What Are the Best Strategies for Building Employee Loyalty?

Your employees will not give you their loyalty if you do not make a conscious effort to show you deserve it. Here are a few ways leaders of smaller businesses can build loyalty in their employees:

1. Be Clear

One of the essential qualities of an entrepreneur is clarity. The entrepreneur must possess a crystal clear vision of each employee’s mission, responsibilities, short-term goals, etc. This shows employees that there is a logic behind your decisions and your optimism about the future. Besides, a lack of a vision is an extremely common culprit of business failure.

Without a vision, your employees will always question your decisions and your motivation for starting a business. They simply won’t know where the company is going. Wouldn’t it be hard to see yourself working at a company with an uncertain future?

2. Watch Your Language

Believe it or not, even the smallest adjustments in word choice can significantly impact employee morale. Your words represent your perception of the company and, therefore, affect your employees’ perception, too. For example, consider the difference between telling someone they work “with” you instead of “for” you. Likewise, using the term “team instead of “staff” makes your company seem more unified and inclusive.

Word choice is also critical when creating job descriptions and job titles. First, using more specific language increases the chance of finding someone who fulfills that unique skill set. Second, using words like “specialist” or “expert” denotes high value and shows that you’re proud to have the individual on board.

3. Show You Care

Studies show employee engagement improves when they feel more connected to the company and their leader. One great way to establish this connection is by showing you care about employees on a personal level. How can you show you care? For starters, you can meet with them one-on-one to learn their aspirations and the most significant obstacles. You’ve welcomed these people into your dream. If you help them grow and tend to their happiness, they will reward you with loyalty and perseverance.

You can also show you care by rewarding their hard work. Possible examples include celebrations, field trips, bonuses, anything that makes them feel valued. Research from the American Psychological Association (APA) revealed that 93% of employees who reported feeling valued were inspired to do their best work. How could you not want to impress someone who gave you one of the most enjoyable nights of your life?

4. Practice Transparency

Co-workers might not share their thoughts, but friends do. Your employees will feel closer to you if you keep them in the know. No, you might not always have good news to share. However, your employees will appreciate any notions of transparency, be it bad news or even the tiniest detail about your personal life. The longer you go without speaking to your employees, the weaker the connection becomes.

Initiating communication also encourages employees to communicate with each other more frequently. They will feel more connected as a team, and who would want to leave a friend behind?

5. Respect and Dignity For All

This seems like a no-brainer. How hard could it be to show politeness and courtesy? It’s very easy to neglect both during stressful times for the company. But whatever happens, you must not forget that your team is only human. There will be misunderstandings and frustrations. However, you will weather these rocky moments much quicker by imbuing respect and dignity into your company culture. We’ll explain the key elements of company culture later on.

Unfortunately, business leaders who maintain respect and dignity during stressful times are increasingly rare. Thus, your employees will not want to abandon a leader who treats them like people, not “employees,” no matter the situation.

6. Keep Your Favoritism Quiet

Every business leader has favorites. It’s only natural. But giving individual employees special treatment is a loyalty killer. Yes, some employees may be more integral to the company’s success. But wouldn’t you want all of your employees to reach this status? You can only make this happen by showing that you value them equally.

Does one employee get to pick the best shifts? Do some get more flexibility in scheduling their shifts? The rest of the team takes notes, and they don’t like it.

The solution is being completely transparent in your decision-making. They might not be thrilled with your decision. But they’ll be more likely to accept it if they understand the logic behind it.

7. Reward Individual Achievements

A 2013 study found that 83% of 1,200 employees felt recognition for their contributions was more fulfilling than other rewards. Employees want their hard work to be acknowledged. It shows that their leader understands how hard their jobs are.

Weekly or monthly awards, however, can quickly become monotonous or systemic. Employees might feel that you are handing out rewards solely because you have to. Hence, a more effective way to show appreciation is through unexpected acknowledgments or awards. After all, the hardest parts of your employees’ jobs often go under the radar. If you indicate that you’re aware of these subtle achievements, employees will see that you know what it’s like to be in their shoes. And that’s another great way to break down that employer-employee barrier.

8. Celebrate Company-Wide Achievements

Your team will appreciate acknowledging company-wide achievements just as much (if not more) than individual results. Unlike individual results, company-wide achievements require contributions from every team member. At smaller businesses, the team can’t hit these goals if just one person is slacking off. Thus, when the team does hit these goals, it means everyone is on point.

Celebrating company-wide achievements shows that you understand the importance and rarity of a working system. Your team will also realize that they have the tools to succeed. As long as they stick together, anything is possible.

9. Get in the Trenches

Far too many business leaders isolate themselves from their teams. They spend their days locked away in their offices or disappearing to mysterious meetings. Not only does this negate transparency, but it also weakens your connection with your team’s day-to-day tasks. As a result, employees will be less receptive to your criticisms. How can you critique someone’s performance when you have no idea how difficult it is to do their job?

Teams feel more connected when they know everyone is in this together. Whatever “this” is for your company, make sure you’re involved. Maybe it’s getting the concrete poured in time to dry so the flooring can get installed on schedule. Perhaps it’s making the hard calls to follow up with customers or insurers about unpaid bills. Employees will be more likely to put in their best effort during tough times when they see you doing the same.

10. Give Employees More Freedom

Larger companies typically have more rules. You have to dress a certain way, sit at the same place, or follow a general code of conduct. This makes employees hesitant to be themselves around their co-workers. These rules may be minor inconveniences to some, but for others, they are deal-breakers. The latter individuals cannot perform to the best of their ability if forced into such restrictive environments.

On the other hand, smaller businesses are more likely to have no dress code, the opportunity to work from home every once in a while, and, most importantly, a more open and friendly workplace. Employees have more freedom to socialize and bond as friends. These advantages are especially appealing for those who don’t work in the most exciting industries. They might think, “I’ve got a pretty boring job, but at least I get to wear whatever I want.”

11. Let Employees Know Their Opinion Matters

Employees of smaller companies usually have more responsibilities. They work directly with the business leader, and their work has a significant impact on the company’s success. At larger companies, on the other hand, lower-level employees have less importance. It will be a very long time before they can even think about people working under them. They might also have zero interest in higher positions since they have no idea what their superior does all day.

