What is SBA Form 1919?

SBA loan requests are notorious for the rigorous application process. Federal loans require extensive documentation and verification before they can guarantee business loans. The SBA examines your business’s financial records and assesses the character and background of all business principals.

SBA Form 1919, “Borrower Information Form,” is a significant part of that process. The SBA uses the form to collect information about your business, the loan request, ownership, criminal background (if any), and previous government loans. The SBA also wants to verify the number of employees the company has and the number of jobs an SBA loan could potentially create to determine eligibility.

Form 1919 requires you to provide the legal name of your business as it appeared on your last tax return. Questions about military status, gender, race, and ethnicity are voluntary and don’t affect the SBA’s credit decision. Form 1919 includes questions about business affiliates, exporting goods, and criminal history. You must answer all questions on the form carefully to avoid delays in the processing of your application. The SBA may use information on the form to facilitate background checks, as authorized in the Small Business Act.

How do I fill out SBA Form 1919?

Completing SBA Form 1919 is an in-depth process with 31 questions to answer. You should set aside at least one hour to complete it and ensure you have any necessary documents.

SBA Form 1919 includes 22 questions that must be carefully and thoroughly answered. Form 1919 requires the legal name of the business as it appeared on the last tax return. Form 1919 inquires about the applicant’s military status, gender, race, and ethnicity; however, these questions are optional.

Form 1919 requires disclosure of any criminal history. All parole and probation must be lifted for eligibility for an SBA loan.

You must include both full-time and part-time employees when detailing the number of employees for the application. The SBA typically orders an independent business appraisal as part of the loan application process. The SBA may review the answers provided in Form 1919 after submission.

The form consists of three sections:

-

Section I: Business Information.

-

Section II: Individual Owner Information.

-

Section III: Entity Owner Information.

Let’s go over each section and the relevant information and questions.

Note: The following information is based on the most recently revised version. The current revised form was released in September 2020 and is set to expire on September 30, 2023. Please ensure you have the most updated version of Form 1919.

