payments without putting too much cash flow pressure on their small businesses.

Bad credit business loans are types of financing options that small business owners can access with a minimum credit score below 600. These loan options are designed to give a business owner enough cash to keep their business running, pay off existing debts, or cover short-term expenses. Terms for small business loans with poor credit history usually do not exceed eighteen months and generally carry a high interest rate compared to other loan options (ex., Merchant Cash Advances, Unsecured Business Loans, etc.). However, the borrowing amount and repayment structure are specifically selected to make small business loans for bad credit relatively easy to repay. This allows the small business owner to quickly meet the eligibility requirements for another loan and possibly raise their business and personal credit score in the process.

Read the rest of this guide to learn what’s available to small business owners with poor personal credit scores and what to watch for when shopping for loan approval. Then you will have the information you need to make the wisest decision when it comes to small business loans for bad credit.

These are the best bad credit business loans available:

As you can see, the only small business loans offered by UCS missing from this list are Business Term Loans and Small Business Administration (SBA) Loans. This is because once business term loans or SBA loans lose their traditionally high borrowing amount, low interest rate, and long term, it essentially becomes a short-term small business loan or a product similar to invoice financing (get paid upfront on unpaid invoices) and merchant cash advances. SBA and term loans are considered the best small business loans, carry the lowest interest rates on the market, and are only available to small business owners with high personal credit scores.

Unlike an SBA or term loan, every one of the small business loan options on this poor credit list can be repaid quickly and provide a modest amount of funding at best. In addition, small business owners can choose from various alternative lenders and financing options rather than being forced into fixed monthly payments. Even short-term business loans can be repaid weekly, bi-weekly, or monthly.

Some bad credit small business loans emphasize cash flow and sales volume rather than low credit scores. For example, your borrowing amount for a merchant cash advance is based entirely on monthly debit and credit card sales. With accounts receivable factoring and invoice financing, your personal credit score is largely irrelevant. Invoice factoring can help businesses access cash quickly by selling unpaid invoices to a factoring company.

Revenue-based business loans have similar personal credit score requirements as a merchant cash advance, except the loan amount is based on your total monthly sales, not just credit cards and debit transactions.

Business lines of credit are also available with poor credit scores. However, the terms won’t be as favorable as a small business line of credit from your local bank. Small business owners with poor credit or limited business credit scores can still have access to revolving lines of credit if that’s the best bad credit product that suits their business needs.

And though business equipment financing carries the same repayment structure as a term loan, the desired equipment is used as collateral. This decreases the heightened risk associated with a poor credit history and personal credit score.

When it comes to business loans, a personal credit score can have a significant impact on the approval process. Lenders often use personal credit scores to evaluate the creditworthiness of a business owner, especially if the business is relatively new or has a limited credit history. A good personal credit score can increase the chances of getting approved for a business loan, while a bad credit score can make it more challenging.

Here are some ways a personal credit score can impact business loans:

Overall, a good personal credit score is essential for business owners who want to increase their chances of getting approved for a business loan. By maintaining a good credit score, business owners can access better loan terms, lower interest rates, and more favorable repayment periods.

Nearly 65% of medium and high-risk credit applicants received at least partial approval when applying to an online lender. Source: 2023 Small Business Credit Survey

55% of business loan applicants at online lenders stated that speed or credit decisions were the primary motivating factor. Source: 2023 Small Business Credit Survey

Generally, most traditional lenders require a minimum personal credit score of 650 for approval. And most lenders of traditional business credit loans and lines of credit prefer a minimum personal credit score of 680. Source: Experian

The primary advantage of small business loans for bad credit is accessibility. A poor credit score won’t prevent you from being approved as long as your business has a steady cash flow. In addition, strong sales can decrease the effect of a bad personal credit score on the small business loan’s cost and terms.

In some cases, lenders may require a personal guarantee, allowing them to leverage personal assets to cover loan repayments if the business fails. This can involve risks, such as the potential impact on personal credit scores and the loss of personal assets used as collateral.

Bad credit borrowers can also use the funds to pay off existing debts, which is a common cause of poor credit. Unfortunately, many traditional lenders require borrowers not to use funds for this purpose or even approve borrowers with too much existing debt.

Another advantage is the establishment of a track record of timely payments. Of course, not every bad credit small business loan will directly impact your personal credit score. But now that you’ve proven you can pay off a small business loan on time, you will likely qualify for a second, larger round of funding with a lower interest rate and more favorable terms.

