What are SBA Loans?

The SBA loan program comprises several financing packages tailored to meet the needs of small business owners. The U.S. Small Business Administration (SBA) administers the program, establishes guidelines and limits for lenders, and partially guarantees the loans.

Since the government agency partially backs the loans, lenders have less risk and can offer higher borrowing amounts at lower interest rates and longer repayment terms. The SBA further helps reduce financing costs by setting maximum interest rates that lenders can charge.

The SBA does not approve SBA loans or issue funding (with a few exceptions). Instead, small business owners typically apply to one of three lending institutions: commercial banks, credit unions, or alternative lending facilitators, such as United Capital Source.

The most common and popular SBA loan is the 7(a) loan. The maximum borrowing amount for 7(a) loans is $5 million. Terms range from 25 years for real estate loans to 10 years for most other loans. There are several subsets of the 7(a) loan program, including Express Loans, Export Lines, CAPLines of Credit, and the Community Advantage pilot program.

Each subset of the 7(a) loan program has a different borrowing amount. Interest rates are pegged to the prime rate plus the lender’s spread. The maximum interest rate depends on the loan amount, maturity, and whether the loan is fixed or variable-rate. You can get a complete overview of 7(a) loans, borrowing amounts, interest rates, and terms.

Uses of SBA 7(a) loans include:

-

Purchasing commercial real estate

-

Working capital needs

-

Purchasing inventory

-

Buying equipment, machinery, or other fixed assets

-

Refinancing business debt

Other SBA loans include:

What is SBA Form 413?

SBA Form 413 is a “Personal Financial Statement.” SBA loan applicants complete the form as part of their application for SBA 7(a), CDC/504 loans, and Microloans. Applicants can expect to spend approximately 30 minutes completing SBA Form 413 if they have their financial information organized. A separate Form 413 is required for the owner’s spouse and minor children for all loan types, except for disaster business loans.

On the form, potential borrowers will identify the following:

-

Basic identifying information.

-

Assets and liabilities, including spouse’s assets if applicable.

-

Sources of income.

-

Debts owed to banks for other institutions, personally loaned money (notes receivable).

-

Stocks and bonds.

-

Any real estate owned, including primary residence.

-

Other personal property or additional assets.

-

Any unpaid taxes or tax liens.

-

Other liabilities.

-

Life insurance policies.

Applicants should provide details for each asset and liability as required by the form instructions.

Why does the SBA require Form 413?

While the SBA-approved lender ultimately approves and underwrites the loan, the SBA still must agree to cover the guaranteed portion. Approval from the SBA does not mean you’re approved for a loan, but it is a necessary step in the approval process.

When assessing a loan application, the SBA determines your creditworthiness by analyzing both your personal and business financials. Business assets and liabilities are covered in other required documentation, but Form 413 is how the agency assesses your personal finances. Failure to complete and file Form 413 could result in your loan application being denied.

Who needs to complete Form 413?

As previously stated, Form 413 is required for SBA 7(a) and 504 loan applications. The specific business partners necessary to complete the form depend on the type of business entity, such as sole proprietorships, partnerships, limited liability companies (LLCs), and others.

Each of the following people must complete the form:

-

Each proprietor of the business.

-

Each owner has a stake of at least 20% in the company.

-

Each general partner.

-

Each managing member, if an LLC.

-

Any other party guaranteeing the loan.

Married applicants must also include any assets and liabilities from their spouse or minor children. If the applicant has a prenuptial agreement or any other arrangement that legally separates their assets, it is not required to include them.

How do I complete Form 413?

Before filling out the form, it would be best to prepare the supporting documents for your assets and liabilities. Examples of required documentation include bank account statements, IRA statements, credit card statements, life insurance documents, and statements from retirement accounts. Ensure that all financial records are up to date, typically within the last 30 to 90 days. You’ll need to include these documents as proof on your form, and it will be easier to record the information on the form if they’re already prepared.

Documents Required for Assets & Liabilities

For listing your assets, you should prepare the following:

-

Bank account statements for checking, savings, or other bank accounts, including IRA and other retirement account statements.

-

Statements for IRA, 401(k), or other retirement accounts.

-

Any current loan agreements or promissory notes for any money you’ve lent to others.

-

Life insurance policy, life insurance documents, and any savings accounts.

-

Net investment income statements for stocks, bonds, or other securities.

-

Any deeds, insurance policies, and current market values for owned real estate.

-

Real estate income.

-

The current market value of any vehicles you own.

-

Personal property values on jewelry, artwork, or antiques.

-

Financial information for any additional personal assets not listed above.

For listing liabilities, you should prepare the following:

-

Any loans or accounts payable for debts you owe to others.

