What is Receivables Factoring?

Accounts receivable factoring, also known as invoice factoring, is a process where a business sells its invoices to convert that static asset into working capital. It requires working with a third party, known as a factoring company, which issues a cash advance based on the invoice value.

This is essentially a factoring transaction, where a business sells unpaid invoices. The amount the company receives is based on the value of the invoice.

The fees typically include a percentage of the invoice that the factoring company retains, as well as a fixed financing charge, referred to as the discount rate or factoring fee. The exact rates and fees depend on the company and your factoring agreement.

How does Accounts Receivable Factoring work?

The accounts receivable factoring company issues payment for a percentage of the total accounts receivable value, minus the discount rate, which is referred to as the advance rate. Advance rates vary between companies. Factoring companies typically pay a large percentage of the outstanding invoice amount, often advancing 70-90% of the invoice’s value upfront.

The company will retain a portion of the accounts receivable until the customer pays the invoice in full. The factoring company collects payment from the customer and pays the seller the remainder of the invoice amount, minus fees.

Business factoring differs from accounts receivable financing, despite similar-sounding terms. With accounts receivable financing, you retain ownership of the invoices. The accounts receivable financing company provides you with an upfront amount based on your invoices, which you repay with interest.

Factoring is usually more expensive than traditional financing methods, with costs often ranging from 1% to 5% of the invoice value per month. With recourse factoring, the seller retains responsibility for any unpaid invoices, while nonrecourse factoring shifts that risk to the factoring company. Businesses can choose to factor all invoices or only those for slow-paying customers, providing flexibility in cash management.

Why do companies Factor Receivables?

Companies use invoice factoring when they need immediate access to funds to address issues such as cash flow shortages or reinvesting in their business. Accounts receivable represent an asset to a company, but in some cases, businesses need to “cash in” on that asset early. Leveraging these assets can help fund business growth.

Businesses may use accounts receivable factoring to maintain cash flow during off-seasons or financial downturns. While accounts receivable ultimately become future cash flows, the amount of time it takes could result in lowered profitability. Factoring invoices turns the static asset into immediate cash flow.

How does Accounting for Factored Receivables work?

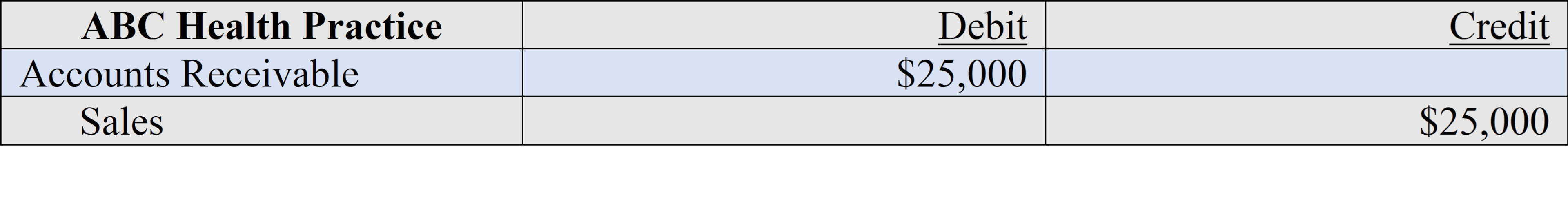

When a company provides goods or services on credit, known as credit sales, the accounting department enters it into the general ledger as an account receivable. When the company sells accounts receivable to a factoring company, it must also enter additional information. Understanding this process is crucial when calculating accounts receivable factoring costs.

