› Business Loans › Lender Reviews › Hello Skip Review

To learn more about Skip, please continue reading:

Finding funding for your business can sometimes feel like finding a needle in a haystack – especially when looking for more than business loans. Hello Skip is a unique service that helps match small businesses with various business funding sources, including business grants, loans, and credit cards.

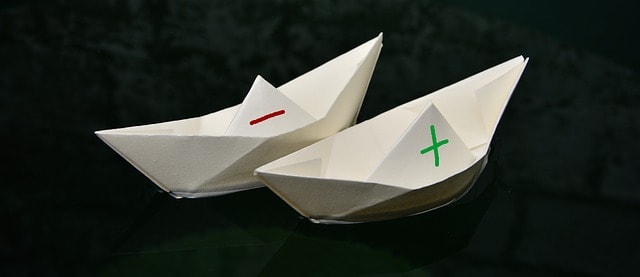

However, the platform might not be the right fit for every small business. In particular, the paid membership can be a dealbreaker for some business owners.

This review explores what you should know about Skip, including the pros, cons, and application process. Specifically, we’ll answer these questions and more:

Skip is a comprehensive platform designed to help entrepreneurs and small business owners find business funding and growth opportunities. As a marketplace, Skip connects users with various funding options, including grants, loans, and other financing opportunities available in the United States. By becoming a Skip member, you gain access to an extensive database of funding sources and expert insights and tips to expedite the funding application process.

Skip, officially known as Hello Skip, is a San Francisco-based seed-stage company founded in 2016 by Ryder Pearce. The company operates as a for-profit organization with a mission to assist small businesses in navigating funding challenges.

Its 4.6-star rating on Trustpilot underlines its credibility. However, Skip is not accredited by the Better Business Bureau (BBB) and has no user reviews listed there.

Skip collaborates with various financial institutions and government agencies to provide funding opportunities for small businesses. While its partner page has not been recently updated, known partners include organizations offering government-backed grants and private funding. Skip’s platform also highlights numerous grant opportunities tailored to small businesses’ needs.

Skip offers various services and features to assist entrepreneurs and small business owners in accessing funding. It markets itself as the “largest funding marketplace in the US.”

Below are the key areas of focus:

The Skip platform offers various grant opportunities, catering to diverse groups such as women, minorities, and veterans. These grants often have stipulations, such as employing a minimum number of staff members. The platform’s user-friendly interface ensures that navigating and applying for these opportunities is a seamless experience.

Skip connects users with loans sourced from its extensive list of partners, including government-affiliated programs and private institutions. The loans offered align with the expectations set by Skip’s reputable partners, ensuring that small businesses have access to reliable funding solutions.

Skip equips small business owners with various tools to simplify the funding process. Features include managing multiple business profiles within a single account and funding matches tailored to personal credit scores.

Grants are often tied to specific deadlines, so Skip allows users to sort funding opportunities by application due dates. This feature prioritizes time-sensitive opportunities, helping users stay ahead of important deadlines.

Skip AI™ is an advanced writing assistant designed to improve grant applications. It offers tips to make responses stronger and more engaging, enhancing the chances of approval. The AI tool can refine user input in seconds, streamlining the application process. Additionally, the platform features a bespoke AI writing assistant to help users with grant application wording, ensuring clarity and professionalism in submissions.

Skip does not impose strict qualifications – any small business owner can become a member. The platform works by matching businesses to funding opportunities based on their profiles.

However, the services you can access depend on your membership plan. Skip offers several membership tiers, and premium features can be expensive.

Each tier offers increasing levels of support, allowing business owners to choose a plan that aligns with their needs and goals.

Skip offers comprehensive funding solutions for entrepreneurs and small businesses, including grants, loans, and credit card options. It primarily focuses on grant funding. The platform is designed to help small business owners find and apply for funding opportunities quickly and easily. Based on factors such as its country of origin, SSL certification, and positive reviews from other websites, Skip has a high trust rating, making it a legitimate and reliable resource.

Skip’s blog is a valuable resource for small business owners. It features easy-to-understand content that provides accessible solutions. The blog includes “getting started” information, news about upcoming grants, approaching deadlines, and other funding opportunities. Skip also offers a business plan generator tool for entrepreneurs needing support to create professional plans efficiently.