In other words, employees stay in small businesses because their opinion truly matters. They are knights of the round table, not robots who are better off keeping their mouths shut. Thus, make sure your employees know that you value their ideas. It will make them feel like they are running the company and share your responsibility as the leader.

12. Cut Out the Commute

Eventually, you may have to move to a new workspace to accommodate a larger team. This presents another critical opportunity to build loyalty.

Several studies have gauged the impact of long commutes on employee performance. Simply put, you cannot expect employees to perform to the best of their ability when they have to worry about traffic, getting home on time, or public transportation issues. It’s safe to say that having to leave work at a specific time to beat traffic or catch a train dramatically limits their productivity.

For this reason, you should choose a workspace that is within a reasonable distance to most of your employees’ homes. Employees will be more tempted to leave if their commute is inhibiting their personal life. The shorter commute will also make them more comfortable at work, making their goals easier to reach. Why leave when your daily routine is only getting more comfortable every day?

How Can Small Businesses Improve Productivity?

Much like loyalty, improving productivity is much harder for smaller businesses. They don’t have the means to incentivize employees with higher salaries. And since small business employees have more responsibilities, they have a higher risk of burning out. Thus, improving productivity at smaller businesses requires creativity and prioritization of mental health.

Here are five ways to improve productivity both on an individual and company-wide level:

1. Offer L&D Opportunities

Employees and businesses must continuously evolve to stay relevant. For individuals, this often means learning new skills or enhancing existing skills as the business grows. In the past, employees would accomplish these things on their own. Today, however, industries move too quickly for employees to take their time learning new skills. You can speed up this process by offering learning and development (L&D) opportunities.

Examples of such opportunities include online courses, training seminars, and industry-related conferences. Employees will be less resistant to L&D when you can prove that the associated skills are becoming increasingly important.

2. Cross-Training

Cross-training refers to employees educating each other about their jobs. Why is this helpful? When you do the same thing every day, it’s easy to get locked into a single approach. Rather than thinking outside of the box, you just apply the same methods because you know they work. But as mentioned in the previous section, what works today won’t necessarily work tomorrow.

Cross-training gives employees a second, very different perspective on improving performance and making their jobs easier. This allows employees to use techniques they would never have thought of on their own. Odds are, every employee’s job involves bits and pieces of their co-workers’ jobs as well.

3. Encourage Regular Breaks

You would think that feeling stressed would make employees take it easy at work. But research shows the opposite is true. When employees feel stressed, they work more. They’ll work through lunch, take their work home with them, and work on weekends. This increases the risk of burnout, which ultimately results in lower quality work.

In other words, employees will only take regular breaks if you encourage them to. For example, you could tell each employee to schedule two or three 20-minute breaks throughout their day. Initiatives like this are more effective when everyone visibly participates.

4. Teach Lateral Thinking

Lateral thinking is a technique designed to improve your problem-solving abilities. The goal is to break out of your traditional, rigid methods of solving problems (i.e., “vertical thinking”) to access innovative but pragmatic solutions.

One fundamental tenet of lateral thinking is combining opposing worlds, like the physical body and technology. You could choose a random word from the first category (i.e., “nose”) and connect it with a piece of technology (i.e., office printer.) Combining these words could generate the possibility of printers giving off a pleasant aroma when they’re low on ink. Lateral thinking ultimately encourages employees to improve productivity with methods that are uncommon to their industry.

5. Reward Innovative Thinking

Rewarding output will probably cause employees to burn themselves out. Rewarding creativity, on the other hand, incentivizes employees to find ways to do the opposite: make their jobs easier. Possible examples include gift cards, extra days off, or dinner with the boss. This could be accompanied by a print certificate or just a social media shout-out to the winning employee.

It’s crucial to remember that the main point of rewards is to make a big deal out of something. For this reason, you shouldn’t just call an employee into the office and hand them an award. Instead, call a meeting and make sure the rest of the team understands the winning employee’s contribution. Also, don’t focus on the “extra hours” they put in or their “dedication to the company.” Focus on the creative process that went into solving the problem.

How Does the Behavior of Business Leaders Influence Employees?

When you’re continually working to move your company forward, it’s easy to forget the effects your words and actions have on your employees. There will always be days when you’re so busy answering questions and ensuring clients are satisfied that your employees’ emotions don’t even cross your mind. But taking stock of your behavior and its role in shaping day-to-day operations is critical for improving company-wide performance.

Here are five behavioral tips for business leaders:

1. Take a Walk

It’s easy to get lost in your work and forget what’s going on around you. Staying in your office all day makes you an outsider in your own company and inhibits your connection with employees. For this reason, business leaders need to take short breaks just to spend time outside of their world. Using this time to express genuine interest in your employees’ lives shows that you do not willingly choose to stay in your office. Employees will be reminded that you’re still thinking of them, even though you’re so busy you can’t step away for more than a few minutes.

2. Create a Strong Work-Life Balance

Work-life balance is an ongoing obstacle for entrepreneurs. Many would even say that work-life balance is a myth. They don’t realize that spending time with friends and family is vital for their mental health. Contrary to popular belief, activities like yoga or meditation are not the only ways to “recharge” after a busy week. Your friends and family members are full of positive energy and support. Thus, spending time with them will lift your spirits and make you feel less alone in your struggles.

Friends and family members can also help you understand the thoughts and actions of your employees. Entrepreneurs are so different from the average person that they often lose touch with their businesses’ human side. For example, let’s say you’ve just introduced a new project management tool. Despite the necessity of this change, your employees are resistant to integrate the tool into their routines. After speaking with your friends, you learn that employees may be worried that the tool will be used to spy on them and find more reasons to get them in trouble.

3. Check Your Mood at the Door

Your attitude has a direct impact on your employees’ performance. If your employees can see that you’re not happy, you can’t expect them to put their best effort into their work. People don’t perform as well when they are motivated by fear. Would you want to please someone who looks upset all the time? A negative attitude also suggests that you’re worried about the business’s future and makes you look ungrateful. Yes, certain things might not go as planned. But at least you’re lucky enough to have employees who listen to you.