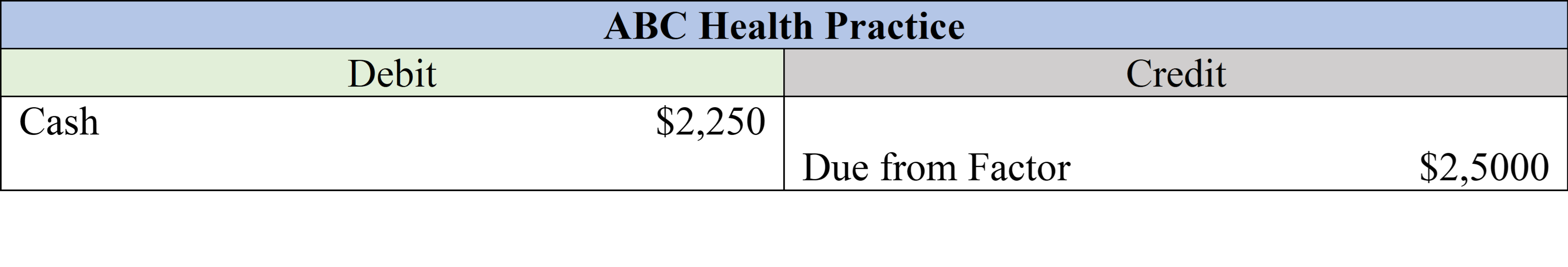

Companies must also account for the fees paid to the factoring company when accounting for factored receivables. The final accounting component is to enter the credit when you receive the remittance amount.

So, there are three separate accounting entries for factored receivables:

-

The journal entry is added to accounts receivable when the invoice is issued.

-

When the company receives the advance amount from the factoring company.

-

When the company receives the remittance amount from the factoring company.

Let’s look at each journal entry with an example.

Accounting for Factored Receivables Example

ABC Health Practice’s accounts receivable total $25,000. The amount is added to the ledger as follows:

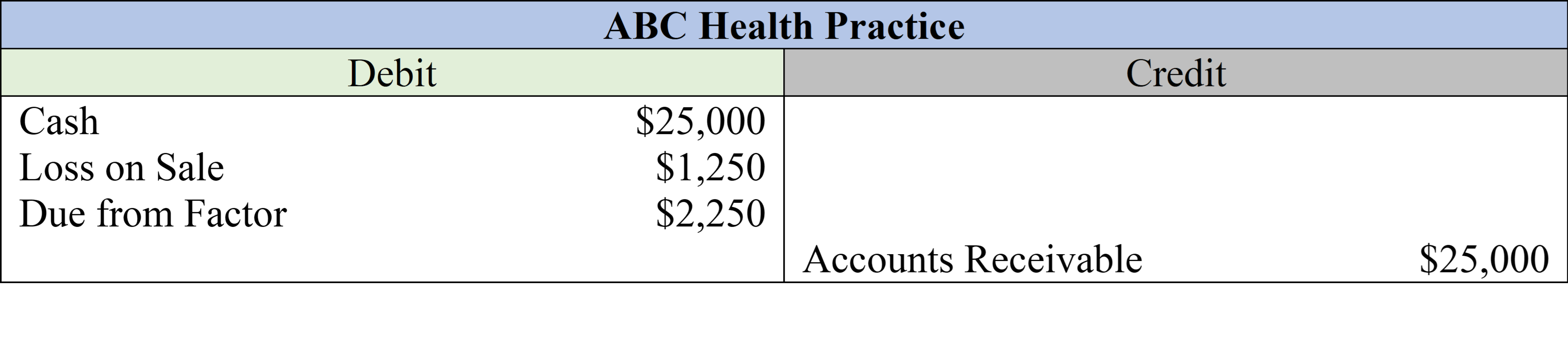

ABC Health Practice signed a factoring agreement with XYZ Factoring Company. XYZ offers the following factoring terms:

-

Advance rate: 85%

-

Factoring fee: 5%

-

Remittance: 10%

The next step is to remove the accounts receivable from your books, as the factoring company now owns the invoices. Set the journal entry up as follows:

The factoring fee is considered an interest expense, while the due-from factor amount is added to the reserve account.

Then, when your company receives the amount due from the factor, you’ll enter it as:

What is a Factoring Company?

A factoring company, sometimes referred to as a Factor, purchases invoices for an agreed-upon fee, allowing companies to convert their accounts receivable into working capital. Once the factoring company owns the assets, it collects payments from customers. The factoring company takes responsibility for the unpaid invoices.