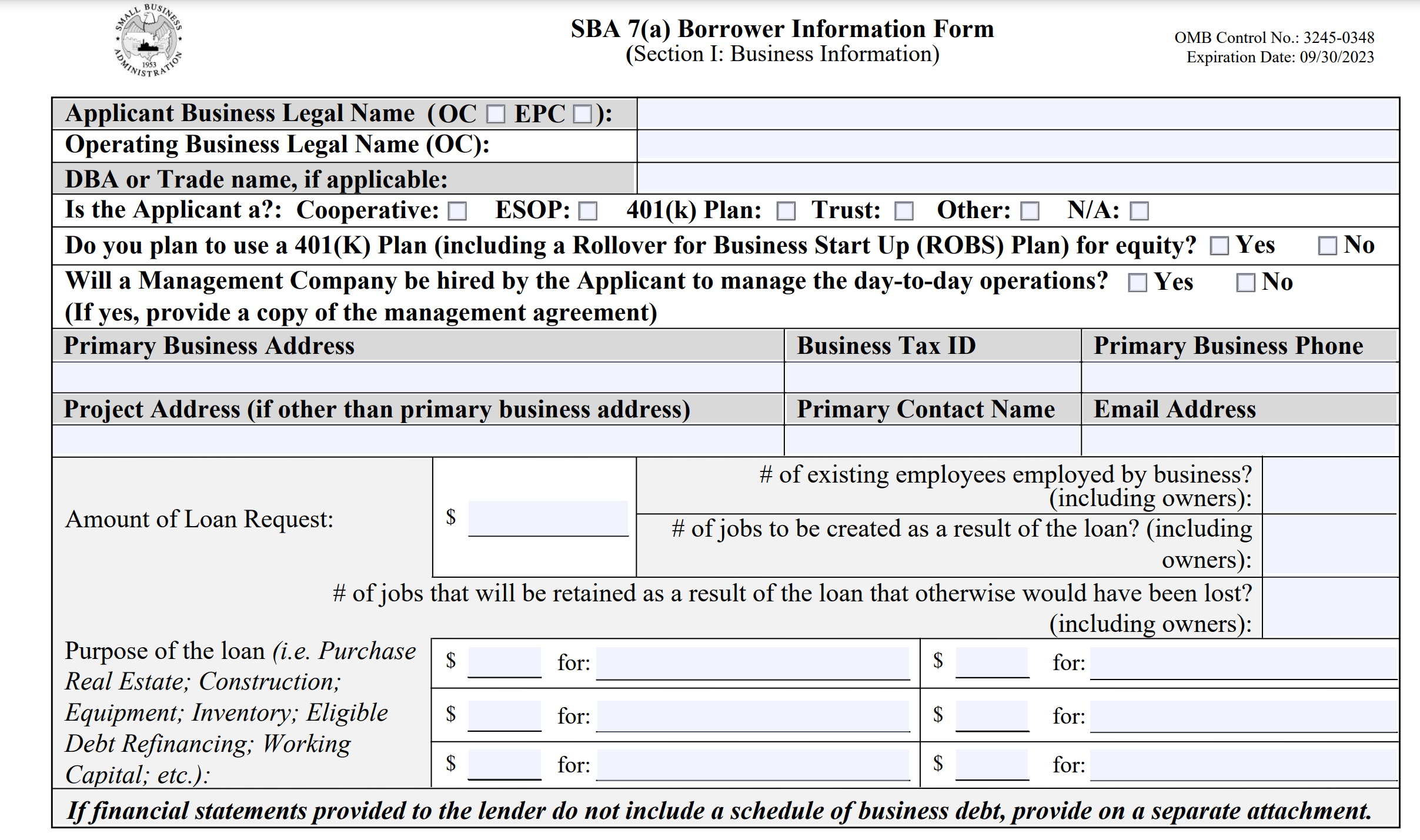

Section I: Business Information

In the first part of Section I, you will provide information about your business and the loan you’re requesting.

You must provide the following:

-

Business name, operating name, and DBA if the business operates under a different name.

-

Whether the applicant is a Cooperative, ESOP, 401(k) plan, Trust, Other, or N/A.

-

If you’re an operating company (OC) or an eligible passive company (EPC)

-

If you plan to use a 401(k) plan for equity (includes Rollover for Business Startups).

-

Whether or not you will hire a Management Company for day-to-day operations.

-

Primary and any secondary business address, primary phone number, and email.

-

Business tax ID.

When completing the portion about your loan request, you will provide

-

Amount requested.

-

Number of existing employees.

-

Number of new jobs created as a result of the loan.

-

Number of jobs retained as a result of the loan.

-

How you will use the loan proceeds.