For this reason, you might think of this type of small business loan/line of credit as your first step towards obtaining all the financing you need to accomplish your goals. After all, less-than-perfect credit doesn’t mean your goals are unattainable. It just means you’ll have to wait a little longer to reach them

Bad credit business loans are not cheap and do not offer the highest loan amounts. However, these characteristics are the natural result of bad credit. Alternative lenders implement lower borrowing amounts, high rates, and shorter terms to offset the heightened repayment risk.

The only other disadvantage stems from choosing the wrong small business loan product or repayment frequency. Remember, bad credit business loans are supposed to have an easy repayment term. However, every business has different cash flow cycles. Thus, what’s easy to pay back for one company could put another in financial straits. In other words, if you choose the wrong small business loan product, the high rates and repayment terms (i.e., daily, weekly, bi-weekly) could do more harm than good for your cash flow. And when you’ve run out of options for business financing, the pressure could cause you to make a hasty (and likely incorrect) decision.

| LOAN TYPES | MAX AMOUNTS | RATES | SPEED |

|---|---|---|---|

| Merchant Cash Advances | $7.5k – $1m | Starting at 1-6% p/mo | 1-2 business days |

| SBA Loan | $50k-$10m | Starting at Prime + 2.75% | 8-12 weeks |

| Business Term Loan | $10k to $5m | Starting at 1-4% p/mo | 1-3 business days |

| Business Line of Credit | $1k to $250k | Starting at 1% p/mo | 1-3 business days |

| Receivables/Invoice Financing | $10k-$10m | Starting at 1% p/mo | 1-2 weeks |

| Equipment Financing | Up to $5m per piece | Starting at 3.5% (SBA) | 3-10+ business days |

| Revenue Based Business Loans | $10K – $5m | Starting at 1-6% p/mo | 1-2 business days |

The speed of the approval process depends on the desired product and a business’s financial health. Some products can be approved in under 24 hours, while others can take up to one week. Here’s how to apply:

Bad credit business loans come in many forms. To choose the right small business loan, consider which borrowing terms pose the least risk for your cash flow. Is your business highly seasonal? Are you prone to occasional dips in revenue? Would a business line of credit or merchant cash advances help you build your business? It would be best to consider the funds’ intended purpose since this directly affects how long it will take you to pay it back.

Depending on the bad credit business loans available, you may need the following documents and information:

You can begin the application process by calling us or filling out our one-page online application. Either way, you’ll be asked to enter the information from step 2 above, along with your desired borrowing amounts.

Once you apply, a representative will contact you to explain the repayment terms & percentage rate of your available small business financing options. This way, you won’t have to worry about any surprises or hidden fees during repayment.

The bad credit business loan application process generally takes a few business days, depending on your chosen product. Once the file is approved and closed, a lump sum of funds should reach your checking account in 1-2 business days.

Bad credit business loans aren’t just a way to get financing for your business. It’s also an excellent opportunity to start building (or improving) your personal & business credit score.

Regardless of the type of business loan you get, make all your required loan payments on time and in full. If you get business lines of credit or another form of revolving credit, keep your balance below the credit limit.

Consistently making your business financing payments on time and in full will positively impact your business credit score. And that means preferred rates and terms when you next need business financing.

After assessing your business’s financial health, the lender may conclude that an approval decision for a business loan would do more harm than good to your cash flow. In this case, we might recommend another tool for financing your business, like a business credit card or personal loan. Business credit cards and personal loan options are usually much easier to qualify for than business loans. If you apply for business credit cards, you may not get the credit limit you need right away, but you can use business credit cards as a tool to increase your credit scores. Business credit cards will beef up your business credit history and help raise your business credit scores with regular use and consistent payments.

Credit unions are also an excellent avenue to pursue. Although credit unions may not always help, it’s worthwhile to try and see what loan offers they can provide.

To improve your credit score as much as possible before applying, you should consider these credit repair services. We can help you identify the issues that keep your credit score down and develop practical solutions for eliminating them. In addition, improving your credit score before applying can expand the business loan options you qualify for and get you better loan offers.

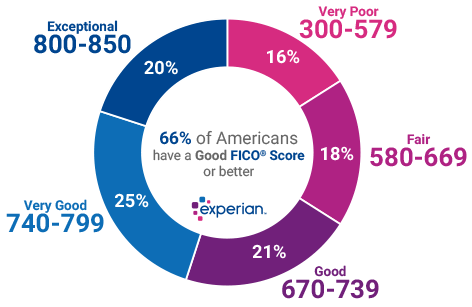

Bad credit is generally defined as a FICO score between 300 and 629. Credit reporting agencies break it down like this:

Several criteria come into play when traditional lenders review small business loan applications. However, they do pay special attention to credit scores. (Note: there are different types of credit scores. Many traditional lenders use FICO scores, developed by The Fair Isaac Corporation, to assess personal and business borrowers’ creditworthiness.)

