› Business Loans › Lender Reviews › Brex Corporate Card & Brex Cash Review

💳 No personal guarantee required: Unlike traditional business credit cards, Brex doesn’t require business owners to back the debt personally.

💼 Tailored rewards for startups: Offers industry-specific rewards, including higher cashback rates for tech, life sciences, and e-commerce businesses.

⚡ Instant approval process: Businesses with strong financials can get approved quickly without a lengthy application process.

🛡️ Soft credit pulls protect personal scores: Applying won’t impact your personal credit since Brex assesses business financials instead.

🌐 No foreign transaction fees: Ideal for international spending, as Brex doesn’t charge extra for overseas transactions.

🏦 Includes Brex Cash Account services: Provides integrated financial management tools, including cash accounts and bill payments.

🔄 No revolving balance or intro APR: Functions more like a charge card, requiring full payment each billing cycle instead of carrying a balance.

⭐ UCS Rating: United Capital Source rates the Brex Card a 4.8 out of 5.

Brex also allows companies to separate business and personal expenses for cleaner bookkeeping, simplifying financial management.

To learn more about Brex Corporate Card and decide if it’s right for your needs, please continue reading:

Small businesses are often recommended to cover certain operational expenses with business credit cards. However, not everyone can qualify for the most advantageous options. And when you carry a balance month-to-month, it’s very easy to accrue a dangerous amount of debt unknowingly. Entrepreneurs who are facing these circumstances might consider a charge card instead.

Charge cards are much like credit cards, except for one significant difference. You must pay off your entire balance at the end of each month instead of gradually paying off the balance with smaller payments. For this reason, charge cards have no interest rates and very few fees. Having a dedicated business credit card like this can also simplify accounting and tax preparation, making it easier to track expenses.

Some charge cards are also designed for specific industries. They might offer rewards programs for everyday expenses or accommodate unique cash flow circumstances. Many business credit cards provide rewards tailored to business needs, such as cashback and points on common expenses, making them a valuable tool for managing operational costs.

One of the more recent examples is the Brex Corporate Card, designed exclusively for tech startups. Brex also offers a corporate cash management account called Brex Cash that integrates with Brex cards. You can use cash from this account with the Brex Daily Card, a corporate card that functions like a debit card for your Brex Cash account.

There are two versions of the Brex Credit Card: one that requires daily payments and one that requires monthly payments. The Brex Corporate Credit Card used to be available for most small and medium-sized businesses (SMBs). But as the company scales up its software-as-a-service (SaaS) financial stack, it now only offers the card to venture-backed startups and mid-market companies.

Customers typically receive a credit limit of 15% to 40% of the cash in their deposit bank accounts.

Credit limits are 10-20x higher than competitors.

The Brex Corporate Card is a charge card with many differences from the typical business credit card. Not only is it much easier to qualify for, but the Brex Corporate Card also carries a credit limit that is 10x to 20x higher than most traditional business credit cards. Customers typically receive a credit limit of 15% to 40% of the cash in their deposit bank accounts.

The monthly card is only available to companies that meet specific size and revenue requirements. It is an enterprise card for mid to large corporations or venture-backed tech startups with enough cash flow to handle the payments. Most small and medium-sized businesses (SMBs) won’t qualify.

Customers typically receive a credit limit of 15% to 40% of the cash in their deposit bank accounts.

Credit limits are 10-20x higher than competitors.

Additionally, signing up for the Brex Corporate Card gives you many discounts and credits for common business expenses in the tech industry. And if you make the Brex Corporate Card your primary card, you can earn extraordinary rewards on expenses like travel, food, and recurring software charges. The right business credit card can streamline expense management and support business growth, making it an essential tool for startups.

All Brex Cash customers get the Brex Card paid daily. It’s available for businesses of any size.

In many ways, the Brex daily card acts as a debit card for the Brex Cash Account. Payments are automatically withdrawn from the Brex Cash Account at the end of each business day. The available credit limit is 100% of your Brex Cash Account balance.

When the company uses the Brex card exclusively, users can earn up to 8x rewards points on all card spending.

Brex Cash is essentially a bank account for Brex customers that lacks several drawbacks of traditional business bank accounts. Customers get free domestic and international wire transfers, ACHs, and mobile checks.