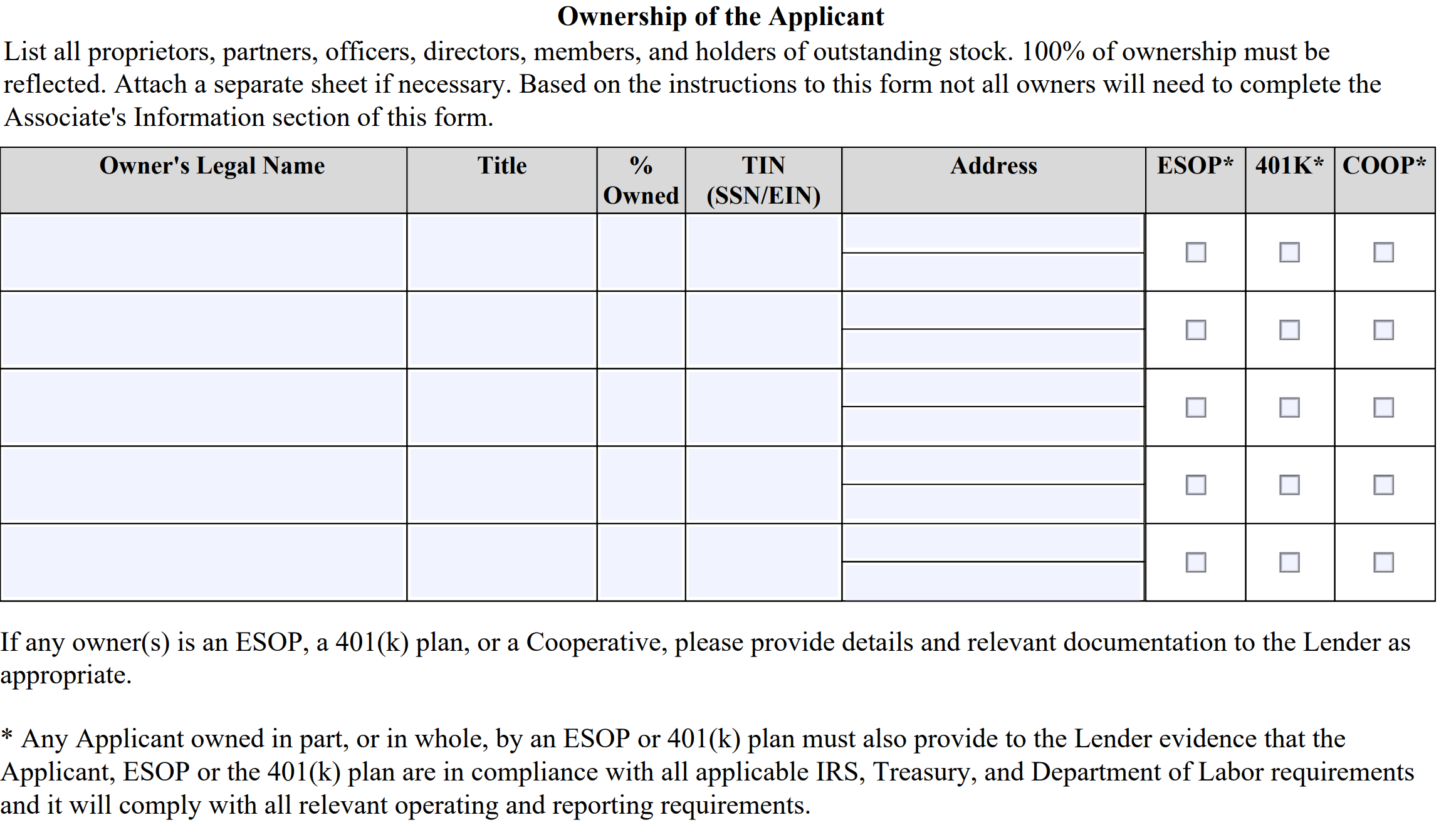

Next, list each owner, including their ownership percentage, SSN or EIN, address, and entity type. Section 1 consists of 16 yes or no questions.

Questions 1-11

This section identifies information about your business. If you answer “Yes” to any question, you will provide details on a separate sheet.

-

Question 1: Are there any co-applicants? Co-applicants include other businesses applying for the loan. Each co-applicant fills out their own version of SBA Form 1919 Section 1.

-

Question 2: Has an application for the requested loan ever been submitted to the SBA, a lender, or a Certified Development Company, in connection with any SBA program? If yes, please provide loan details in a separate sheet, including the amount, purpose, application date, and whether the loan was accepted or denied.

-

Question 3: Has the Applicant and/or its Affiliates ever obtained or applied for a direct or guaranteed loan from SBA, or another Federal agency loan program (including, but not limited to USDA, B&I, FSA, EDA), or been a guarantor on such a loan?) If yes, you must answer 3(a) Is the financing delinquent? And 3(b), did you default and cause a loss to the federal government? If you answer yes, your loan may be denied.

-

Question 4: Is the Applicant presently suspended, debarred, proposed for debarment, declared ineligible, or voluntarily excluded from participation in this transaction by any Federal department or agency? If the answer is yes, the loan request may be denied.