As a business leader, you have to check your mood at the door. You can’t show your stress on your face or in your body language. If you have trouble putting on a smile when you’re stressed, let your employees know that you’re working on it. You have to tell them that your facial expression is not a reflection of your attitude towards the business’s future.

4. Empower Employees

Two sections ago, we noted that entrepreneurs think differently than the average person. One example is how quickly entrepreneurs act on their ideas. If an entrepreneur has an idea of improving their workday, they immediately put it into action. Your employees, on the other hand, probably aren’t as confident in their solutions. They might know what’s stopping them from maximizing productivity or efficiency. But they won’t put their ideas into action unless you ask them.

In summary, you should regularly ask your employees what they would change about their workday. This is likely a better use of your time than trying to come up with company-wide solutions. What helps one employee might do the opposite for another.

Building Loyalty Through Company Culture

We’ve repeatedly alluded to the role of company culture in building loyalty. In many industries, strong company culture is what separates good companies from great companies. Everyone from Trader Joe’s to Google would likely agree that company culture has been a primary contributor to their growth and overall success.

But like other integral elements of your business, doing the bare minimum won’t give you the results you’re looking for. To reap company culture’s intended benefits, you must put significant effort into developing and maintaining it.

Of those benefits, arguably, the most important is a motivated and dedicated team. This is the dream scenario, right? When employees feel a personal connection to their company, they enjoy coming to work and continuously make decisions that serve the company, not their own interests.

Let’s be honest: you can’t expect every employee to feel a personal connection to their work or industry. It’s entirely feasible, however, to instill a relationship with specific values and goals. After all, people feel more connected to each other when they learn the beliefs that guide their decisions. Well, the same concept applies to businesses. Company culture gives employees a way of life that they can identify with and immerse themselves in. If you choose the right values, this way of life will bring out each team member’s best version.

This section will explain the true definition of company culture and how to create it and use it as a tool for growth.

What Is Company Culture?

Company culture is like a code of conduct for your work environment. It determines how employees treat each other, how they approach daily tasks and new challenges, and the kind of “vibe” employees feel in the workplace.

Most businesses derive company culture from their core values, which are supposed to reflect their goals. If employees remain true to their core values, the business’s goals become much easier to achieve. The central purpose of company culture is to ensure that employees do just that. For this reason, company culture is widely viewed as a highly effective form of discipline. Despite all the changes your business goes through, your company culture stays the same. This allows employees to continue making the right decisions while never losing track of their long-term goals.

Company culture also represents the type of personality that is most likely to succeed in your business. Since an employee’s character is just as (if not more) important than talent or experience, strong company culture can prevent you from unknowingly hiring the wrong candidates.

Company Culture: What Makes it Strong

Influential company culture makes employees want to come to work. At first, this sounds very naïve and unrealistic. What if employees disagree with the values you’ve chosen? You can’t just force someone to like their job.

To understand what makes company culture “strong,” think about how someone goes from an acquaintance to a trusted friend. The more you get to know someone, the closer you feel to that person. You learn the beliefs that guide their decisions and how they acquired those beliefs in the first place. This person might not have the same values as you. But don’t you feel more connected to them after learning the roots and strength of their values?

Strong company culture does the same thing for employees and your business. Your employees might not share the same values as your business in their personal lives. But if you convey your business’s core values strongly enough, your employees will feel connected to them. In this sense, company culture is a lot like your business’s brand identity. It turns your business into a person with a multi-layered background by giving your business “human” qualities.

Every business has its own definition of the “right” company culture, just like every person has their own way of doing things. But despite their differences in specific values, virtually all businesses strive for the same general outcomes of company culture. They want employees to feel comfortable, fulfilled, respected, and of course, motivated. In other words, work should give them all the mental and emotional tools they need to perform to the best of their ability. Without company culture, your employees will likely feel that their work environment is working against them, not for them.

How Do Businesses Create Company Culture?

Earlier, we mentioned that you wouldn’t reap the benefits of company culture if you don’t take the time to develop it properly. This is a step-by-step process, and you can’t skip or breeze through any steps and expect company culture to have a real impact on your business.

Many entrepreneurs struggle with developing a company culture because there are no immediate results or notions of success. You won’t know if you’re doing a good enough job until several weeks or even months have passed. All you can do is trust the process by going about it the right way:

1. Define Your Core Values and Goals

This is easily the most critical step, so it deserves the most thought. If you’ve already been through the branding process, the following exercises should seem reasonably familiar.

Core values and goals are the cornerstones of company culture. Think about why you launched your business and the value you wish to provide for your customers. On the surface, your business exists to sell a product or service. Well, what are the mental and emotional benefits of your offerings?

Maybe they make a particular everyday activity more enjoyable. Popular examples include eating, shopping, or sleeping. Maybe your offerings bring your customers closer to their friends or family members. You’re essentially trying to figure out the role your offerings play in your customers’ lives.

For example, let’s say you own a clothing company that makes unique products for a unique type of person. Thus, the product inspires customers to embrace their individuality and reminds them that they are not alone.

Some businesses define their core values by imagining their ideal employee, or the kind of person who would achieve the most success at your company. How does your perfect employee communicate with co-workers? How does your perfect employee show that they have the business’s best interests at heart?

When describing your ideal employee, try to use as much detail as possible. What kind of music does this person listen to? How do they dress? What kind of products would they own?

One way to answer these questions is to envision three people who would succeed at your company co-mingling at a party. Which passions or hobbies would they share? What would they talk about?

You could also try the opposite approach: Describing someone who would fail in your business.

2. Hire Candidates That Reflect Your Company Culture

Now that you’ve nailed down your core values and personality, you can establish the criteria for future hires. A critical element of maintaining company culture is only hiring people who exhibit your ideal employee’s characteristics.

Yes, it’s much harder to find someone who possesses a particular personality than it is to find someone with an impressive resume. But that just shows the importance and sensitivity of company culture. If your hiring policies deviate from your core values, it may affect your current team’s loyalty and work ethic. And when you finally find the right candidate, the chances of this hire not working out should be slim to none. As long as the candidate’s personality meshes well with the rest of the team, they will have a much easier time learning specific tasks. Industry-related knowledge can be taught, but the right personality traits cannot.

You can avoid interviewing candidates with the wrong personalities by tailoring your job descriptions to core values. If you can’t write a job description for your ideal employee, then you haven’t defined these characteristics enough.