Brex Cash does not charge the fees associated with traditional bank accounts, such as minimum balance fees, overdraft fees, maintenance fees, returned deposit fees, inactivity fees, and account closing fees. The absence of a minimum balance fee stems from the fact that there is no minimum monthly balance.

To apply for the monthly corporate card, you need your employer identification number (EIN), which can be necessary for applying for a business credit card. Additionally, some business credit cards require you to provide documents like tax returns and profit/loss statements when you apply.

Employer Identification Number (EIN).

Business bank account number.

Information regarding how your company is funded (investors, venture capital, etc.).

The daily card does not have an application. Brex Cash Account customers automatically receive the card when they create their account.

Brex Corporate Cards are only available to businesses that meet the following criteria: Common business credit card requirements include reviewing the business revenue and financial health. Many lenders assess business revenue and cash flow before granting a new credit line, ensuring the business can manage its financial obligations effectively.

Venture-backed startups: Include professionally funded, non-traditionally funded, and pre-funding companies.

Mid-market Companies: Either a professionally-funded company with 20 or more employees or companies with 50 more employees that are not invested.

Eligibility and credit limit are based on your spending patterns, cash balance, and the amount of money you’ve raised from investors. There’s no credit check, personal guarantee, or collateral required. If the business cannot repay its debt, the owner doesn’t have to worry about seized personal assets.

Now for the cold facts: Applicants usually need at least $50,000 in their business bank account and/or generate at least $50,000 in sales every month, depending on what line of business they’re in.

Here are the other key criteria:

Functional website and web presence

Must pass Experian credit check

At least three months of “runway” (vs. cash burn)

Must not be in the following industries: restaurants, consulting, construction, manufacturing, used goods

There’s no annual fee, nor are there any foreign transaction fees. You can also get unlimited cards for free to provide to employees. Brex easily tracks all employee spending in a convenient online tool.

With no fees or interest rates, you’re probably wondering how Brex makes any money. They have a partnership with Mastercard, which charges a merchant fee whenever someone swipes the card. Brex makes money by taking a cut of that fee.

U.S. EIN

Must be incorporated (Inc.) – no sole props or LLCs

2 years of business history

Functional website & web presence

Pass Experian credit check

3 months of ‘runway’ (vs. cash burn)

Consulting businesses

Restaurants

Construction businesses

Sellers of used goods

New Brex Card members earn up to 50,000 when they spend $9,000 in the first 30 days. Additionally, Brex offers a sign-up bonus of 10,000 points when you spend $3,000 in the first 3 months.

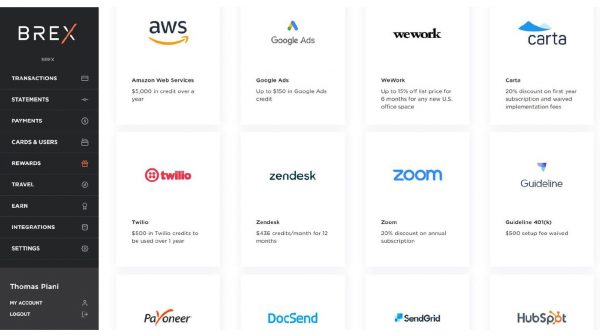

Earlier, we established that this card is designed to manage business spending for tech startups. When you sign up, you gain many discounts and credits for everyday expenses in the tech industry. This includes digital marketing services, project management tools, and CRM (Customer Relationship Management) platforms.

Additionally, the company offers a Brex Business Account for cash flow management. Brex is a financial technology company but not a bank. Brex Treasury, LLC operates the account. Past performance does not guarantee results.

Here are the tech-related discounts and credits you get for simply signing up:

Amazon Web Services: $5,000 in credit to be used over one year.

Google Ads: Up to $150 toward Google Ad spend.

UPS Shipping: 50% off.

QuickBooks: 50% off your first year.

Gusto: Receive 50% off for the first year with the payroll and benefits platform.

Slack: 25% off paid plans.

Vouch Business Insurance: Receive up to 25% off.

Freshworks: $10,000 credits on products.

Brex Exclusive members get 7x (seven points per dollar spent) for rideshare and taxi purchases, 4x points on travel expenses booked through Brex Travel (flights, hotels, and Airbnbs), 3x points back on restaurants and coffee shops, and 2x points back on recurring software expenses.