-

Question 5: Does the Applicant Business operate under a Franchise /License /Distributor /Membership /Dealer/ Jobber or other type of Agreement? If yes, you will provide details on a separate sheet.

-

Question 6: Does the Applicant have any Affiliates per 13 CFR 121.301? If yes, provide any information on your affiliates.

-

Question 7: Has the Applicant and/or its Affiliates ever filed for bankruptcy protection? Provide any details if yes.

-

Question 8: Is the Applicant and/or its Affiliates presently involved in any pending legal action? You may need to provide court records and any judgments or determinations from the court.

-

Question 9: Are any of the Applicant’s products and/or services exported (directly or indirectly), is there a plan to begin exporting (directly or indirectly) as a result of this loan, or is this an Export Working Capital Program (EWCP)* loan? If yes, you must answer 9(a); Provide the estimated total export sales this loan will support. If an EWCP loan, answer 9(b), List of principal countries of export (at least 1).

-

Question 10: Has the Applicant paid or committed to pay a fee to the Lender or a third party to assist in the preparation of the loan application or application materials, or has the Applicant paid or committed to pay a referral agent or broker a fee? If yes, the lender or third party to whom you paid the fee may need to submit a form disclosing their fee compensation.

-

Question 11: Are any of the Applicant’s revenues derived from gambling, loan packaging, or from the sale of products or services, or the presentation of any depiction, displays or live performances, of a prurient sexual nature? If so, your loan will be denied because the SBA doesn’t accept applications from businesses that derive income from these activities. The sole exception is if 30% or less of your revenue comes from state lottery sales.

Questions 12-16

This section is intended to prevent a conflict of interest. The SBA cannot approve loans where a conflict of interest exists.

Answering yes to any of these questions does not mean the loan is automatically denied. However, the lender must submit the application through a different process.

-

Question 12: Is any sole proprietor, partner, officer, director, stockholder with a 10 percent or more interest in the Applicant an SBA employee or a Household Member of an SBA employee? A household member means a spouse or minor child of an employee, any blood relation, or a spouse of a blood relation who lives in the same home.

-

Question 13: Is any employee, owner, partner, attorney, agent, owner of stock, officer, director, creditor or debtor of the Applicant a former SBA employee who has been separated from SBA for less than one year prior to the request for financial assistance? If yes, provide any information on the individual, including their separation date.

-

Question 14: Is any sole proprietor, general partner, officer, director, or stockholder with a 10 percent or more interest in the Applicant, or a household member of such individual, a member of Congress, or an appointed official or employee of the legislative or judicial branch of the Federal Government? Provide any information about the individual on a separate sheet if yes.

-

Question 15: Is any sole proprietor, general partner, officer, director, or stockholder with a 10 percent or more interest in the Applicant, or a household member of such individual, a Federal Government employee or Member of the Military having a grade of at least GS-13 or higher (or Military equivalent)? If yes, the SBA lender may still submit the application through the standard process.

-

Question 16: Is any sole proprietor, general partner, officer, director, or stockholder with a 10 percent or more interest in the Applicant, or a household member of such individual, a member or employee of a Small Business Advisory Council or a SCORE volunteer? Again, provide any relevant information on a separate sheet if the answer is yes.

After completing the questions, review your answers to ensure everything is accurate. If so, sign and date at the bottom of page 5.

