What is a Business Line of Credit?

A business line of credit is a form of financing that gives businesses access to a predetermined amount of funds they can draw from as needed. Unlike a loan, where you receive a lump sum upfront, a line of credit lets you withdraw funds up to your approved limit as needed. A business line of credit can fund any legitimate business expenses, including inventory and payroll.

One key difference between a business line of credit and other forms of business financing, such as term loans, is its flexibility. With a line of credit, businesses can use the funds for various purposes, including covering short-term expenses, managing cash flow fluctuations, or seizing new opportunities.

Additionally, businesses only pay interest on the amount they borrow rather than the entire credit limit, potentially lowering the monthly payment. This makes it a cost-effective financing option for managing day-to-day operations and unexpected expenses.

Some lines of credit further help lower monthly payments by allowing interest-only payments. However, this method results in a balloon payment at the end of the term.

Business Lines of Credit through United Capital Source (UCS) offer the following features:

- Max funding amount: $1k – $1 million.

- Factor rates: Starting at 1% p/mo.

- Term: Up to 24 months.

- Funding speed: 1 – 3 business days.

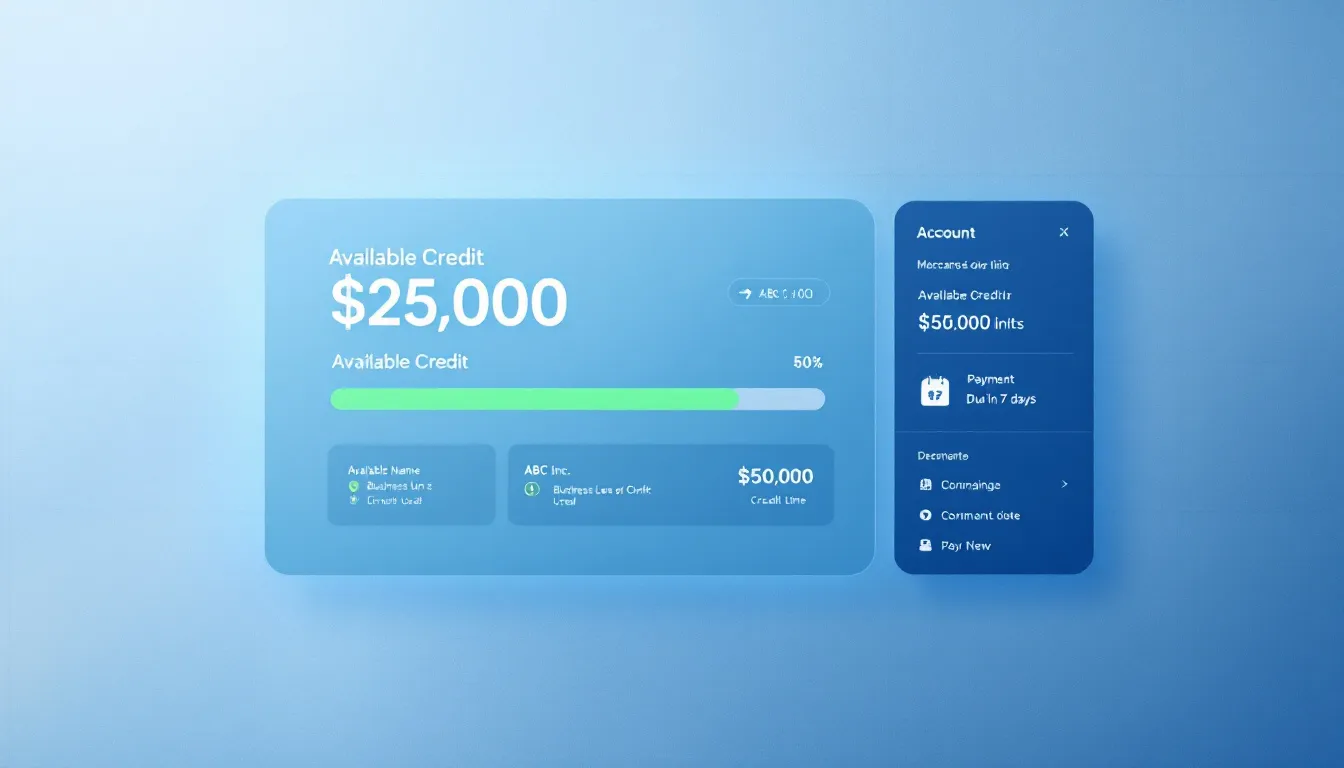

How does a Revolving Line of Credit work?