After writing the description, think of specific interview questions to tell you more about the candidate’s personality. Also, when discussing company culture to potential candidates, don’t just list your core values. Additionally, you must explain what it means to exhibit these values and provide examples of how your current team does this each day.

3. Show That You Take Company Culture Seriously

We’ve repeatedly emphasized that establishing a company culture isn’t easy. It requires constant effort from the whole team, but it begins with the business owner’s actions. The traditional “Do as I say, not as I do” mindset cannot be applied to today’s workforce. Anyone can give instructions or put up posters, and your team knows that.

To show that you take company culture seriously, focus on immersing your team in a world built on your core values. Company culture must be immersive to produce the intended results. Think about how some of your favorite restaurants create an immersive experience for their customers. This experience comes from several elements, like music, decorations, and staff members’ personalities. These elements work together to immerse the customer in the restaurant’s culture.

As the business owner, it’s your job to immerse your team in your company culture through physical and non-physical elements. Examples of the former might include the layout of your office, wall art, or the available food/beverages. It’s the non-physical elements, however, that matter most. This includes your management style, internal communication, and the kind of behavior from employees you choose to reward or denounce.

In summary, you can’t expect employees to follow core values if you do not outwardly exhibit them each day. This is another reason to choose your core values very carefully. During this process, ask yourself: What can I do to manifest this value through our company culture outwardly? Certain parts of you and your team’s day-to-day routine should present the opportunity to display at least one or two core values.

4. Use Company Culture to Solve Disagreements

Company culture is supposed to create a positive, motivational, and highly productive work environment. Employees must not be concerned about how things get done or how they will deal with new challenges. You can squash these concerns by building company-wide respect, yet another significant benefit of strong company culture.

This takes us back to the connection mentioned above between company culture and discipline. Employees will come to respect each other (and their superiors) by collectively following the same core values. There won’t be any notions of individual employees bringing the rest of the team down or impeding their productivity. Both scenarios are prevalent in businesses that lack company culture. Many companies choose to strengthen their company culture solely to prevent employees from resenting each other.

Company-wide respect is especially important when it comes to communication, collaboration, and solving internal conflicts. But your employees won’t instantly know how to apply their core values to these processes. You must develop step-by-step methods for allowing company culture to dictate how multi-employee situations play out. For example, when two employees disagree, which values should they consider to determine the solution?

Strong company culture is also reflected in how you reward individual and company-wide success. Yes, even your celebratory measures must take your core values into account. Certain types of rewards, like happy hours, entertainment, or working from home, will show your team how company culture can be integrated into numerous areas of their lives. These are just more opportunities to bring out the best version of your employees and remind them that this is the true purpose of company culture.

5. Develop a Plan For Maintaining Company Culture

Many businesses develop company culture with great ambition but neglect to maintain it over time. They forget that company culture requires constant effort, much like marketing, hiring, or any other long-term initiative. You have to create a plan that describes how you will maintain and strengthen company culture throughout the coming months. Little by little, you must consistently modify company policies and procedures to align with your core values. This is an ongoing, endless process since there will always be more elements of your business (including your own management style) that could be refined to better support company culture.

And like the previous steps, it’s crucial to be as specific as possible with your long-term plan. For example, it’s easy to write down a plan to improve communication or structure. But how will you do it? Which smaller steps will you take to move closer to this larger goal? Think about the specific resources associated with implementing new policies: videos, written documents, email surveys, etc.

Here’s the kicker: the methods you use to maintain company culture must align with your core values as well. This might mean disregarding specific traditional methods because they won’t do as good a job as cementing loyalty and trust amongst employees.

6. Market Your Company Culture Through Your Brand

The first two steps were centered around your ideal employee and establishing the kind of personality you need to look for in new hires. Unfortunately, these people won’t come to you on their own. Part of the challenge of company culture is its effect on the hiring process. If you want to hire a particular type of person, you have to market to that audience. Your ideal employee is out there, searching for a business like yours. You just have to make sure that when this person discovers your business, they immediately get the feeling that they’ve found their new home.

This is why company culture and branding go hand-in-hand. Your business’s brand identity is supposed to reflect your core values. When developing promotional materials (your website, email advertisements, social media presence), keep your company culture in mind. Does the voice, structure, and messaging reflect your core values? A great start is the “About Us” or “Meet The Team” section of your website.

How Do Businesses Change Their Company Culture?

Despite the importance of company culture, only recently has it become a household name. Plenty of established businesses lack company culture. Some of them, however, finally realize that this is the reason they’ve had trouble with growth and employee loyalty. Thankfully, it’s never too late to change or improve your company culture.

Here are a few tips for starting this process:

1. Allow Employees to Share Ideas

When asked why they don’t prioritize company culture, entrepreneurs’ common answer is, “I’m too busy.” But you can’t put off company culture until you have more time on your hands, as that time may never come. You can start by creating a group of employees who will brainstorm ideas for core values and new policies.

Unless these employees have some ideas already, it might not make sense to hold meetings just yet. This probably won’t be a good use of their time. Instead, just ask them to write down whatever ideas come to mind. Once each group member has amassed a decent list, they can begin holding meetings and deciding which ideas to move forward with.

2. Reward Employees Who Exhibit Core Values

One of the easiest ways to put your core values into action is by rewarding employees who exhibit them. This will give your team a clearer picture of the kind of company culture you’re trying to develop.

Recognition and positive reinforcement are two essential tactics for strengthening company culture in general. If you don’t acknowledge employees who follow your core values, how important could they possibly be?

3. Focus On Creating a Happy Work Environment

All types of company culture share at least one common goal: Positivity. If your employees seem happier and more confident at work, you are probably doing a good job building company culture. This suggests that your employees are correctly interpreting your core values.

An increase in productivity doesn’t mean your employees aren’t thinking about leaving your business. Loyalty comes from the combination of motivation and comfort, which can only be achieved through an indisputably positive work environment. It’s crucial never to forget that this is the central purpose of company culture. You’ll know your plan is working when there’s more positivity in the workplace.