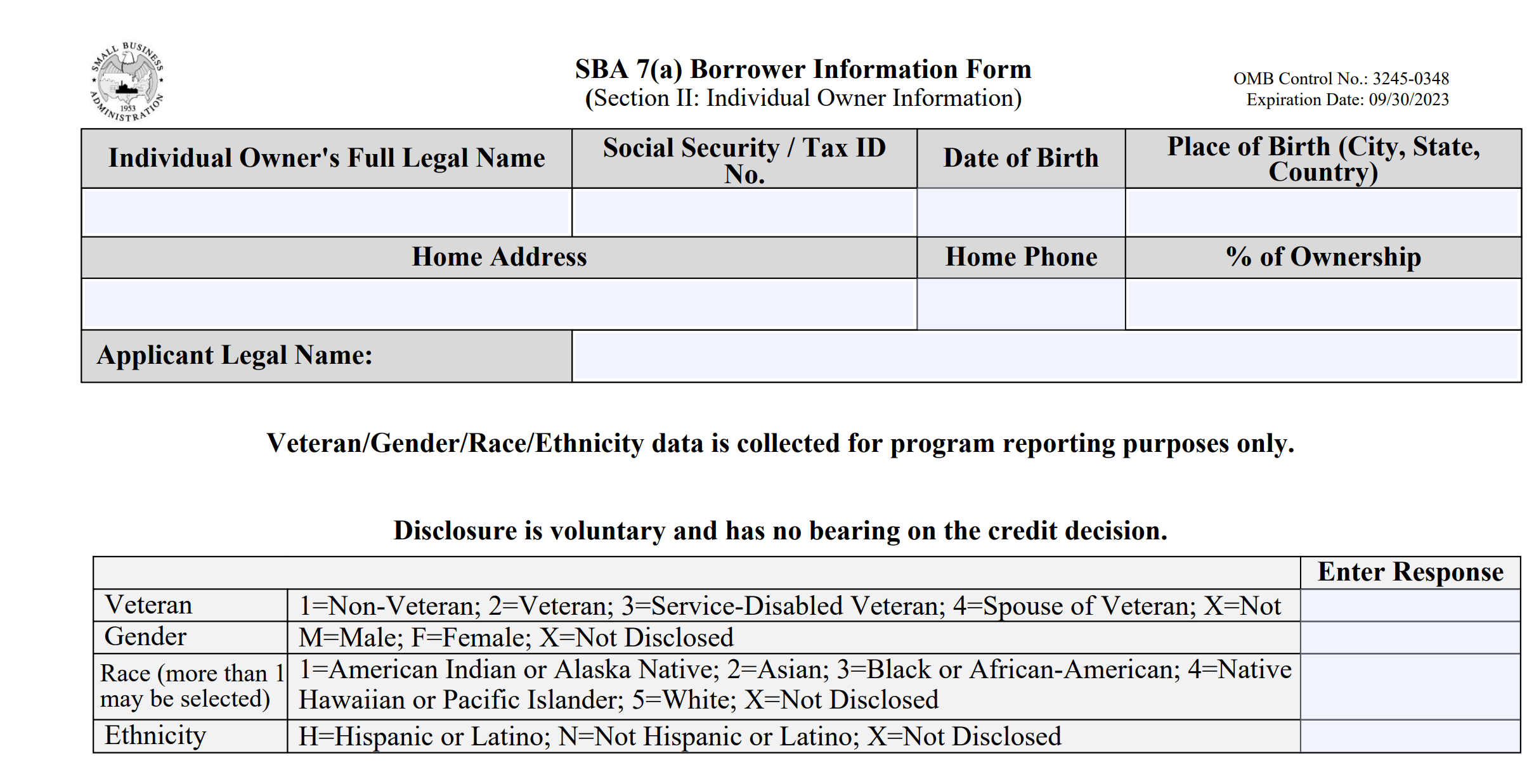

Section II: Individual Borrower Information

You’ll provide more information about yourself in this section. You will enter your full name, date of birth, social security number, home address, ownership percentage, and country of your birth. You can also voluntarily disclose your veteran status, gender, race, and ethnicity.

Questions 17-26

This section asks about your background. If you answer “Yes” to any question, you must include details in a separate sheet.

-

Question 17: Are you presently subject to an indictment, criminal information, arraignment, or other means by which formal criminal charges are brought in any jurisdiction? If yes, you are ineligible for an SBA loan.

-

Question 18: Have you been arrested in the last 6 months for any criminal offense? Answering yes to this question doesn’t automatically disqualify you, but you must provide details.