A revolving line of credit for business works by providing a predetermined credit limit that can be used repeatedly as long as the borrower makes regular payments and keeps the account in good standing. As the outstanding balance is paid off, the available credit is replenished, allowing ongoing access to funds. This type of credit is flexible and can be used for various business needs, such as managing cash flow, purchasing inventory, or covering unexpected expenses.

Interest on revolving credit is calculated based on the principal balance amount. Borrowers only incur interest on the funds drawn from the credit line, making it a cost-effective option for managing short-term financial needs.

In contrast, a non-revolving line of credit provides a credit limit but doesn’t replenish as you pay it back. The account is closed once the funds are repaid, and the borrower must reapply for a new credit line if additional funds are needed. This type of credit is less flexible but may be suitable for specific one-time expenses or investments.

Many lines of credit are unsecured loans, meaning the borrower does not pledge any collateral to back the line of credit. Secured lines of credit are attractive to lenders because they provide a way to recoup funds in the event of non-payment. You may be familiar with a home equity line of credit in personal finance, which uses the value in your home as collateral.

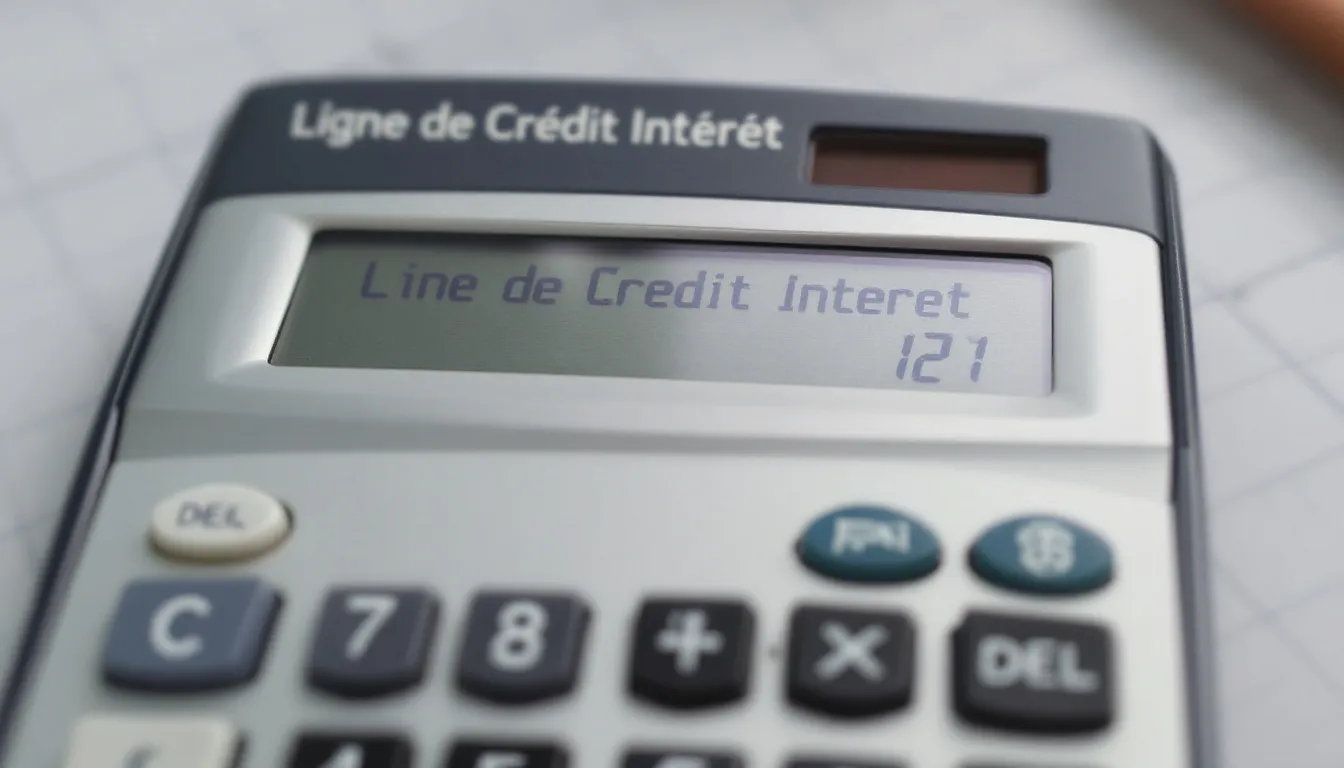

How do you Calculate Interest on a Revolving Line of Credit?