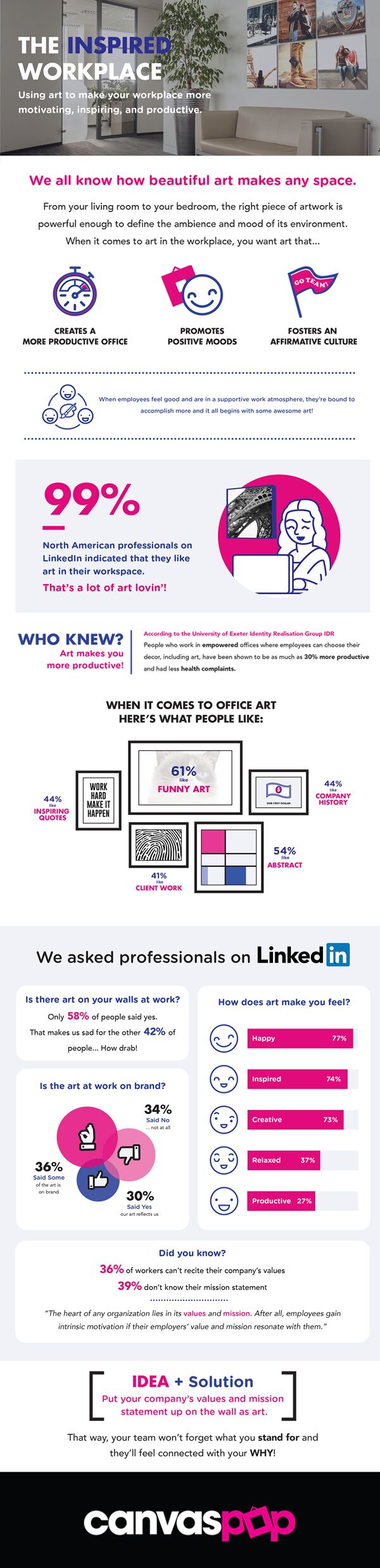

What are the Benefits of Workplace Art?

To establish a company culture, you must immerse your team in the business’s core values. Well, one highly effective way to do this is through workplace art. The following infographic contains some additional benefits of workplace art:

Which Benefits Should Small Businesses Consider Offering?

Another popular way to enforce your core values is through your benefits package. Different personalities place different levels of value on certain types of benefits and perks. Your benefits package should ultimately be designed to give your ideal employee the peace of mind they need to perform.

Here are eight different benefits that are becoming increasingly valuable in today’s workforce:

1. On-site Chair Massages

As stress at work increases, soothing perks like corporate massages become part of workplace wellness plans. Typical on-site employee chair massages last from around 15 to 30 minutes. Some massage therapists charge by the hour or by the massage. According to Angie’s List, rates run between $50 to $80 per hour or $10 to $20 for a 15-minute massage. But also consider other costs. For example, someone will need to spend time scheduling the massages every week, month, or quarter. Plus, you’ll need a room dedicated to an on-site massage. You can hire companies dedicated to on-site services yourself or strike up deals with local businesses to offer your employees group discounts. But don’t skimp on doing your due diligence on vetting massage companies. Ensure they have qualified therapists, or your plan may backfire.

2. Funeral Insurance

Yes, it may seem like a strange perk, but funeral insurance (also known as “burial insurance” or “final expense insurance”) can save an employee’s family severe financial stress. At an average cost of $8K, funerals are a high cost to most employees. Burial insurance plans are whole life insurance policies meant to pay for end-of-life expenses like burial or cremation. And they’re inexpensive perks too, especially when employees lock in their monthly rates early. For example, a 50-year-old female wanting a $5,000 to pay for cremation could lock in a monthly premium for the cost of a Netflix subscription. Your employees will appreciate the peace of mind that comes with having their family’s end-of-life expenses covered.

3. Free Snacks

Free snacks at work have several benefits for employees. For one, they’re tangible rewards. Employees can see and immediately benefit from a free pack of peanut butter crackers. And snacks fuel employees who snack through lunch, making them more productive. And by offering a constant supply of healthy snacks (e.g., fruits and veggies), your company is promoting a healthy lifestyle. That translates into happier, more productive workers with lower stress and who take fewer sick days. In its Cost of Employee Happiness Calculation, Hubspot estimates that providing free snacks to employees cost companies around $650 per year. But small businesses can lower their snack costs by buying in bulk at wholesale markets.

4. Fuel Gift Cards for Carpoolers

Fuel cards and carpooling are a win-win for your company and employees. It allows employees to take advantage of the HOV lane, which shortens their commute. The group commute will also help build personal bonds between your workers. If you already have a corporate fuel credit card, lend it to that week’s driver so they can fill up their personal vehicle—estimate costs for an average commute and credit the account for that week. Then give the card to each employee in the driving rotation. Or hand out gas gift cards to carpooling commuters each month. This is also a “green” office perk that helps reduce pollution and greenhouse gases. You could also reward employees who use public transportation by providing free bus or train passes.

5. Flex Hours

Flexibility in when employees work isn’t just a perk. It’s a way to future proof your business. More quality hires are looking for companies with flex hours. Working these hours will let them meet their goals while tending to their personal lives. Flex hours aren’t the same as remote work or working from home. Instead, give workers a choice of eight-hour shifts (e.g., 7 to 3, 8 to 4, or 9 to 5). And studies show that a properly managed flex work schedule improves productivity, job satisfaction, and retention. Flex hours let employees work when they’re the freshest and most energized. And flex time also makes morning commutes easier by shifting driving times to avoid rush hour traffic.

6. Birthdays Off

Give your employees the gift of the entire day off for their birthday. It’s a super simple, cheap perk that reaps big rewards. It’s an easy way to give every worker the same gift that makes them individually feel special. Plus, it eliminates planning and paying for monthly birthday parties, which can be real time drains. Not to mention, they’re filled with unhealthy sweets and deserts. If taking a birthday off doesn’t work for some employees, give them the option of swapping it for another day. Or consider simply giving them days off for other “special” events, like wedding anniversaries or family reunions.

7. On-site Health Screenings

Responsibilities at work and home leave little time for employees to tend to their physical health. Help them by scheduling on-site health screenings — mobile units that come to your place of business to serve employees. There are mobile units for everything from dental checks to mobile mammograms. Although hospitals and health organizations run many mobile units, some services are privately owned. So, costs will vary. Check with local hospitals or specialized health centers in your area to see if they have a dedicated mobile unit for hire. And if you’re already required to run employee screenings for vaccinations, physicals, or drug testing, try rolling these services into the same mobile service to save money.