-

Question 19: For any criminal offense – other than a minor vehicle violation – have you ever: 1) been convicted; 2) pleaded guilty; 3) pleaded nolo contendere; 4) been placed on pretrial diversion; or 5) been placed on any form of parole or probation (including probation before judgment)? Answering yes to this question means you are ineligible for an SBA loan.

-

Question 20: Citizenship. In this area, you will check off your citizenship status. If you are not a US citizen, include your country of citizenship and any relevant information.

-

Question 21: Are you presently suspended, debarred, proposed for debarment, declared ineligible, or voluntarily excluded from participation in this transaction by any Federal department or agency? If you answer yes, you are ineligible for an SBA loan.

-

Question 22: If you are a 50% or more owner of the Applicant, are you more than 60 days delinquent on any child support payments arising under an administrative order, court order, repayment agreement between the holder and a custodial parent, or repayment agreement between the holder and a state agency providing child support enforcement services? If you answer yes to this question, you’re ineligible for an SBA loan.

-

Question 23: Do you have any ownership in other businesses which would be defined as an Affiliate of the Applicant in the definition found on page 1? If yes, include the Affiliate and your ownership percentage on a separate sheet.

-

Question 24: Have you, or any business you controlled, ever filed for bankruptcy protection? Provide details if yes.

-

Question 25: Are you, or any business you control, presently involved in any legal action (including divorce)? Provide details if yes. Involvement in specific legal actions may disqualify you from an SBA loan.

-

Question 26: Have you or any business owned or controlled by you ever obtained a direct or guaranteed loan from SBA or any other Federal agency or been a guarantor on such a loan? If yes, you must answer 26(a), Is the financing considered delinquent? If the answer to 26(a) is yes, you must answer 26(b): Did the loan cause a loss for the government? If both questions are yes, you must provide the Lender with a written explanation.

Review all your answers to ensure they’re accurate. Then sign and date on the appropriate spaces on page 8 of the form.