-

Any lease or auto loan statements.

-

Credit card statements.

-

Bank account statements.

-

Amounts owed on mortgages or home equity lines of credit.

-

Statements of any taxes owed.

-

Installment loan statements, such as student loans or personal loans.

-

Life insurance information.

-

Any additional personal liabilities not listed above.

You can begin completing Form 413 once you’ve compiled the documentation. Let’s go over how to complete it step-by-step.

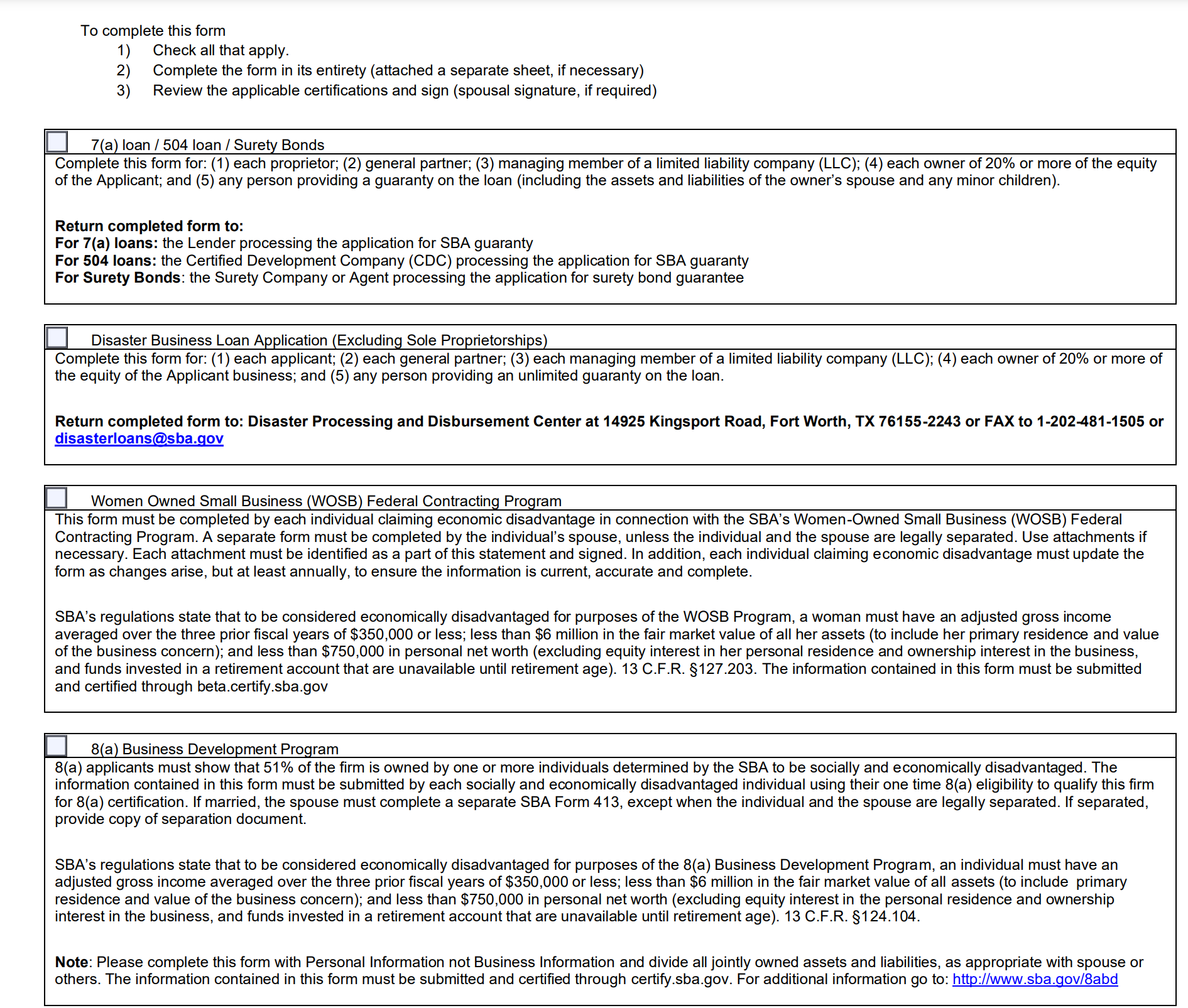

Select the SBA Loan

First, you’ll check off the SBA loan you’re applying for.