Brex Cash Account customers can earn the following rewards:

8X on rideshare purchases

5X on travel booked through Brex Travel

4X on restaurants

3X on eligible Apple purchases through the Brex Rewards Portal

1.5X on ads

1X on other purchases

Brex’s rewards program is based on tech entrepreneurs’ common expenses. There’s no cap for rewards points, and they never expire.

To understand the rewards program’s potential, we must envision typical day-to-day scenarios for tech startups. For example, most tech startups are in cities, where it’s more sensible for employees to use ridesharing services and taxis than personal cars.

Many startups cover employee transportation expenses with business credit cards. These expenses could theoretically add up to around $1,000 per month. Since Brex offers 7 points per dollar on ridesharing or taxis, that company would earn $70 in points per month.

Business owners can also use these travel rewards for every major airline and lodging company, including Southwest Airlines, which is reportedly omitted from most other business credit card rewards programs.

And if you were surprised to see Airbnb in the program, you’re not alone. Brex is currently the only business credit card or charge card that allows cardholders to use points for Airbnb stays.

7x RIDESHARE

4x BREX TRAVEL

3x RESTAURANTS

2x RECURRING SOFTWARE

Before explaining the rewards program, it’s crucial to note that the following rewards are only available for “Brex Exclusive” members. To become a Brex Exclusive member, you must make Brex your exclusive or primary corporate card. In other words, you cannot have another business credit card or charge card linked to your business bank account. The Brex Corporate Card must be your go-to card for business expenses.

If you are not an Exclusive member, your only rewards are 1x points back on all purchases or one point for every dollar you spend. Eligible cardholders can earn a flat 1 point per dollar on all other purchases. All Brex Corporate Cardholders can also redeem their reward points in several ways. First, you can redeem your points for cash back at a value of 1 cent per point. It usually takes 1-2 days to process redemptions, and there’s no minimum for redemption amounts. Brex points can be redeemed at a value of 1 cent per point as a statement credit against a transaction made on the card.

The second way is by transferring your points to the following airlines at a 1:1 ratio:

Aeromexico

Air France / Flying Blue

Asia Miles

Avianca

Emirates

Qantas

Singapore Airlines

Brex Cash is available to any US-based company that does not belong to Brex’s prohibited or restricted businesses list. Sole proprietorships are also ineligible.

And yes, you can open a Brex Cash account even if you have other bank accounts. There is no limit to the number of bank accounts you can have as a Brex Cash customer.

Brex Cash customers gain access to the standard rewards program for Brex cardholders. This bountiful program includes a $5,000 credit to Amazon web services over two years, 20% off an annual Zoom subscription, 25% off an annual Monday subscription, and much more.

Applying for the Brex Corporate Card takes just a few minutes. Here’s how to get started: To apply for a business credit card, you typically need to complete an online application form. The application process for business credit cards can vary significantly between issuers.

First, go to the website for the Brex Corporate Card and click “Apply now.”

The application requires your name, work email, and basic business information, such as your company role and external funding sources. Then, click “Create Account.”

Brex obtains your financial information when you link Brex to your business bank account. This also allows Brex to see if your account is linked to other business credit cards. Gathering the required documents before applying can help make the application process faster and more accurate.

If approved, you will immediately gain access to a virtual card. Your physical card should arrive in the mail in three to five business days. Processing times for business credit card applications can vary, but decisions are usually made within 7-10 business days.

Once you start borrowing funds, you have 30 days to pay off your entire balance or pay it daily, depending on which card you get. If you don’t pay off your entire balance, Brex may close your account.

Also, your credit limit fluctuates per your business’s cash flow. Remember, Brex is linked to your bank account, so it knows when your balance goes up or down. Your credit limit may increase if your balance is higher than when you initially applied. On the other hand, if your business depletes most of its bank balance, the credit limit will likely decrease until the balance recovers.

This system is called “dynamic credit.” It essentially prevents businesses from unknowingly spending money they can’t afford to pay back at the end of the month. Companies also don’t have to contact Brex to increase their credit limit or wait several months (at least) to qualify for credit increases.

Brex is a corporate card without a revolving credit limit. That means your credit balance can’t be transferred each month. If you’re looking for a business credit card with a revolving line of credit, you’ll need a different card.