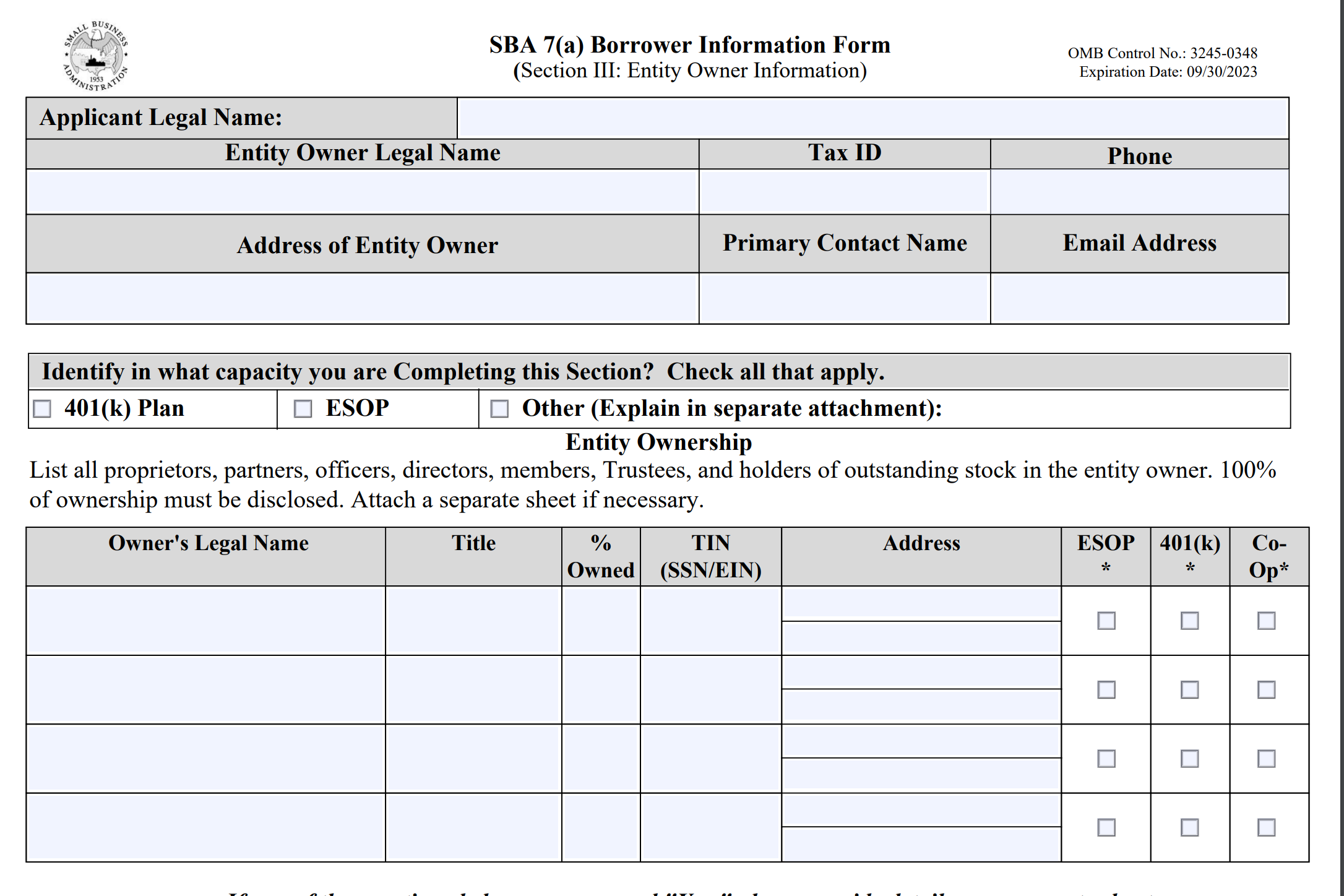

Section III: Entity Owner Information

This section is new to Form 1919. It repeats some of the questions from the previous section, but is for all entity owners, not just the applicant.

You’ll enter the entity owner’s legal name, tax ID, and contact information. Then, list all owners, partners, members, and so on, just as you did in Section I.

Questions 27-31

These questions ask about the background and status of all entity owners.

-

Question 27: Is the Entity, or any of its owners, presently suspended, debarred, proposed for debarment, declared ineligible, or voluntarily excluded from participation in this transaction by any Federal department or agency? If yes, the application won’t be approved for an SBA loan.

-

Question 28: Does the entity have any Affiliates? If yes, include a list of affiliates in a separate sheet.

-

Question 29: Has the entity and/or its Affiliates ever filed for bankruptcy protection? Provide any information on the bankruptcy, if any. Recent bankruptcies might disqualify you from an SBA loan.

-

Question 30: Is the entity and/or its Affiliates presently involved in any pending legal action? If yes, provide details in a separate sheet.

-

Question 31: Has the Entity ever obtained a direct or guaranteed loan from SBA or any other Federal agency or been a guarantor on such a loan? If yes, you must answer 31(a), is the financing considered delinquent? If the answer to 31(a) is yes, you must answer 31(b): Did the loan cause a loss for the government? If both questions are yes, you must provide the Lender with a written explanation.

Review your answers for accuracy. After confirming all information is correct, sign and date on the appropriate lines on page 10.

You have now completed SBA Form 1919.

How to apply for an SBA loan:

United Capital Source can assist with submitting an SBA loan application by following these steps.

Step 1: Ensure you qualify

You’ll need a credit score between 650 and 700 and a healthy, consistent cash flow. How you intend to use the money also plays a significant role.

You’ll need a detailed plan of how the funds will help you invest in and grow the business.

Step 2: Gather your documents

Be prepared to provide:

-

Driver’s License.

-

Business license or certificate.

-

Voided Business Check (for business bank account information).

-

Bank Statements.

-

Credit Report/Statement of Personal Credit History.

-

Business Tax Returns.

-

Credit Card Processing Statements.

-

Personal Tax Returns – 3 Years.