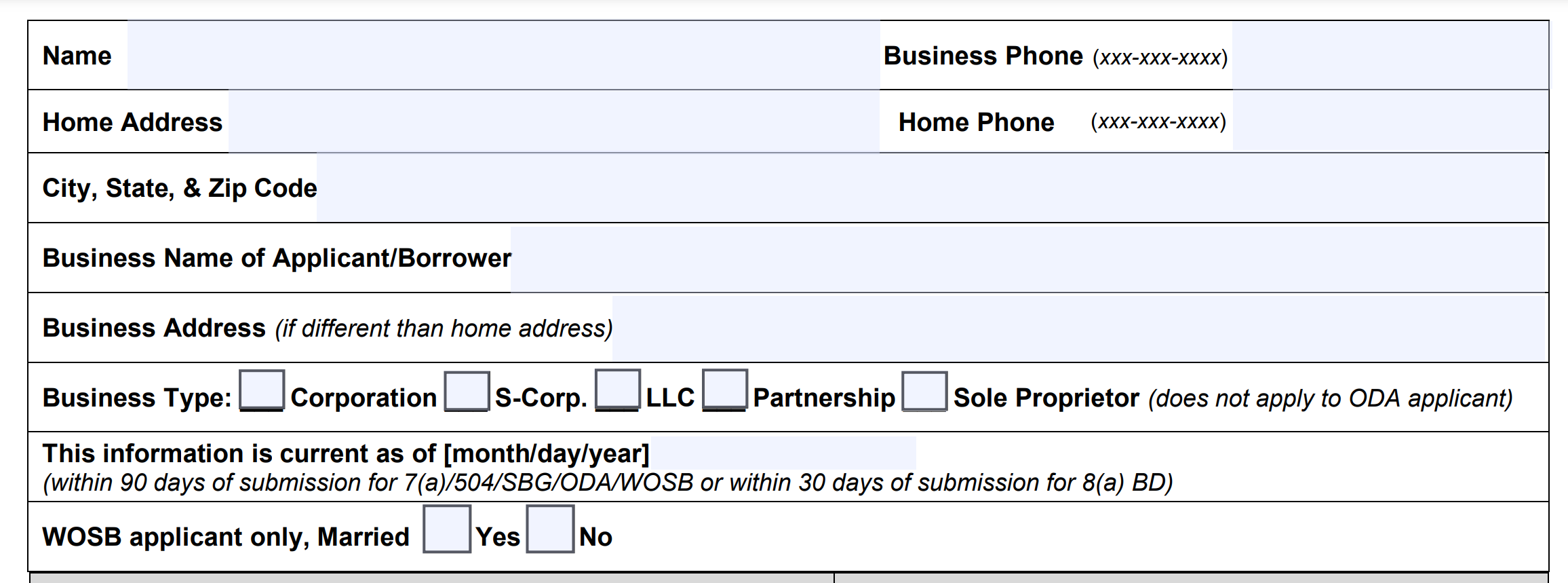

Enter Your Personal & Business Information

In this section, you’ll enter your name, contact information, the business’s name, contact information, and the type of business entity.