8. Mental Wellness Days

Employees feel like “sick days” only refer to physical ailments that reflect the misguided attitudes we have towards mental health in the workplace. We don’t treat mental health the same as physical health. Yet an employees’ mental health affects their work performance just as much, if not more, as their physical health. But aside from simply offering days off, invest in your workers. Offer free on-site meditation or yoga classes. Hire professional therapists to provide workshops and training on stress management and mindfulness. And encourage your workers to take free mental health tests to identify problems before they get worse.

Why Should Small Businesses Offer Wellness Benefits?

It seems the workforce is finally recognizing the importance of prioritizing mental and physical health. Since employees of smaller businesses tend to have larger workloads, their bosses must pay extra attention to their overall well-being. Fewer sick days, however, are far from the only reward of incorporating wellness-related perks.

Here are six more reasons for small businesses to incorporate wellness benefits:

1. Gain a Competitive Edge

When you make wellness part of your company culture, you will stand out among your competitors. It’ll show your employees and potential recruits that you genuinely care about your employees. You will also boost morale and help create a positive work environment for everyone.

2. Small Business Wellness is Now Affordable

There’s been a long-standing debate over whether or not a small business could even afford to put a wellness initiative into its budget. The costs of healthcare in small companies are shared by both the employer and employee. But any healthcare professional will tell you that the cost of reactive healthcare dwarfs the cost of proactive healthcare. In other words, waiting until serious health issues arise to fix them costs more money than preventing such problems from arising at all. Spending on wellness now lowers the expense of employee illness later.

3. Improve turnover rates

In small businesses, the internal culture is generally reminiscent of a family bond. For this reason, when you include opportunities for your employees to participate in their health and wellness actively, that relationship gets stronger. Showing your team that you don’t just care about when they punch in and punch out will make them want to stick around.

4. Boost productivity

When your staff is excessively stressed, their productivity suffers. Offering wellness as part of your company policy makes employees more likely to seek healthy ways to manage stress. These health-conscious initiatives will remove potential productivity issues before they arise.

5. Promote a healthier workforce

In a small business, when people are absent, it doesn’t go unnoticed. Having unplanned absences can negatively affect your entire workforce, leaving already-busy workers to pick up the duties of those out sick. Let’s not forget that these unforeseen events can incur high costs if overtime is necessary to complete tasks. Having a wellness program in place will help combat the many factors that go into illness-related absences. Healthier people are only less likely to miss work.

6. Your workforce will be happier

Incorporating a wellness program in your workplace can bring your employees together. For example, you could set health-related challenges for your team that encourage them to work together. These goals can build a strong sense of teamwork among co-workers.

Creating a work-life balance that allows them to support their family while maintaining quality time with their children is ideal for working mothers. When the company they work for recognizes those challenges and wants to help them navigate their new situation, it can build a sense of ownership and loyalty that encourages them to stay with you—doing this helps prevent the costly expense of turnover. Companies, both small and large, can find ways to support working mothers in their business.

What Benefits Can Be Added To Support Working Mothers?

-

Give her maternity leave

The first few weeks of a baby’s life are crucial for brain development and growth. The best thing for a baby is to be with her mother as much as possible. The rapid growth occurring in these first few months of the baby’s life creates healthy neural connections that will support her later. Recovery from pregnancy and delivery also is a concern for the working mother on your team. Having ample recovery time without feeling pressured is essential to both her physical and mental recovery.

Nationwide, certain qualified workers at companies with over 50 employees are required to be given 12 weeks of unpaid family leave. Some states additionally require paid family leave. While small businesses are exempt from these requirements, creating a benefit that works for you and your employees can pay off in the end through the retention of your experienced and valuable workers. Look into options such as temp agencies or contract workers to help fill in the gaps where needed.

-

Let her work from home

Working from home is quickly becoming the norm instead of the exception for lots of companies. Technology makes it easier than ever to stay connected in real-time. Creating work-from-home opportunities, especially for those small businesses that cannot offer a parental leave benefit, may be just the ticket. If the work can be done remotely, consider whether this may be the ideal solution. More than ever, companies in 2020 are building secure online work-task systems into their business structure. Also, many new startups are operating without a central office. Building in set check-in meetings and teleconferencing calls can help keep everyone on task and accountable for weekly or daily projects.

-

Offer flexible workday schedules

With children, inevitably, emergencies arise. They can get sick at daycare, have a problem at school, or a caregiver can cancel at the last minute. Parents appreciate having the flexibility to deal with the issues that pop up, without the stress of wondering what it’s doing to their work relationships. Flexible scheduling can be an attractive benefit for non-parents as well. Giving your workers ownership over how they manage their work schedule can help employees avoid burnout, but it can help them feel valued and build a greater sense of investment in your company. Try offering options to work weekend days, evenings, or longer days with shorter weeks.

-

Offer lactation rooms

Some larger companies have added private lactation lounges for their working mothers. These rooms provide a private space for breast pumping. They come equipped with comfortable chairs, soothing décor, sinks, cleaning products, hospital-grade pumps, refrigerator storage, and more. Even smaller companies can offer this benefit by installing privacy pods like those made by Mamava for nursing or breast pumping. The Fair Labor Standards Act requires that new mothers have a private space and time for breast pumping. Setting aside a place designed just for lactation offers the best option for privacy, comfort, and employee peace-of-mind.

-

Train your managers

Research has shown that working mothers often find themselves having to prove their value and abilities upon returning to work from maternity leave. Joan C. Williams and Rachel Dempsey, authors of “What Works for Women at Work,” say managers unconsciously can create a work situation in which these returning mothers are asked to work harder than before to show both leaders and colleagues that they’re still capable of doing the job and equally as dedicated to it, which ends up injuring their perceived value to the company.

Educating managers on this unconscious bias and offering coaching to help them avoid this behavior can help head it off before it happens. Adopting fair and uniform work performance expectations and evaluations also can help.

