What is the Credit Utilization Ratio?

The credit utilization ratio is the percentage of your available revolving credit you’re currently using. It’s also sometimes called the debt-to-credit ratio, credit usage, credit usage rate, or credit utilization rate.

It adds up your current credit balances and divides the sum by your total credit limits. For example, if you have a balance of $1,000 on a credit limit of $10,000, your credit utilization ratio is 10%.

Experts recommend keeping credit usage below 30% to maintain a good credit score. Keeping credit usage below 10% is ideal and can help raise a low credit score or help move a good score into the exceptional range.

Revolving Accounts vs. Installment Loans

Credit scoring models only factor your revolving credit accounts, such as credit cards, into credit utilization. These accounts are called “revolving” because they don’t have an end date – the amounts owed carry over or “revolve” month to month. You pay interest on the balance each month.

In addition, revolving credit accounts replenish as you repay what you draw. You can continue to draw from the credit line indefinitely if you don’t max out the credit limit and are in good standing.

Installment loans, such as mortgages or student loans, carry fixed payments. Installment loan balances are not calculated in credit utilization.

How do I Calculate my Credit Utilization Ratio?

Determining credit usage involves taking your current credit card balances and dividing them by your total available credit limits. The formula is:

Credit utilization ratio = Your Total Debt ÷ Your Total Available Credit

So, let’s say you have $3,000 in debt and $12,000 in total credit limits. You would calculate your credit utilization as follows:

$3,000 ÷ $12,000 = 0.25, which becomes 25%.

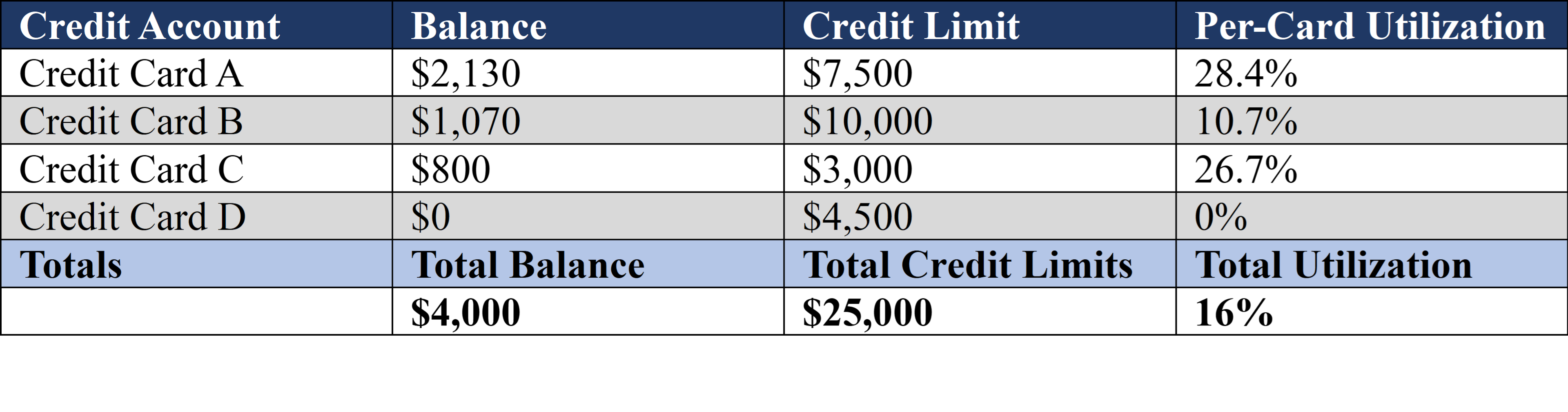

Total Credit Utilization vs Per-Card Utilization

If you have more than one credit card, you can calculate the utilization ratio for each card, called your per-card utilization. Add up all your credit card account balances and the credit limits of each card to calculate overall credit utilization.

Example

Here’s an example of per-card and total credit utilization calculations.

How does Credit Utilization impact Credit Scores?

Credit utilization is the second most significant factor for FICO scores. Here’s the full breakdown of FICO credit score factors:

- Payment history: 35%

- Amounts owed (credit utilization): 30%

- Length of credit history: 15%

- Credit mix: 10%

- New credit: 10%

The higher your credit utilization ratio, the more it lowers your credit score. For example, a credit utilization ratio of 80% lowers a score more than a ratio of 50%. On the other hand, a low credit utilization rate can help raise your credit score. The exact impact depends on other factors, like your payment history.

Credit utilization of 100% means you’ve maxed out your available credit. That could significantly hurt your credit score and ability to take out new credit.

Credit scoring models interpret a low credit utilization ratio to signify you’re more responsible about managing spending habits. It also indicates your monthly payments are manageable and that you have the capacity to take on more debt.

On the other hand, a high credit utilization indicates you may be struggling to manage your finances and rein in spending. It also means you’ll have high payments and likely can’t afford to take on new credit.

How can I lower my Credit Utilization Ratio?

The following actions will help lower your credit utilization.

Pay Off Balances

The safest and most reliable way to reduce credit utilization is to pay off your revolving credit balances. Best practices state that you should pay off your monthly balance to avoid accruing interest and reporting credit card usage.