The Skip App allows business owners to access all platform features on the go, making it even easier to stay updated on funding opportunities. Additionally, Skip collaborates with various funding partners, including government agencies and private lenders, ensuring a broad array of reliable financial solutions tailored to diverse business needs. This mix of features positions Skip as a robust tool for small businesses seeking to secure funding.

Skip offers a business funding affiliate program and a partner program. ISOs and business loan brokers can sign up to partner with Skip on the company’s website.

The application process is simple. Follow these steps to begin using the platform.

Sign up on the Skip website by providing your email address and creating a password.

Fill in details about your business, such as industry, size, and location. This information helps Skip tailor funding matches.

Select a membership plan that aligns with your business goals and budget.

Log in to your account to view funding matches and explore available grants, loans, and other options.

Use Skip’s tools, including Skip AI™, to complete and submit your grant and loan applications.

Once funding is secured, Skip continues to support business owners by offering resources and tools to maximize the impact of their funding. The platform provides ongoing advice and assistance to ensure businesses remain on track with their growth plans.

For business grants, you don’t have to repay the funding. The grant provider will work with your business to ensure a smooth transition. Skip can continue to play an advisor role in best using the funds.

For business loans, you’ll follow the lender’s repayment structure. Once you repay the debt, depending on the lender and your business profile, you may qualify for additional funding.

Skip simplifies the process of finding funding opportunities, offers tools to enhance grant applications, and provides additional business services such as consulting and strategy planning. Its membership options cater to varying levels of support, allowing businesses to choose the right plan for their needs.

Small business owners can opt in for hands-on help and consultancy. The platform’s AI tools can help you refine your application for the best results. In addition, the platform assists businesses with developing business plans, navigating regulations, and cutting through red tape.

While Skip offers valuable services, its paid membership requirement may deter some users. Additionally, funding is not guaranteed, and canceling memberships requires contacting support, which could be inconvenient.

Pros:

Cons:

Skip is a legitimate platform with a high trust rating, supported by positive reviews and secure site features. Data from its country of origin, SSL certification, and user feedback reinforce its credibility.

User reviews of Skip often highlight the platform’s ease of use, helpful customer support, and the variety of funding opportunities available. However, some users have reported issues with data migration and concerns about the instant grants feature. Negative reviews also mention dissatisfaction from other entrepreneurs about specific services.

Skip does not have a formal approval or denial process. While it attempts to match businesses with suitable funding opportunities, success is not guaranteed. Business owners are encouraged to explore multiple funding options and refine their applications for better results.

By providing a comprehensive suite of funding solutions, Skip positions itself as a valuable resource for entrepreneurs and small business owners seeking growth opportunities. However, it might not suit every business need.

Fortunately, small business owners can access a diverse range of lender options. While Skip’s dedication to helping businesses find grant funding is unique, other lenders and marketplaces focus more on business loans.

You might be interested in one of the following small business loans:

Skip can be a viable solution for companies looking for any source of funding and are willing to pay to find it. Its focus on grants and assistance with application preparation makes it stand out.

However, the paid membership can be a roadblock for some companies. In addition, some small business owners would prefer working with a marketplace that focuses on financing solutions.

We rate Skip as a 3 out of 5 based on the available information. It’s a solid source for seeking grants, but there are better lender and marketplace options for small business loans.

Disclaimer: The Skip trademark is owned by YoGovernment Inc., and its use herein is for reference purposes only, and it does not indicate sponsorship or endorsement from YoGovernment Inc.

Fraud Disclosure:

Please be aware that individuals have been fraudulently misrepresenting to business owners (and others) that United Capital Source, Inc. (“UCS”) can assist small businesses in receiving government grants and other forgivable business loans, when in fact those grants or loans do not exist or are not available. These individuals have ulterior motives and are engaging in the unauthorized use of the names, trademarks, domain names, and logos of UCS in an attempt to commit fraud upon unsuspecting small business owners.

UCS will never communicate with a prospective client on Facebook, Facebook Messenger, or any other type of social media. Further, any email communications will always come from an official UCS email address and not a Gmail, Yahoo, or other email domain. If you believe you have been contacted by someone posing as an employee of UCS, please email [email protected].