You only need to repay the funds you borrow from a revolving line of credit. The formula to calculate the interest fee on a revolving line of credit uses an APR:

(Balance x Interest Rate) x Days in Billing Period / 365 = monthly interest.

Calculating credit or loan payments is crucial for making informed financial decisions. Estimating these payments helps in understanding the costs associated with different financial products.

To calculate interest on a revolving line of credit, follow these steps:

- Determine the interest rate: The first step is determining the interest rate on your revolving line of credit. This can usually be found in the terms and conditions of your credit agreement.

- Current Balance: Determine the principal balance owed on the business line of credit on the last day of the billing cycle. Interest on a revolving line of credit is calculated based on the outstanding principal balance for the prior month.

- Multiply Balance by Interest Rate: Once you have the balance owed and the interest rate, multiply the two numbers.

- Multiply by Days in the Billing Period: Use 30 days for a 30-day month or 31 days for a 31-day month.

- Divide by 365: Since we use an APR model for this example, divide the total by 365. Interest rates are typically periodic rates calculated by dividing the APR by 360 or 365 days, multiplied by the days in the billing period.

- Consider any Additional Fees: Some revolving lines of credit may have additional fees or charges that must be factored into the total interest calculation. For example, you might have an annual fee for maintaining the account. Be sure to consider these when determining the total amount of interest owed.

- Repeat for Each Billing Cycle: Remember that the interest on a revolving line of credit will vary monthly based on changes in the balance and the interest rate. Be sure to recalculate the interest for each billing cycle to stay on top of your payments.

With many lenders, you will never pay interest on interest with a revolving line of credit. Unlike a credit card, you typically only pay interest on the money you’ve used from the credit line.

Business Line of Credit Calculator

To make things easier, some companies provide convenient lines of credit calculators. You can use these tools to determine monthly interest and your minimum payment amount, or as a line of credit payoff calculator. Note: These tools typically provide general advice, are intended for illustrative purposes, and are not guaranteed costs. Ensure you use a calculator from a reputable service.

Interest on a revolving line of credit is typically calculated based on actual days over a 360-day year. In addition to interest charged, annual fees are also considered when determining line of credit costs.

Interest on a line of credit is usually calculated monthly through the average daily balance method. The average daily balance is found by summing the amount of each purchase made and dividing by the total number of days in the billing period. After calculating average purchases, the leftover figure is the balance multiplied by the annual interest percentage rate (APR).

What are the benefits of a Business Line of Credit?

A business line of credit offers flexibility in managing cash flow and addressing short-term financial needs. Businesses can access funds as needed rather than taking out a lump sum loan, which can be particularly helpful for covering unexpected expenses or pursuing growth opportunities.

It can also help improve credit scores by demonstrating responsible credit use. A business line of credit provides a financial safety net, allowing businesses to navigate through lean periods without relying on high-interest credit cards or other costly forms of borrowing. A business line of credit can help build a relationship with a financial institution, potentially leading to better terms and rates on future financing needs.

What are the drawbacks of a Business Line of Credit?

Business lines of credit often have higher interest rates than traditional loans, making it more expensive for businesses to borrow money. Calculating loan payments and interest rates is crucial to understanding the financial implications. With a business line of credit, there is a risk of overborrowing and accumulating more debt than the business can handle, leading to financial strain and potential default.

Some business lines of credit have variable interest rates, which means that the cost of borrowing can fluctuate over time. This can make it difficult for businesses to budget and plan for repayments. Additionally, drawing on a business line of credit and carrying a high balance can negatively impact a business’s credit score, making it more challenging to secure favorable terms for future financing.

Startup businesses or those with a limited operating history may struggle to qualify for a business line of credit. Lenders often prefer to work with established businesses with a proven track record.

Business Line of Credit Pros & Cons

Pros:

- Flexibility to access funds as needed.

- It can help with cash flow management.

- Only pay interest on the amount borrowed.

- Can be used for various business expenses.

Cons:

- May require collateral.

- High interest rates for some borrowers.

- Potential for overspending and accumulating debt.

- Limited availability for new or small businesses.

What are the qualifications for a Business Line of Credit?

Lenders typically review your personal credit history, time in business, and annual revenue to determine eligibility for a business line of credit. Approved businesses we work with here at UCS typically meet the following minimums:

- Credit Score: 625+.