Request a Credit Limit Increase

Another option is to ask your credit card issuer to increase your credit limit. You’ll be more likely to get an increase if your account is in good standing and you regularly use the credit line. A higher credit limit reduces your credit utilization ratio. Some credit card issuers periodically adjust your credit limit (raising or lowering) depending on your credit score and how often you use the line of credit.

Open Additional Credit Cards

You can also increase your total available credit by opening another credit card. However, be careful as there are some potential pitfalls in doing this. First, you might be tempted to spend more money using the new card, which would only increase your debt and credit utilization. Secondly, opening a new card usually requires a hard credit inquiry, and each inquiry can lower your FICO score by 5 points.

Consider a Balance Transfer Card or Debt Consolidation Loan

Balance transfer cards allow you to move your current balance(s) onto the new card. Several credit card companies offer balance transfer cards with low introductory APRs. If you have good credit, you might be able to get a balance transfer card with a 0% introductory APR – although you’ll likely still have to pay a balance transfer fee.

Another option is a debt consolidation loan. This would move your revolving debt balances to an installment loan balance, significantly lowering your credit utilization. However, effectively using a debt consolidation loan requires the discipline to not make additional charges on your credit card(s) that you just paid off with the loan.

Frequently Asked Questions

Here are the most common questions about credit utilization ratios.

What’s a good Credit Utilization Ratio?

Experts recommend keeping credit utilization below 30% to maintain good credit. Credit usage below 10% is ideal and can help raise a credit score quickly. The average credit utilization rate for individuals with a perfect credit score is 4.1%.

How much Credit can I use if I pay it off every month?

Theoretically, you could use 100% of your credit if you pay it off each month, but only if you know when your credit card issuer reports to the credit bureaus. Most credit card companies update your information with credit reporting agencies at the end of the billing cycle, usually 30 days.

Your credit card balance when your credit card bill reports is the balance reflected in your credit report. Even if you pay it off the next day, you’ll have to wait until the end of the next billing cycle before it updates in your credit report.

Consider making an additional payment during the month to keep your balance low when the account gets updated with the credit bureaus.

Do my loan balances impact Credit Utilization?

Balances for installment loans, such as car loans, debt consolidation loans, or mortgages, do not impact credit utilization. However, your loan balances do affect your lending options.

Most lenders use the debt-to-income ratio (DTI) to evaluate your ability to pay a new credit account, whether a loan or credit card. DTI divides your total monthly debt payments (installment loans + revolving credit) by your gross monthly income.

DTI = Total Monthly Debt ÷ Gross Monthly Income

Experts recommend keeping your DTI ratio below 43%. DTI ratios below 35% are considered good.

Your DTI ratio is vital for personal financing approval but doesn’t impact your credit score.

Note: For business loans, lenders consider your company’s debt service coverage ratio (DSCR), which is your business’s debt obligations over its cash flow. One way to think of it is that DSCR is the business lending equivalent of DTI in personal financing.

Does my Credit Utilization matter for Small Business Loans?

When you apply for a small business loan, lenders consider your personal credit score the same way consumer lenders do. Your business credit is also important, but lenders can only go on your personal credit if you haven’t built business credit yet.

Credit utilization matters because high utilization can lower your credit score. However, you should still qualify if you meet the lender’s minimum credit score requirement and don’t have other negative credit report information (foreclosure, charge-offs, bankruptcy, etc.).

If your credit usage caused a low credit score, it will significantly limit your overall business loan options. Credit-challenged business owners who need urgent funding can consider bad credit business loans.

Most business loans for bad credit carry higher interest rates and fees. In addition, you’ll likely get lower borrowing amounts/credit limits and shorter repayment terms.

But a business loan for bad credit can provide fast funding when you’re in a jam. Most funders for bad credit business loans are online lenders or alternative business financing facilitators, like UCS. That means you get a convenient online application with quick approvals.

Some small business owners use business loans with bad credit as bridge financing. It can provide short-term funding while you repair your credit and grow your business. You can then qualify for more advantageous long-term business loans.

Bad Credit Business Loan Pros & Cons

Pros:

- Accessible financing for borrowers with a low credit score.

- Could potentially help build or repair credit with timely payments.

- Might be able to use the funds to pay off existing debt.

- Quick and easy online applications.

- Usually fast approval and funding times.

Cons:

- Higher interest rates & fees than conventional loans.

- Lower borrowing amounts than traditional business loans.

- Typically short-term financing with frequent repayments.

- Might require collateral or a personal guarantee.

- Could require automatic payment withdrawals.

- Fewer options for lenders and loan types.

Credit Utilization Ratio & Its Impact on Credit Scores – Final Thoughts

It’s no secret that high credit card balances are bad for your finances. High balances mean more accrued interest and higher monthly payments. It also makes it more challenging to pay off your debt, increasing the chances you carry the balance over monthly.

High credit card balances also usually mean a high credit utilization ratio, which can lower your credit score. For all of these reasons, it’s essential that you pay down your debt and keep credit usage below 30%.

Consider a debt consolidation loan or balance transfer card if you’re having trouble managing your revolving credit balances. You can also request a credit limit increase or open new cards. But be careful not to add more debt until you’ve paid off the current balances.

Contact us if you have more questions on credit utilization or to apply for a small business loan. Our loan experts can help you find the best business loans for your credit score range.