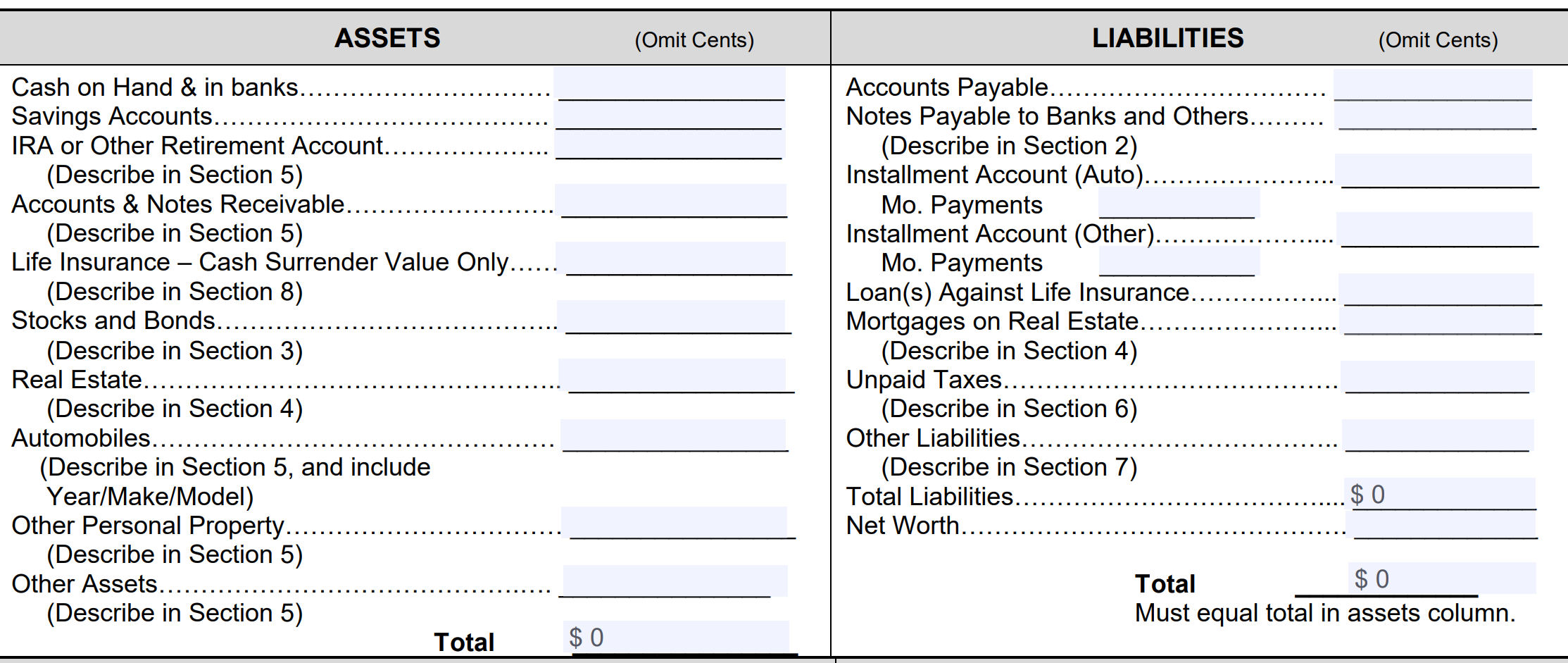

Asset & Liabilities

Next, list all your assets and liabilities. If you are married, you must include the assets and liabilities of your spouse on SBA Form 413, even though it does not make the spouse a guarantor for the loan.

When listing liabilities, be sure to include all credit card accounts, including personal credit cards, and provide the current balance and monthly payment for each. Also, list all loans, such as auto loans, personal loans, or any other installment account, and specify the monthly payment and remaining balance for each. Don’t forget to include any outstanding debts, such as those for which you are a guarantor or co-signer.

For assets, include categories such as real estate, stocks, bonds, vehicles, retirement accounts, savings accounts, and other assets, such as jewelry, antiques, or collectibles. For each asset category, list the total value to give a complete picture of your financial position.