-

Offer mentoring

For first-time mothers, going back to work can pose significant challenges. She may feel torn between being home with her baby and advancing her career. Providing mentorship and networking opportunities with working mothers who have been there and leadership development opportunities for working mothers can help. It can offer new mothers pathways to manage work responsibilities while juggling the demands of a new infant. It can also keep communication open to avoid scheduling problems, conflicts with managers, or other issues that may arise.

-

Consider a daycare benefit

If you have enough working parents with young children in your company, it may be valuable to offer a daycare benefit. It doesn’t mean that you need to host one on-site. There are plenty of ways to make childcare options easier for working mothers. Consider offering a subsidy for the cost of childcare – which can earn your company a tax break. The benefit is highly attractive to employees who would otherwise be stuck with those out-of-pocket costs. Other benefits include Flexible Spending Accounts (FSAs) or emergency childcare backup plans for a set number of days. Large companies sometimes create small daycare centers in house. Even some small businesses with a high percentage of working mothers have set up in-house daycare. They did so by hiring a childcare worker and setting aside space – all deductible.

Keeping good communication with your working mothers to help support their needs can resolve many conflicts. It can resolve scheduling, childcare, management, workload, and other issues before starting. Being proactive, innovative, and enthusiastic about your offerings also can build a great company culture. After all, your goal should be to attract and retain the hardworking people you need.

How Should Small Businesses Deal With Difficult Employees?

All entrepreneurs will deal with difficult employees at some point. Sometimes, you can correct the employee’s behavior and gain their loyalty as a result. But some employees just aren’t in the right place at this time in their lives. Either way, you can only figure out whether the employee should stay or go by applying a formal process to the situation.

What Do You Mean By “Difficult?”

A problematic employee could be someone who is not performing to company standards. Toxic employees may be technically proficient, but their lousy attitude ruins the work environment for everyone else.

Then you have employees who engage in illegal or unethical behavior, like showing up to work intoxicated. Employees like this must be dealt with immediately. You cannot keep an employee who endangers your customers and other employees’ health or overall well-being.

Identifying Difficult Employees

You can’t address what you don’t know. But if you provide regular feedback and performance reviews, performance issues won’t surprise you.

Watch and listen to how your employees interact with each other and their customers. Do employees tend to shy away from working with the same employee?

Don’t just hope that difficult employees will resolve their own issues without outside management. According to employee management consultant Erika Andersen, “Most managers will spend months, even years, complaining about poor employees… and not ever give them actual feedback about what they need to be doing differently.”

Don’t be that manager.

Getting On the Path to Change

Now that you’ve identified a problematic employee, it’s time to act. Start by listening to them. Don’t assume that you’re aware of the entire context for their behavior.

Instead, ask them how they feel about any recent changes to their routine. How do they feel about using the new medical billing codes? How has the teamwork been with the new subcontractors? Does the new waitress feel overwhelmed by the size of her station?

Listening is especially essential if the problematic behavior is out of character. Is your ordinarily cheery employee short-tempered lately because her child is having school problems? You won’t know if you don’t ask.

You may find that showing empathy is all the employee needs to get back on track.

Be Precise With Employees

A thorough understanding of the employee’s problem allows you to be more precise about where they’re missing the mark. Don’t personalize your comments. Something like “You have a bad attitude” isn’t helpful and will only put your employee on the defensive.

Instead, you might say: “I noticed you often refuse to bus tables when we’re busy, or “I overheard you making unkind comments about [patients/customers/coworkers, etc.].”

Be specific about which goals or tasks aren’t being executed to your company’s standards. As long as you frame it right, employees will value your feedback. They just want to do a good job!

Then, involve the employee in designing their own solution. Ask them if they feel they need additional resources or support. Can they identify specific aspects of their own behavior that would help them change?

Employees will often recognize when challenging behavior comes from a personal problem. That’s good news. It means it’s entirely within their power to resolve the issue.

Agree on What Constitutes Positive Change

Now that you’ve talked about what needs to be done, it’s time to document the plan you’ve created together. This plan should explain:

- Which standards aren’t being met

- What the employee will do differently moving forward

- What kind of results will denote a positive change

The plan must also be time-sensitive. Remember our overwhelmed waitress? If the idea is to give her a smaller station, define precisely which new tables will be added and when. What’s the final date by which she should be handling a full station?

Next, outline the consequences if the behaviors aren’t changed, and new goals aren’t met. Let’s say an employee is consistently late. Their plan might specify that they’ll be terminated if they’re late two more times over the next month without good reason.

Know When to Let Them Go

No one wants this to happen. But remember when I mentioned that ignoring bad behavior is no way to deal with difficult employees? Well, letting it go on after you’ve worked to fix the situation falls into this category.

Is the employee refusing to acknowledge that they need change? Or that there’s even a problem? Did they agree to the change plan, but didn’t make any actual changes? If so, this just might not be the position for them.

Your change plan clarified the conditions that would result in dismissal. Hence, no one should feel surprised when it arrives. The truth is, some situations just can’t be fixed.

In this case, let the employee go respectfully. Then, use this as a learning experience when searching for your next hires.

Should You Hire Full-Time Employees or Independent Contractors?

Boosting productivity and efficiency is much easier with an appropriately-sized team. More and more business leaders realize that assigning particular responsibilities to 1099 workers instead of full-time W2 employees makes more sense.

The former option is often much cheaper and puts fewer legal obligations on the employer. This is just one of the many differences between the two types of employees. And like other important business decisions, the cheaper option isn’t always best.

This section will explain the differences between 1099/W2 employees and which positions suit each type of employee.

What is a 1099 Worker?

1099 workers are also known as independent contractors because they are technically self-employed. The name “1099” comes from the form they receive from their employer to report income on their personal tax returns. Tax deductions do not come out of the employee’s paycheck, saving the employer from paying payroll taxes. 1099 workers must, therefore, put money away and pay taxes themselves.

The lack of deductions makes 1099 workers ineligible for employee health insurance and other fringe benefits like retirement plans. In most cases, employers enlist independent contractors to work for a defined period. That time frame, along with several other conditions, makes up the employee’s contract, hence the name “contractor.”

This includes the conditions for termination. Since independent contractors usually fulfill specific tasks, the only grounds for termination are failing to meet their outlined obligations.