-

Business Tax Returns – 3 Years.

-

Business Plan (Not in all cases).

-

Personal Financial Statement.

-

List of Real Estate Owned or Business Leases, if applicable.

-

Debt Schedule/Loan/Rent/Lease Documentation

-

Deeds/Title/Ownership documentation for any collateral/Security

-

Current Profit & Loss Statements and Balance Sheet Year-to-Date

-

A/R and A/P Reports

-

United Capital Source 1 Page Application

-

SBA Form 1919.

Step 3: Fill out the application

You can begin the application process by calling us or filling out our one-page online application.

Either way, you’ll be asked to enter the information from the previous section along with your desired funding amount.

Step 4: Speak to a representative

Once you apply, a representative will reach out to you to explain the repayment structure, rates, and terms of your available options. This way, you won’t have to worry about any surprises or hidden fees during repayment.

Step 5: Receive approval

SBA Loans through our network generally take 3-5 weeks to process. Once approved and your file is closed, funds should appear in your bank account in a few business days.

What are the advantages of SBA loans?

The US Small Business Administration partially guarantees SBA loans, which allows lenders to offer larger loan amounts at lower interest rates and extended repayment terms. Additionally, the SBA sets limits on the interest and fees that lenders can charge.

Small business owners can use SBA loan proceeds for almost any business need. The SBA loan program offers a range of loan packages tailored to meet specific needs.

SBA-approved lenders report on-time payments to the major credit bureaus. You can build your business credit using SBA loans.

What are the disadvantages of SBA loans?

SBA lenders often have high approval requirements. You’ll typically need at least two years in business, high annual revenue, and a good to excellent credit score.

The application process is tedious and requires extensive documentation. It could take 60-120 days from the initial application to close and fund the SBA loan request.

Most SBA loans require a down payment of at least 10%. You will usually need to provide collateral. All SBA loans require a personal guarantee from any owner with a 20% or greater stake.

SBA loan pros & cons

Pros:

-

The SBA partially guarantees the loan.

-

Large loan amounts with low interest and long repayment terms.

-

You can use the funds for most business purposes.

-

Paying your SBA loan on time helps establish and build your credit.

Cons:

-

High approval requirements.

-

Lengthy application process with exhaustive documentation.

-

It could take 60-120 days to close and fund the loan.

-

Typically requires a down payment of at least 10% and collateral.

-

Requires a personal guarantee.

Frequently Asked Questions

Here are the most common questions about SBA Form 1919.

Who needs to complete SBA Form 1919?

The parties required to complete Form 1919 depend on your business structure.

-

Sole proprietorship: the sole proprietor.

-

Partnership: General or limited partners owning 20% or more of the firm or any partner involved in management.

-

Corporation: Owners of 20% or more, and each officer and director.

-

LLCs: Members owning 20% or more of the company, officers, directors, and managing members.

-

Key employees: Any person hired by the Applicant to manage the day-to-day operations of the Applicant’s business

-

Trustor: if a trust owns the Applicant.

Managers hired to manage day-to-day operations must also complete Form 1919. If not a US citizen, you must provide your Alien Registration Number on Form 1919. If unable to complete the form, you may use a packager, broker, or other professionals for assistance.

What do I need to complete SBA Form 1919?

The following information will help you complete SBA Form 1919:

-

Business tax returns.

-

List of business affiliates.

-

Business licenses and agreements.

-

Contact info for all owners.

-

Number of employees.

-

Loan amount and how you plan to use the funds.

Do I need to complete SBA Form 1919 if I already gave my info to the lender?

Yes, you still must complete Form 1919. The document is intended for the SBA, not the lender.

SBA Form 1919 – Final Thoughts

SBA loan applications can be confusing and time-consuming. However, with some preparation and planning, you can significantly reduce the guesswork and uncertainty associated with the process.

The information included in this guide should help you complete SBA Form 1919 accurately and efficiently. Contact us if you still need help completing the form or are ready to apply for a small business loan.