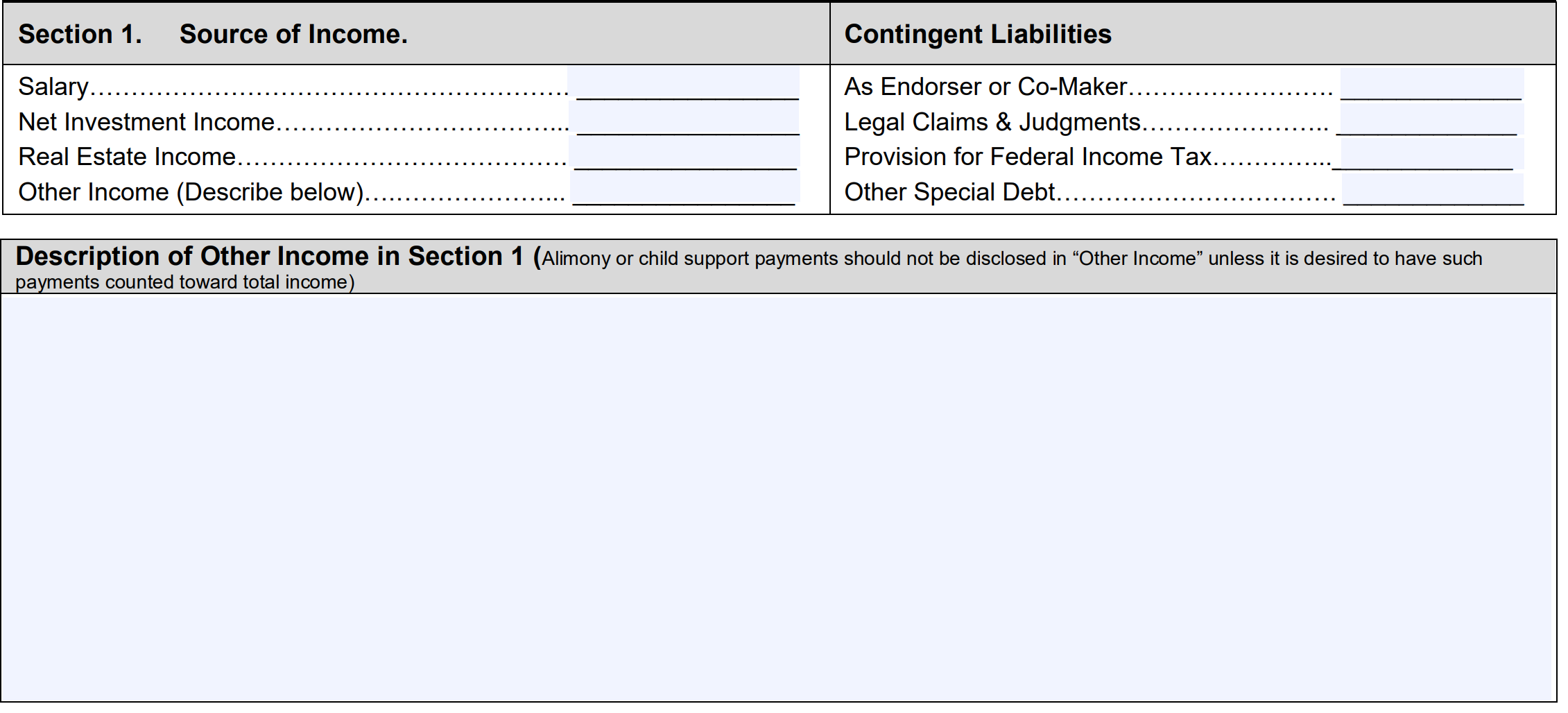

Section 1: Sources of Income

You’ll list any sources of income here. If you have a source of income not listed, write it in the “other income” section.

This section also requires you to list any contingent liabilities, which are debts you may incur pending the outcome of an event in the future. Examples include pending lawsuits or judgments. Another example is that if you co-sign on a loan, you could incur debt if the borrower defaults.

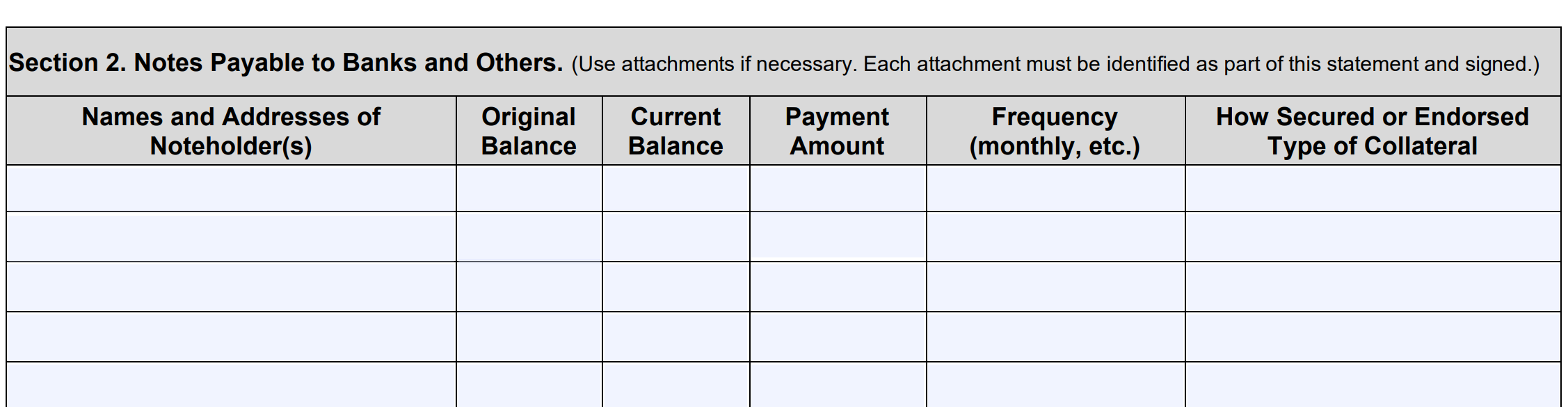

Section 2: Notes Payable to Banks and Others

Here, you’ll list any debt owed to banks or other lenders, including installment accounts such as auto loans or personal installment loans. You must indicate the original balance, current balance, monthly payment amount, and payment schedule for each loan or installment account. You’ll also identify if the loan is secured and, if so, what collateral you used to secure it.