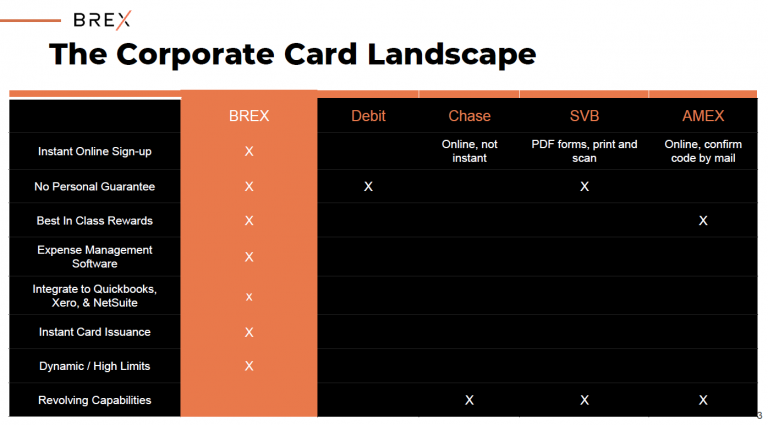

We’ll start with eligibility. It is extremely rare to find a business credit card that does not require a personal guarantee, credit check, or collateral. A personal guarantee makes the business owner personally responsible for the business’s debts. Credit card issuers often require healthy revenue and cash flow before issuing a credit line. However, some business credit card providers accept applications from newly formed LLCs, making it easier for startups to access credit.

If the business fails, the credit card company can seize your personal assets. Brex has no personal guarantee because they know cardholders might not be comfortable risking their personal assets on a business that has only been alive for a few months.

Owners of young businesses might also have little credit history or poor credit from using personal credit cards for expensive startup costs. The lack of an annual fee is a rarity, especially considering the extensive rewards program.

And while other business credit cards have lengthy applications, business owners can complete the Brex Corporate Card application in minutes. You can even start using the virtual card immediately after approval, which can be very helpful since every day counts in the business world.

Lastly, Brex’s sign-up bonuses and rewards program could save tech startups tens of thousands of dollars annually. Hubspot, Salesforce, and Zendesk are three top-rated tools for tech startups that become cheaper with the Brex Corporate Card.

Many tech entrepreneurs don’t travel much, but virtually all tech startups have recurring software expenses. Brex offers 2x points back for these expenses and incentivizes startups to acquire more of the tools they need to succeed. Brex estimates that the total value of their partnership discounts equals about $150,000, although the actual amount depends on which services your company uses.

The biggest drawback to the Brex Corporate Card is the limitation on companies that qualify. As we stated earlier, only venture-backed startups, professionally-funding companies with at least 20 employees, or non-invested companies with at least 50 employees qualify. This excludes most small business owners, sole proprietors, and other businesses.

Unless your business has a steady revenue stream, paying back the entire balance every month could be an issue. Hence, new companies that have yet to find their legs should look elsewhere for business credit cards.

If Brex’s target market wasn’t already narrow enough, the card’s rewards program has an additional requirement. You cannot have other business credit cards linked to your business bank account. So, to access the rewards program, you must be far enough in your journey to have obtained substantial funding but not far enough to have already obtained a business credit card.

Businesses that frequently use ridesharing services and taxis will likely reap the most benefits from the rewards program. If your company does not fit these criteria, you’d probably prefer a card that offers 7x points back for another expense, like travel or lodging. And though the sign-up bonuses do feature various popular software tools, many tech startups don’t use all of them.

Pros:

Robust rewards program with uncapped rewards.

No personal guarantee is required.

No annual fees or additional fees, which can benefit startups and small businesses. Many business credit cards have no annual fees, which can be particularly advantageous for startups and small businesses looking to minimize costs.

Businesses don’t need good credit to qualify.

No foreign transaction fees.

Business checking account services are available through Brex Cash Account.

Integrates with Brex’s larger financial stack SaaS.

Cons:

Excludes most SMBs.

Requires robust cash flow.

The rewards program requires exclusivity for maximum rewards.

No revolving balance or intro APR.

Your first five cards are free. Each additional card costs an extra $5 per month.

Your total balance is automatically deducted from your business checking account each month.

You can redeem points for a statement credit through Brex’s online dashboard.

The requirements for the Brex Corporate Card (and its rewards program) should give you a pretty clear picture of its target market. Above all else, your business should be heavily capitalized and/or have a steady revenue stream. Many credit card companies may not consider businesses that are less than a year old for credit applications. Business credit cards can also facilitate access to loans and lines of credit by establishing a business credit profile, which is crucial for long-term financial planning.