Your credit score is a number that represents how likely you are to pay back your small business loans. It’s based on your previous credit history. Lenders look at business owners’ personal credit scores before offering credit to new small businesses or if a personal loan guarantee is required.

Credit reporting agencies calculate credit scores based on what’s known as “The 5 C’s of Credit.” They include

Offer Collateral – To boost the likelihood of getting a “yes” to a small business loan with a bad credit score, offer collateral as security. This could be equipment or your accounts receivable to a factor, customer invoices for invoice financing, or future credit card sales.

When underwriters assess business owners with bad credit history, they look at other factors, in addition to the minimum credit score, to determine their ability to repay. These other factors include:

The last item on this list stems from the fact that bad credit may be more common in small businesses in specific industries. Your industry also gives us an idea of which repayment structure works best for your cash flow.

Time in business is at the top of the list because it shows that you’ve managed to get your business out of financial dilemmas before. In other words, you’re more likely to repay a loan when you have more experience keeping your business alive during desperate times. Many companies make money, but only some stay in business for years.

As for collateral, it’s important to remember that business lenders usually do not accept your assets’ full monetary value as security. For example, let’s say your collateral is worth $10,000. That might be enough to secure a $6,000 business loan or line of credit.

Generally, our network of alternative lenders doesn’t need collateral for most programs. Instead, business loan terms are structured differently for those small businesses that have owners with a poor credit history. A business credit card also requires no collateral in most cases.

There are many benefits to getting a business loan when you have bad credit. If you choose a short-term small business loan, just a few months’ worth of payments can dramatically raise your business credit score. This is a much more effective and efficient way to offset previous credit issues than getting something removed from your credit profile. Business lenders and potential business partners would rather see a previous credit issue followed by a paid-off loan than nothing at all.

When you get a business loan, you can create a new payment history. This record of timely payments shows that you’re no longer the kind of person who misses payments or defaults on loans.

A business loan also gives you another funding source, so you don’t have to continue using other sources, like your credit card. One key factor for determining your credit score is your credit utilization rate. This reflects how much of your available credit you use. If you use your credit cards too much (or nearly max them out), your utilization rate gets too high and keeps your credit score down. Thanks to a business loan (and alternative lenders), you can only finance certain expenses with the credit limit on your business credit card and keep your utilization rate low.

Online business lenders can offer funding options with less stringent requirements compared to traditional banks. Traditional lenders often want businesses in operation for at least two years and prefer good credit applicants. Alternative lenders have become more popular due to their flexible credit requirements for business loans.

Payments for most working capital loans, equipment financing, and a business line of credit usually get reported to business credit bureaus. The other types of business loans for bad credit are much easier to repay because payments are deducted automatically. Most often, your payment history for these loans will not impact your business credit score.

If raising your score is a top priority, check how often payments are reported. It can take 30 to 90 days for the information reported to a business credit agency to appear on your report. The sooner your reported payments appear on your report, the quicker you raise your credit score.

Using inventory as collateral can help you get a small business loan with bad credit. However, this strategy only works under certain conditions:

The type of inventory matters, as well. Different types of inventory are easier or harder to sell in the event of default. This is reflected in the inventory’s liquidity. The easier it is to sell, the more of its value you can borrow.

Small businesses borrow money for a wide variety of reasons, including

While bad credit business loans can provide necessary funding for businesses with poor credit, there are alternative options available. These alternatives can offer more favorable terms, lower interest rates, and fewer fees. Here are some alternatives to bad credit business loans:

These alternatives can provide businesses with poor credit with more favorable funding options. However, they may have their own set of requirements and limitations. It’s essential to research and compare these alternatives to find the best option for your business needs.

Fraud Disclosure:

Please be aware that individuals have been fraudulently misrepresenting to business owners (and others) that United Capital Source, Inc. (“UCS”) can assist small businesses in receiving government grants and other forgivable business loans, when in fact those grants or loans do not exist or are not available. These individuals have ulterior motives and are engaging in the unauthorized use of the names, trademarks, domain names, and logos of UCS in an attempt to commit fraud upon unsuspecting small business owners.

UCS will never communicate with a prospective client on Facebook, Facebook Messenger, or any other type of social media. Further, any email communications will always come from an official UCS email address and not a Gmail, Yahoo, or other email domain. If you believe you have been contacted by someone posing as an employee of UCS, please email [email protected].