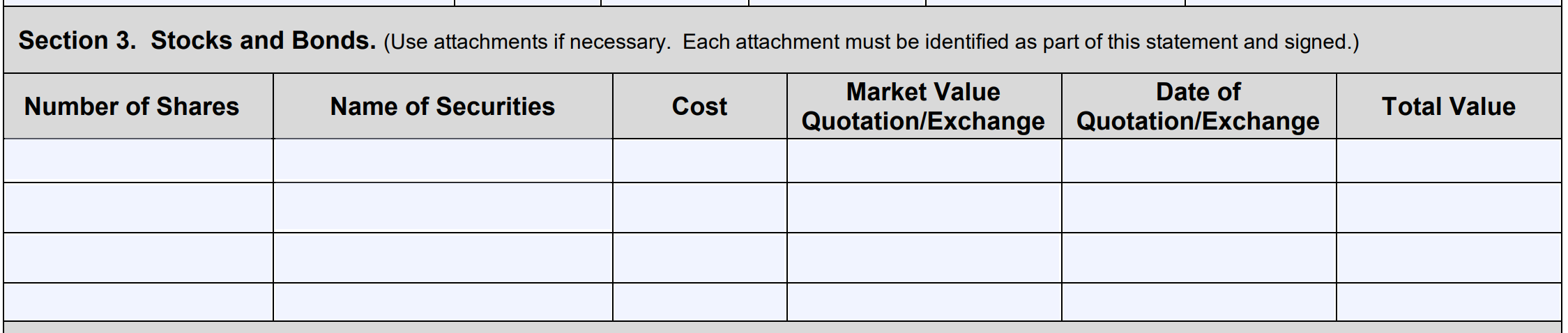

Section 3: Stocks and Bonds

Fill out any stocks or bonds you own in this section. Include the shares you own, your current market value, the total value of all stocks and bonds owned, and the date of the current valuation. Per the form instructions, use attachments to include any stocks and bonds that could not fit in the space provided.