Regardless of where the money comes from, you’ll need to maintain a high bank balance every month to pay back the card’s balance in full. If you have no concerns about that department, you can move on to the following most important requirement: the tech industry.

Since many business credit cards exist, businesses often narrow their search by prioritizing sign-up bonuses and rewards programs. If a well-funded tech startup were to base its decision on these factors, the Brex Corporate Card would likely be a no-brainer.

Not only would the company save money on vital resources, but it would also have a much easier time deciding which resources to choose. Tech startups have a ton of choices when it comes to software tools. With Brex, they can access some of the most reputable options for discount prices. This makes the alternatives significantly less appealing. Why bother shopping around when there’s no competition in terms of price?

The rewards program is geared towards individuals who use ridesharing services as their primary source of transportation. Such individuals usually live in big cities and rarely go for more than a few days without using Uber, Lyft, etc. Brex’s rewards system for ridesharing is so advantageous that it doesn’t make sense to get this card if you rarely use the services mentioned above.

You could draw this conclusion from the rewards program alone. Like all Brex offerings, Brex Cash and the Brex Daily Card are geared towards early-stage tech startups. Odds are, a more established business has already built an arsenal of subscription services and isn’t looking to take on more recurring expenses.

An established business has also probably developed a solid banking partnership. Though Brex Cash customers can have other bank accounts, this might not make sense considering Brex’s complete lack of fees. In other words, why run the risk of incurring fees from another bank account when you can eliminate this risk?

Thus, an early-stage tech startup should consider Brex before opening a traditional bank account and getting a traditional debit card. Brex may be a safer option for their tumultuous finances, and no bank can compete with their standard rewards program.

Brex bases credit decisions on a business’s cash flow and available runway. The company will run a credit report on the business but does not look at personal credit scores. As such, you can get approved if you have bad credit if your business meets the financial requirements for approval.

Yes, Brex partners with the business credit bureau Dun & Bradstreet as well as Experian. Brex reports your payment history, account balance, credit limit, and more. Reporting to credit bureaus helps startups build their business credit history.

Brex’s target market is tech startups with all the funding they could ever want, and almost all of it has come from investors. Has your business already begun earning steady revenue on its own? If so, your business is probably too advanced in its development to meet Brex’s criteria.

Your application might also be declined if not enough of your funding comes from investors. Businesses operating on investors’ funds are less likely to run out of money. And when you always have cash at your disposal, you have no trouble paying your entire balance every month.

Many business credit cards have loose requirements for personal credit scores and carry very few fees. And if you pay off your balance at the same rate as a charge card, you won’t have to worry about high interest rates or limited borrowing power. In this case, you should look into the myriad of other advantageous and highly accessible business credit cards on the market.

Another option is financing your business through other means, like small business loans. Many business financing companies do not require high credit scores, personal guarantees, or more than six months in business. Also, the occasional slow month won’t automatically disqualify you from competitive interest rates or longer terms.

If Brex declined your application because of your cash flow, you must find a business financing company specializing in your financial circumstances.

In summary, the Brex Corporate Card is a sensible choice for young startups that have recently raised a great deal of funding. Here at UCS, we give Brex a 4.8 out of 5 rating and highly suggest working with them if you qualify. If you have yet to raise funding or are already fully operational, it’s probably best to consider other options.

Disclaimer: The Brex Corporate Card & Brex Cash trademarks are owned by Brex Inc., and their use herein is for reference purposes only, and it does not indicate sponsorship or endorsement from Brex Inc.

Fraud Disclosure:

Please be aware that individuals have been fraudulently misrepresenting to business owners (and others) that United Capital Source, Inc. (“UCS”) can assist small businesses in receiving government grants and other forgivable business loans, when in fact those grants or loans do not exist or are not available. These individuals have ulterior motives and are engaging in the unauthorized use of the names, trademarks, domain names, and logos of UCS in an attempt to commit fraud upon unsuspecting small business owners.

UCS will never communicate with a prospective client on Facebook, Facebook Messenger, or any other type of social media. Further, any email communications will always come from an official UCS email address and not a Gmail, Yahoo, or other email domain. If you believe you have been contacted by someone posing as an employee of UCS, please email [email protected].