What are No Doc Business Loans?

No doc business loans, also called alternative loans, don’t require the extensive documentation and financial statements a traditional business loan requires. It’s an excellent option for newer businesses that don’t have the years of tax returns, balance sheets, and profit & loss statements that established companies can provide.

Online lenders that provide no-doc business loans typically use a financial technology (fintech) platform that connects to your business bank account or accounting software. The platform quickly analyzes your financial performance in real-time rather than relying on financial statements.

The process usually involves a quick and easy application with an approval decision within 1-2 business days. Once approved, these business loans also provide fast funding, usually in 1-3 business days. Some no-doc business loan lenders can offer same-day approval and funding.

Most fintech lenders also consider your personal credit score and income when underwriting alternative business loans. However, you can get approved with a low credit score.

In exchange for the convenience, speed, and minimal documentation of these loans, online lenders tend to charge higher rates and fees. Some small business owners are willing to pay the extra charge when they have an urgent funding need and lack documentation.

How do No Doc Business Loans work?

The “no doc” in no documentation business loans typically refers to financial statements like profit & loss statements, balance sheets, etc. It can also refer to supporting documentation like your business plan, financial projections, and tax returns.

In most cases, you’ll still have to provide proof of identification, like a driver’s license or other government-issued ID. You might still have to provide limited documentation like merchant statements or three months of business bank statements.

There are several forms of no-doc business loans:

- True No Doc Loans: These are business loans where you have to fill out the application and let the lender review your credit eligibility. A true no-doc loan is less common.

- Low Doc Business Loans: The most common type of no doc business loans. Low-doc business loans require some documentation, like business bank statements, but don’t require financial statements.

- State Income Loans: Lenders will ask for documents stating your income but don’t require supporting documentation to verify it.

Several types of small business loans require little to no documentation. Here are the available no-doc business loans.

Short-Term Business Loans

- Loan amount: $10k – $5 million.

- Factor rates: Starting at 1%-4% p/mo.

- Term: 3 months – 5 years.

- Speed: 1-3 business days.

Business term loans are traditional financing structures where a business receives a large loan disbursement, repaid with interest and fees. Most term loans use an APR and carry fixed monthly payments for the loan term.

A short-term business loan primarily operates the same way, with a shorter repayment period. However, that could sometimes mean a lower borrowing amount and trading monthly payments for daily, weekly, or bi-weekly payments.

Business Lines of Credit

- Loan amount: $10k – $1 million.

- Factor rates: Starting at 1% p/mo.

- Term: Up to 36 months.

- Speed: 1-3 business days.

Business lines of credit (LOCs) are short-term financing that offers excellent flexibility. Instead of a single loan disbursement, your funds are activated as an available credit limit.

You can draw funds from your credit limit as needed. You only pay interest on the money you draw and never have to draw the total amount.

Once you repay what you took out, the credit limit replenishes, and your funds are available for the next time you need them. This is called revolving credit and works like a credit card.

The credit limit essentially gives you funding on demand. LOCs are excellent for ongoing projects, seasonal businesses, and covering unexpected costs.

Merchant Cash Advance

- Loan amount: $10k – $1 million.

- Factor rates: Starting at 1%-6% p/mo.

- Term: Up to 24 months.

- Speed: 1-2 business days.

A merchant cash advance (MCA) is a type of working capital loan that provides funding in the form of a lump sum of cash. The advance is repaid with a percentage of your future receivables.

MCA funders base your approval amount on your previous sales history and projected future sales. That’s because your sales are the primary source of repayment.

Most merchant cash advances require daily payments, but some are weekly. In a traditional MCA, the repayment amount comes directly from your debit or credit card reader. However, many MCA companies are moving to a more reliable process of repayment where the funds are automatically debited from your business bank account via ACH transfer.

Invoice Factoring

- Loan amount: $10k – $10 million.

- Factor rates: Starting at 1% p/mo.

- Term: Up to 24 months.

- Speed: 1-2 business weeks.

Invoice factoring, also called accounts receivable factoring or invoice financing, converts your outstanding invoices into immediate working capital. Like an MCA, the process is technically a business-to-business transaction, not a loan.

Companies that sell on credit deliver their products or services to a client and issue an invoice at a later date. The process is convenient and helps some companies attract more business.

However, delays between delivering the goods and receiving payment may cause critical cash flow interruptions. This process lets you sell or “factor” those unpaid invoices to a third-party financial services business called a factoring company to smooth out cash flow gaps.

The factoring company issues funds based on the invoice’s value, called an advance rate. Most advance rates are between 75%-95%. The factoring company then owns the invoice and collects payment from your client.

What are the advantages of No Doc Business Loans?

The primary advantage is that you don’t have to track down and compile documents before getting your loan. The process saves significant time, and you don’t have to hand over as much sensitive information to the lender.

Most no-doc business loans provide fast funding. This form of business funding is good when you have an urgent need.

The application process is quick and easy. Many alternative loans don’t require collateral. Some loans provide early payoff discounts.

Eligibility requirements for alternative business loans are much more lenient than traditional loans. You can typically get a business loan with a low credit score and less than a year in business.