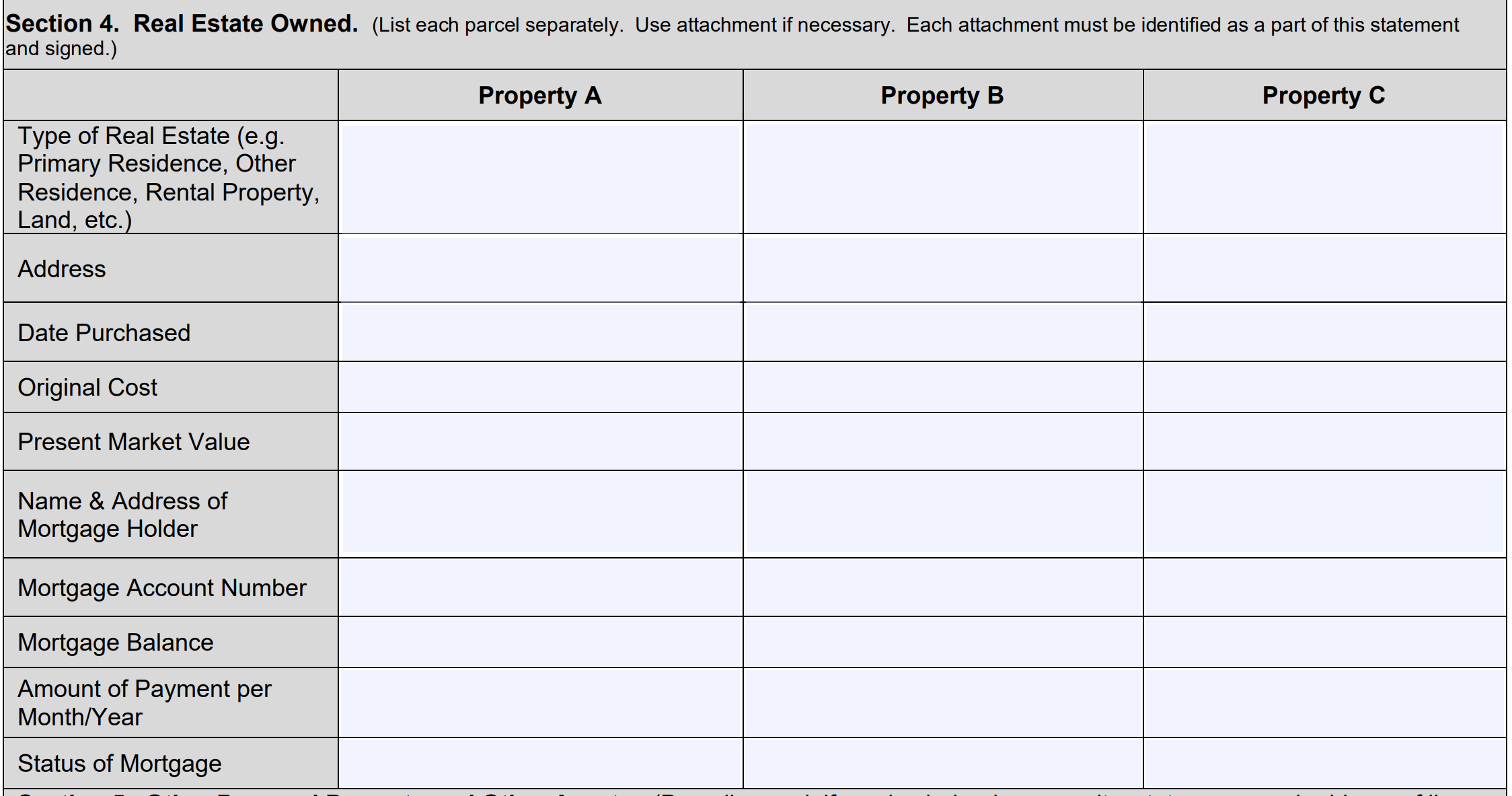

Section 4: Real Estate Owned

This section provides space to list up to three properties you own. Be sure to identify your primary residence separately from other real estate holdings, such as income or rental properties. You can use attachments if you have more than three to include. Follow the form instructions to identify key information for the three properties. Duplicate the same columns and rows in any attachments, if necessary.

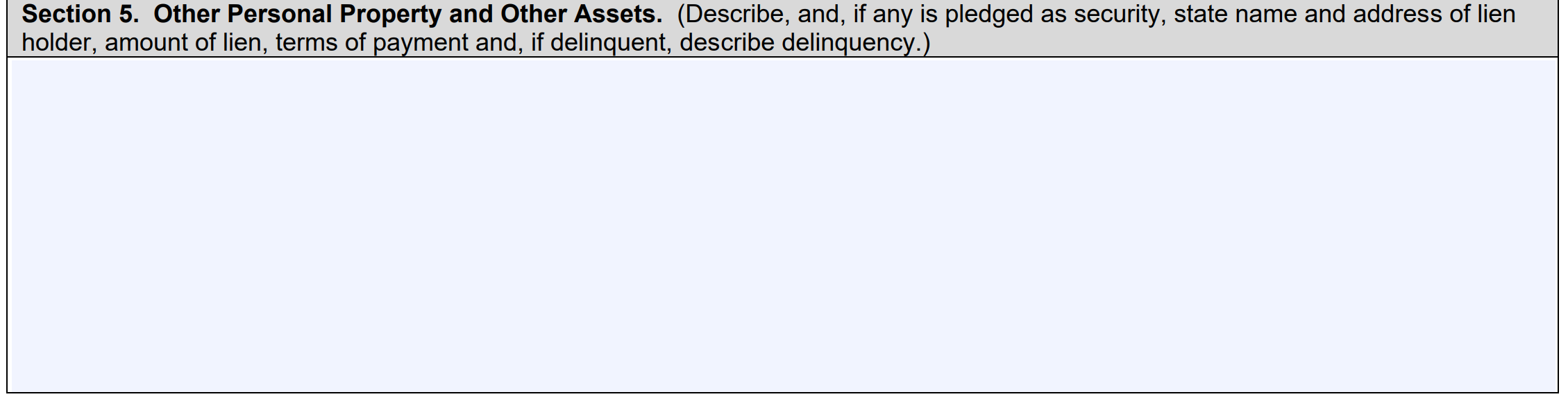

Section 5: Other Personal Property or Assets

Use this section to identify any other personal assets of value. Examples could include jewelry, artwork, or vehicles. List the make, model, and year of any vehicle.

You should also include any other assets not otherwise listed, such as antiques, collectibles, or miscellaneous valuable items. Additionally, if you have personally loaned money to others (notes receivable), be sure to list these amounts here as part of your overall asset valuation.

Section 6: Unpaid Taxes

In this section, you’ll expand on any unpaid taxes listed in the liabilities section at the beginning of the form. Include the type of tax, such as federal taxes, state, or local income tax, the amount owed, when they’re due, and any tax liens on the property. The SBA might request tax transcripts from the IRS to verify any tax information.

Section 7: Other Liabilities

Here you’ll list any additional liabilities not included in the sections above. Remember only to include liabilities for your personal finances.

Be sure to list any outstanding debts, outstanding contingent debts, and other outstanding contingent debts. Special debts, such as legal claims, pending legal claims, and child support payments, should also be disclosed if applicable.

Section 8: Life Insurance

In the final section, you’ll include any life insurance policy information. For each policy, list the insurance company, type of life insurance, face amount, beneficiaries, and the applicable cash surrender value. Only include the life insurance cash surrender value from whole life insurance policies, as term life insurance policies do not have a cash surrender value and are not relevant for this asset calculation.

Once you complete all the sections above, you’ll certify the form with your signature, social security number, and the date of the application. For SBA 7(a) loans, you’ll include the form with your application to the SBA lender. For SBA 504 loans, you’ll send the form to the Certified Development Company (CDC).