In some ways, the factoring company acts as your accounts receivable back office. Most factoring companies follow up with your customers to collect payment and then issue the remaining balance once the customer has paid. Factors evaluate the creditworthiness of the seller’s customers to determine eligibility for factoring, rather than the seller’s credit history.

How do I find Factoring Companies?

There are many factoring companies to choose from, and the question is, how do you find the right factoring company? Several key factors should be considered when selecting a factoring company.

Fees

The first thing to consider is the cost. Invoice factoring will always be an expensive way to secure financing, but some companies are far more costly than others. You want to ensure that you can afford the fees and that the cost of funding is worthwhile for your business.

Recourse vs. Non-Recourse

Recourse factoring means your company is liable if your customers default on their invoices. In non-recourse factoring, the factoring company accepts responsibility for any unpaid invoice. You don’t have to pay if your customers default due to specific reasons, such as bankruptcy. Non-recourse factoring is more expensive, but the added protection may make it worthwhile.

Notification Factoring

The factoring company assumes responsibility for the invoice. Some factoring companies will notify your customers when they purchase the invoices, and others will not. If you don’t want your customers alerted when you sell their invoices, look for a company that doesn’t notify them.

How to apply for Receivables Factoring:

You can apply to enroll in receivables factoring right through United Capital Source.

Step 1: Make sure your customer is reliable.

Factoring invoices only works when your customers pay their invoices on time and in full. Ensure you’re certain your customers will pay before contacting a factoring company.

Step 2: Gather your documentation.

When you apply, the factoring company needs to review the following documents:

-

Driver’s license.

-

Voided business check.

-

Bank statements from the previous three months.

-

Business tax return.

-

Accounts receivable aging report, Accounts payable report, and debt schedule.

Step 3: Apply.

You can complete our one-page application or contact us by phone to apply. Either way, you’ll need to provide the information above and the invoice amount you want to sell.

Step 4: Speak to a representative.

Once you apply, one of our representatives will contact you to discuss the factoring fee, factoring rate, and terms associated with the sale. You’ll get an upfront breakdown of all costs, so you don’t have to worry about hidden fees.

Step 5: Receive approval.

The entire process takes about two weeks to finalize. Funds will appear in your bank account 1-2 days after completing the application.

What are the advantages of Factoring Receivables?

There are several advantages to factoring accounts receivable. It’s much easier to qualify for invoice factoring than other types of business financing options, such as bank loans.

Receivables factoring isn’t a loan, so you don’t incur any debt. It’s a viable alternative for companies in urgent need of funding that don’t want to add to their debt.

When you factor invoices, the factoring company assumes responsibility for collecting payments from your customers, saving you time and resources. And don’t worry – factoring companies won’t relentlessly pursue your customers, either. When you work with a company like UCS, your customers won’t even know you sold the invoice. Some factors do require notification factoring, however.

The most significant benefit is turning accounts receivable into working capital. Unpaid invoices are like unsold inventory – the longer they go without converting into cash for your business, the less profitable they become.

What are the disadvantages of Factoring Receivables?

We’re not going to sugarcoat it – receivables factoring is expensive. Like most near-term and short-term financing options, invoice factoring typically carries higher rates and fees compared to traditional long-term business financing.

Due to the complex nature of receivables factoring, it’s also difficult to compare costs to a loan or other forms of financing. Using the techniques described above, accounting for factored receivables helps understand the total costs involved.

While you don’t need good credit for approval, your customers do. If your customers are unreliable and already paying late, you are unlikely to get approved. Receivables factoring is most effective for established businesses with multiple customers or clients.

Factoring accounts receivable is not the only way to avoid late payments and convert invoices into cash. Sometimes, all you need to do is improve billing. You can try automating your invoices, offering customers more payment options, and enhancing your collections team’s efforts.

We prepared a pros and cons list for a quick summary.

Receivables Factoring Pros & Cons:

Pros:

-

Turn unpaid invoices into cash.