Independent contractors can work on one or multiple projects at a time. Some of them continuously work for the same or a select few employers because they have a mutual arrangement that both parties enjoy. The employer can renew the employee’s contract as many times as he or she likes.

Common examples of independent contractors are freelancers who are not sole proprietors. To clarify, that means any freelance copywriter, graphic designer, consultant, etc. who doesn’t have their own business.

What is a W2 Employee?

A W2 employee is a typical employee when it comes to salary, taxes, and benefits. While 1099 workers are technically self-employed, W2 employees work for your company and are therefore eligible for employee benefits. Most individuals who work for companies are W2 employees.

Payroll taxes are deducted from W2 employee paychecks, which is just one reason W2 employees are the more expensive option. Employers must also supply the required equipment for W2 employees, whereas independent contractors must provide their own equipment. When a W2 employee acquires a work-related expense, he or she is usually reimbursed by the employer. Since independent contractors are their own bosses, their employers typically do not reimburse them for business expenses, though their contract terms can say otherwise.

Unlike independent contractors, W2 employees can be fired for virtually any work-related, non-discriminatory reason. An employer can fire a W2 employee even if he or she is performing well.

Are Your Employees 1099 or W2?

You’ve just hired a new employee or have finished assembling your initial team. It’s now up to you to decide whether your employees are independent contractors or W2 employees. For many business owners, this is not a simple decision. The line between the two options can get blurry very quickly.

But it is a critical decision, as the penalties for misclassifying workers can be quite severe. Let’s say the IRS finds out that someone who should have been classified as a W2 employee was instead classified as an independent contractor. You’d have to pay a portion of the income taxes that should have been deducted from the worker’s paychecks, in addition to interest, penalties, and your share of FICA and unemployment taxes. If the IRS deems your misclassification as “willful,” you’d have to pay the full amount of the unpaid income taxes.

To help employers classify employees correctly, the IRS lists three main factors to consider:

- Behavioral – Does the employer control when, where, and how the employee does their job?

- Financial – Does the employee receive a flat fee or salary? Who pays for tools and other business expenses?

- Type of relationship – Does the employee receive benefits? Are the terms of the relationship outlined in a contract or other form of documentation?

Still Not Sure?

If you’re still unsure whether an employee is 1099 or W2, you can file a Form SS-8 with the IRS. The IRS will then consider the circumstances of the position and conclude classification. It can take at least six months for the IRS to issue their decision, but the form is highly recommended for employers who plan on hiring more individuals for the same unclassified position. The sooner you file the form, the sooner you can hire more employees.

1099 or W2: Which Does Your Business Need?

The differences between the two types of employees make it easier to deduce each option’s pros and cons. This section will go over the most significant advantages and disadvantages of independent contractors and W2 employees.

1099 Worker Advantages

- Lower Costs – Employers do not have to pay payroll taxes or provide benefits to independent contractors. And since independent contracts are meant to be hired for a specific period, you don’t have to worry about paying someone to sit at a desk and do nothing all day. For every minute, independent contractors are under your employment, they are actively working and contributing to revenue.

- Experience – Independent contractors usually work on individual projects or a specific type of project. In other words, they are more likely to have extensive experience with particular tasks. So, if you are looking for someone to tackle a specific, relatively advanced project, an independent contractor may be the better choice.

- Flexibility – The relationship between employers and W2 employees does not have a specific time frame. You technically have no idea how long they will work for you. Independent contractors, on the other hand, can be hired until a project is finished.

- Less Legal Risk –Independent contractors cannot receive workers’ compensation coverage or other benefits. The terms of the relationship are clearly defined in a contract. Like a wrongful termination claim, the likelihood of a work-related lawsuit is much lower than with a W2 employee.

W2 Employee Advantages

- Work On Your Terms – A big reason W2 employees are more expensive is that you pay for them to play by your rules. The employer controls when they work, where they work, and how they do their jobs. While independent contractors are only loyal to their contracts, W2 employees are loyal to their employers, in exchange for benefits and a steady paycheck.

- More Flexibility – Independent contractors technically do not have to do any work that isn’t in their contract. W2 employees, on the other hand, gradually take on more work and learn new skills. Though they might not have an independent contractor’s expertise, W2 employees are more willing to put in the extra effort when your company is ready to grow.

- Clearer Picture Of The Future – Once you hire a W2 employee, you don’t have to worry about continuously finding someone else to handle that employee’s responsibilities. That element of your business is permanently under control. This takes stress off the employer and gives them more time to concentrate on growing other aspects of the company.

- Company Culture – W2 employees work regular business hours in your location, making it possible to train them in company culture and other important policies. Company culture has proven essential for growth, but only if employees clearly understand your standards and goals.

Key Factors That Simplify The Decision

Sometimes, a particular aspect of the position you are looking to fill makes it very easy to decide between an independent contractor or W2 employee. Here are a few scenarios in which the nature of the position requires one option over the other:

- Short-Term Projects – If you need help completing a small project, an independent contractor is usually the better choice. Independent contractors tend to have significant experience with specific projects and can, therefore, get the work done faster.

- Employee Must Be On Location – If the employee must work at your location and on your schedule, a W2 employee is usually the better choice. Independent contractors typically prefer to work remotely and on their own schedule.

- Smaller Amount Of Work – Let’s say the open position requires just a few hours’ worth of work per week. In this case, an independent contractor would be the better choice because there’s not enough work to justify the cost of a W2 employee.

- Job Requires Training – Many companies incorporate systems and methods known only by their team members. In this case, a W2 employee would be the better choice because it requires exclusive company training.

Conventional vs. Unconventional

As you can see, independent contractors are often the better choice when the job is less conventional. W2 employees are the better choice when you need help with ongoing, time-consuming tasks. Knowing when to choose either option will take a lot of stress off your shoulders because amid your many other cash flow issues, at least you can say you aren’t overpaying for labor.

Managing Employees: An Endless Journey

There is always more you can do to get the most out of your employees. Smaller businesses must take exceptional care of their teams because each individual has a major impact on its success. With the right management style, your team’s size will not stop you from achieving your most precious goals. All the world’s money and resources cannot match a truly loyal and dedicated team’s potential.

Which management tactics did you use to build employee loyalty? Share any tips or resources on our contact page!