How to Apply for an SBA Loan:

United Capital Source can help you apply to an SBA-approved lender following these steps.

Step 1: Ensure You Qualify

You’ll need a credit score between 650 and 700 and a healthy, consistent cash flow. How you intend to use the money also plays a significant role.

Step 2: Gather Your Documents

Be prepared to provide:

-

Driver’s License.

-

Business license or certificate.

-

Voided Business Check.

-

Bank Statements.

-

Credit Reports.

-

Business Tax Returns.

-

Credit Card Processing Statements.

-

3 Years of personal and business tax returns

-

Personal Financial Statement.

-

List of Real Estate Owned.

-

Debt Schedule/Loan/Rent/Lease Documentation

-

Deeds/Title/Ownership documentation for any collateral/Security

-

Current Profit & Loss Statements and Balance Sheet Year-to-Date

-

A/R and A/P Reports

-

SBA Form 413.

-

United Capital Source 1 Page Application

Step 3: Fill Out the Application

You can begin the application process by calling us or filling out our one-page online application. Either way, you’ll be asked to enter the information from the previous section along with your desired funding amount.

Step 4: Speak to a Representative

Once you apply, a representative will reach out to you to explain the repayment structure, rates, and terms of your available options. This way, you won’t have to worry about any surprises or hidden fees during repayment.

Step 5: Receive Approval

SBA Loans through our network generally take 3-5 weeks to process. Once approved and your file is closed, funds should appear in your bank account in a few business days.

What are the advantages of SBA Loans?

SBA loans are often considered the gold standard of small business financing. There are numerous advantages, but the most significant ones are the large borrowing amounts, low interest rates, and extended repayment terms.

On-time SBA loan payments are reported to the major credit bureaus. Successfully paying your loan will help build your business credit, making it easier to secure financing in the future.

The low interest rate and long repayment terms mean your monthly payments are lower than most loan structures. This helps ensure that you maintain a strong cash flow throughout the life of the loan.

The high borrowing amounts allow businesses to make significant investments in their future. You can use the funds to acquire commercial real estate, hire more staff, purchase equipment and supplies, and more.

What are the disadvantages of SBA Loans?

The most significant disadvantage is the difficulty in getting approved. While you might assume that partially guaranteed loans are easier to qualify for, and it’s a logical assumption, the truth is often the opposite.

Since the SBA doesn’t provide concrete qualifications, lenders can set their own standards, and some are more stringent than others. For example, commercial banks tend to be more biased toward established companies.

The loan application process also requires a lot of patience and having enough runway to wait for approval. Aspiring applicants may wait weeks to receive a determination on whether the SBA will guarantee the loan.

It’s not uncommon to meet with several different lenders and submit multiple applications. Some lenders may advise applicants to try again in a year once their finances have improved.

Pros & Cons

Pros:

-

High borrowing amounts – up to $5 million.

-

Low interest rates and long repayment terms.

-

The funds can be used for a variety of business purposes.

Cons:

-

Long application and approval process.

-

Large amounts of paperwork.

-

Might require collateral.

-

Almost always requires a personal guarantee & down payment.

-

Requires good to excellent credit.

Frequently Asked Questions

Here are the most common questions about SBA Form 413.

What documentation do I need to prepare in addition to Form 413?

The exact documentation requirements depend on the lender and the specific SBA loan. In general, you should prepare any documents on personal or business assets and liabilities, personal and business tax returns, and any licenses, certificates, or other records about your business.

Financial documents such as bank account statements, retirement account statements, life insurance documents, and credit card statements are also commonly required as part of the paperwork. Contact the lender for any additional documents that may be required.

What should I do if my liabilities are greater than my assets?

The SBA is most interested in your monthly debt liability and debt-to-income ratio (DTI), not your total net worth. If you have concerns about your financial situation, consider working with a loan expert to help guide you through the process.

What are my options if I don’t qualify for an SBA Loan?

While SBA Loans are the most advantageous small business loans, they are far from your only options. Many alternative lending platforms offer various loans with more lenient requirements and significantly faster funding times.

You could consider any of the financing options:

If you’ve been denied for credit reasons, bad credit business loan options are also available.

SBA Form 413 – Final Thoughts

SBA loans are among the best small business financing options available, but the application process can be tedious and time-consuming. Compiling the necessary documentation for completing 413 may be challenging, but it’s potentially worth it if it gets you the lowest-cost financing for your business.

Contact us if you need additional help with SBA Form 413 or if you’re ready to apply for an SBA loan. Our loan executives can help you start the process and answer any questions you have.