- Time in Business: 6+ months.

- Annual Revenue: $200k+.

How do I apply for a Business Line of Credit?

The first step is to research and choose suitable lenders. Look for reputable financial institutions or online lenders that offer competitive terms and interest rates. Consider factors such as annual percentage rate (APR), repayment terms, and customer reviews.

You can apply for a business line of credit through our network of lenders by following these steps.

Step 1: Determine How Much Funding You Need

Unlike other loans, business lines of credit are often not pursued with specific investments in mind. After all, you’re supposed to apply before you need the money.

For this reason, aspiring borrowers might not know exactly how much funding to request. Think about how you’ll most likely use your funds and why you are applying in the first place. This will help us understand why you’re requesting this amount.

Step 2: Gather Your Documents

You might not need all of the following documents depending on your creditworthiness. However, it’s better to have them on hand just in case:

- Business bank account statements from the past three months

- Driver’s license

- Voided check

Step 3: Complete Application

You can begin the application process by calling us or filling out our one-page online application. Either way, you’ll be asked to enter the information from the previous section along with your desired funding amount.

Step 4: Speak to a Representative

Once you apply, a representative will contact you to explain the repayment structure, rates, and terms of your available options. This way, you won’t have to worry about surprises or hidden fees during repayment.

Step 5: Receive Approval

If and when you’re approved, funds should appear in your bank account in 1-2 business days.

Frequently Asked Questions

Here are the most common questions about the business line of credit interest calculation.

What interest rates do Business Lines of Credit typically offer?

The average interest rate for a business line of credit typically ranges from 7% to 25%. However, this can vary depending on the lender, the business’s creditworthiness, and the line of credit terms. Therefore, companies need to shop around and compare offers to find the best interest rate for their specific needs.

What factors determine the interest rates for a Business Line of Credit?

Interest rates for business lines of credit are influenced by factors such as your credit score, business financials, and the lender’s risk assessment. Businesses with solid credit profiles and stable revenues may qualify for lower interest rates.

Is a Business Line of Credit or a business credit card better?

A revolving line of credit provides more flexibility in fund usage compared to a business credit card. It allows the borrower to access funds up to a specific limit, while a business credit card only permits purchases within the available credit limit.

Moreover, a business line of credit typically offers lower interest rates than a business credit card. This means that borrowing money is generally cheaper with a line of credit than using a business credit card for financing needs.

However, obtaining a business credit card may be easier than a line of credit, especially for startups and new businesses. Most business credit card issuers have more lenient standards, but the higher interest rates are the tradeoff for that accessibility.

Can I use my Business Line of Credit for personal expenses?

It’s essential to keep your business finances separate from personal expenses. While it might be tempting to use your business line of credit for personal needs or vice versa, it can create accounting challenges and complicate tax filings. Moreover, some commercial lenders might enact penalties for using funds from a line of credit for non-business expenses.

How quickly can I access funds from my approved Business Line of Credit?

Once approved, accessing funds from your revolving line of credit can be quick, often within one or two business days. This allows you to respond promptly to unexpected opportunities or address urgent cash flow needs without delay.

Are there penalties for not using the full amount available in my Business Line of Credit?

With most revolving lines of credit, you only incur costs when you draw against the available funds. There are typically no penalties if you don’t utilize the total approved amount; this flexibility makes it an attractive option for managing unpredictable financing needs.

What are my alternatives to a Business Line of Credit?

Besides a business line of credit, many small business loans and alternative funding products are available. Loans are structured with fixed repayment schedules over a predetermined period, which can make them a preferred choice for one-time expenses. Most loans provide a fixed amount.

You might be interested in one of the following small business funding options:

- Bad credit business loans

- Business line of credit

- Business loans for women

- Business term loans

- Equipment financing loans

- Accounts receivable factoring

- Merchant cash advances

- Revenue based business loans

- SBA loans

- Working capital loans

- ERC advance

How to Calculate Interest on a Revolving Line of Credit – Final Thoughts

You’ve now gained a comprehensive understanding of how a revolving line of credit works, including calculating interest and its benefits and drawbacks. With this knowledge, you can make informed decisions when considering a business line of credit.

Remember to weigh the alternatives and assess your qualifications before applying. A business line of credit can be a valuable financial tool for small businesses, whether managing cash flow or seizing growth opportunities.

Contact us if you have more questions about business line of credit interest calculations or to apply for a small business loan. Our alternative funding experts can help you find the most advantageous financing options for your business needs.