What are the disadvantages of No Doc Business Loans?

The tradeoff for the speed and convenience of no-doc business loans is the cost. Most of these carry high-interest rates or factor rates.

In addition, you might have to pay fees, like an origination fee. Some lenders have extra charges like draw fees for lines of credit. Depending on the loan type and lender, you might also have early payoff penalties.

These business loans also have frequent repayment schedules. Small businesses typically have to repay short-term loans on daily or weekly schedules.

While most no-doc business loans don’t require collateral, some do. You’ll typically have to sign a personal guarantee even when collateral is not required.

Pros & Cons

Pros:

- Quick & easy online application process.

- Lower eligibility requirements.

- You can usually receive approval within 24 hours or sooner.

- Fast funding time once approved.

- Doesn’t require extensive documentation.

- Most loans don’t require collateral.

- Some lenders offer early payment discounts.

Cons:

- Potentially expensive loan costs with high interest or factor rates.

- Might have to pay additional fees.

- Some lenders charge early payoff penalties.

- Most loans require a personal guarantee.

- Frequent repayments, typically daily or weekly.

What are the qualifications for a No Doc Business Loan?

The qualifications for no-doc business loans largely depend on the type of loan you receive. Lenders consider your personal credit score, business credit, time in business, and annual revenue.

Here are the minimum qualifications by loan type.

Term Loans

- Minimum credit score: 550+.

- Time in business: 6 months+.

- Annual revenue: $75k+.

Business Line of Credit

- Minimum credit score: 575+.

- Time in business: 1year+.

- Annual revenue: $75k+.

Merchant Cash Advance

- Minimum credit score: 550+.

- Time in business: 4 months+.

- Annual revenue: $120k+.

Invoice Factoring

- Credit score: 550+.

- Time in business: 1 year+.

- Annual revenue: $250k+.

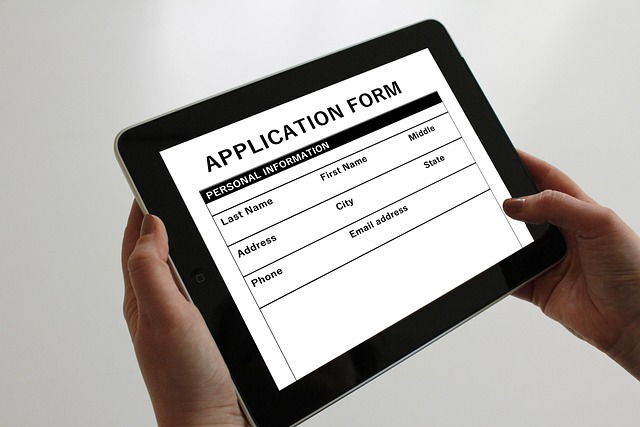

How to apply for a No Doc Business Loan:

The application takes just a few minutes if you have the required information. Upon approval, funds can appear in your bank account in 1-3 business days. Here’s how to get started:

Step 1: Consider Your Financing Needs

Before you begin the process, take some time to ensure this is the right financing option for your needs. Will you be able to access your desired working capital amount? Will you be able to fulfill the repayment structure? Answering these questions ahead of time will ensure that you don’t run into liquidity issues when making payments.

Step 2: Gather Your Documents

Depending on the loan type, the application may require some minimal documentation, such as the following information:

- Driver’s license

- Voided business check

- Business bank statements from the past three months

Step 3: Fill Out the Application

You can begin the process by calling us or filling out our one-page online form. Either way, you’ll be asked to enter the information from the previous section along with your desired funding amount.

Step 4: Speak to a Representative

Once you apply, a representative will contact you to explain the repayment structure and rates of your available options. This way, you won’t have to worry about surprises or hidden fees during repayment.

Step 5: Receive Approval

If and when you’re approved, funds should appear in your bank account in 1-2 business days.

Frequently Asked Questions

Here are the most common questions about no-doc business loans.

Do banks offer No Doc Business Loans?

It’s highly unlikely that a bank or credit union would offer a no-doc business loan. Traditional lenders typically have a much more involved loan process, including due diligence with extensive documentation.

Can I get a No Doc Business Loan with bad credit?

Yes, getting a no-doc small business loan is possible if you have bad credit, but your business must have consistent revenue. In addition, bad credit business loans carry higher interest rates and fees.

A small business owner might use bad credit business loans as bridge financing. After building their business credit, they can qualify for lower-cost business financing options.

What are my alternatives to No Doc Business Loans?

Several small business loan options still have low eligibility requirements but require more documentation. You might be interested in one of the following small business loan options:

No Doc Business Loans – Final Thoughts

No doc business loans are suitable for younger businesses with urgent funding needs. The costs are higher, but the speed and convenience may be worth the cost.

More established businesses with the available documentation can likely qualify for a lower-cost conventional business loan. But remember, traditional business loans usually take longer to close and fund. The extra costs of alternative business loans could be justified if you need urgent funding.

Contact us if you have more questions on no-doc business loans or want to apply for a small business loan. Our loan executives can help you find the best funding program for your business needs.