-

Easier to qualify for than other forms of business financing.

-

You can use the funds for various business purposes.

-

Invoices and receivables are treated as collateral.

Cons:

-

Higher rates & fees than traditional loans.

-

Fees are based on the time it takes customers to pay their invoices.

Frequently Asked Questions

Here are some of the most common questions about receivables factoring.

What is an Accounts Receivable Journal Entry?

An accounts receivable journal entry refers to the recording of information about an accounts receivable (A/R) transaction in the accounting ledger. A journal entry must include information about the transaction, such as the name of the company, the day of the transaction, and the amounts involved.

Accounts receivable have a minimum of two entries – the date the receivables were added as an asset and the date the money was received, turning that asset into cash. Companies need a third journal entry when they factor invoices.

What are the alternatives to Accounts Receivable Factoring?

While accounts receivable factoring can be a helpful solution for businesses needing fast access to working capital, it’s not the only financing option available. Depending on your cash flow needs, credit profile, and long-term goals, there may be other business funding options that make more sense for your situation. Here are some popular alternatives, including several forms of debt financing:

Business Term Loans

A business term loan provides a lump sum of capital that is repaid over a fixed period, usually with monthly payments. These loans are ideal for funding larger investments, such as expanding operations, purchasing inventory in bulk, or refinancing higher-interest debt. Term loans are best for businesses with solid credit and steady revenue that want predictable repayment schedules.

Business Line of Credit

A business line of credit provides flexible access to capital that you can draw upon as needed, much like a credit card. You only pay interest on the amount you use, and once repaid, the funds become available again. This option is handy for managing fluctuating expenses, covering seasonal slowdowns, or capitalizing on short-term opportunities. Unlike factoring, a line of credit doesn’t rely on your customers’ creditworthiness but may require strong financials and good credit.

Equipment Financing

If your business needs to purchase or upgrade machinery, vehicles, or other physical assets, equipment financing could be a smart alternative. The equipment being purchased typically serves as collateral, which can make approval easier even for businesses with limited credit history. This financing method enables you to preserve your working capital while investing in tools that can enhance productivity and drive revenue growth.

SBA Loans

Loans backed by the Small Business Administration (SBA) are another option for qualified borrowers. These loans often offer lower interest rates and longer repayment terms compared to traditional bank loans. While the application process can be lengthy and paperwork-intensive, SBA loans are outstanding for businesses that meet the eligibility requirements and have time to plan their funding.

Merchant Cash Advance

A merchant cash advance (MCA) provides a lump sum of working capital in exchange for a percentage of your future credit card or daily sales. MCAs are easy to qualify for and can be funded quickly, making them a viable option for businesses with high daily transaction volumes. However, they can come with significantly higher fees and daily repayment structures that may strain cash flow if not carefully managed.

Bad Credit Business Loans

If your credit score is holding you back from traditional funding, there are still financing options available. Bad credit business loans are designed for business owners with lower credit scores or a limited credit history. These loans typically have shorter terms and higher interest rates, but they can provide much-needed capital to keep your business running or take advantage of growth opportunities. Many lenders look beyond credit scores and consider factors such as business revenue, time in business, and cash flow.

Accounting for Factored Receivables – Final Thoughts

Accounts receivable factoring can help you grow your business by converting outstanding invoices into immediate working capital. While there are many benefits, it is also essential to consider the associated costs and risks.

Managing your books for accounts receivable is already a complicated task. When you begin factoring your accounts receivable, it becomes even more complex. However, accurate accounting for receivables helps you understand the total cost to your business.

There are numerous business financing options available for businesses seeking to secure working capital, enabling them to maintain a stable cash flow and invest in growth and expansion. Deciding the best option requires due diligence and thorough accounting for all costs. Whether you’re currently factoring invoices or considering a factoring agreement, ensure you understand how to account for factored receivables with accurate journal entries.

Contact us to learn more about factoring through UCS, or visit our Accounts Factoring Resources page.