Each wholesale club’s card excels for a different type of business. Costco’s program is best suited for companies with heavy travel and dining budgets, Sam’s Club is ideal for fuel-intensive operations, and BJ’s is the most rewarding for frequent in-store buyers with smaller-ticket purchases.

Choosing the right card isn’t just about which wholesale club is closest to your business—it’s about

Running a small business means keeping expenses in check while still stocking up on the necessary supplies to operate smoothly. For many owners, wholesale clubs like BJ’s Wholesale Club offer significant savings by allowing bulk purchases at discounted prices. To make those savings go further, BJ’s also provides its own line of business credit cards, which reward you for BJ’s

A tradeline is any credit account that appears on a credit report. In personal finance, this could be a credit card account, an auto loan, or a student loan. In the business world, business tradelines encompass vendor accounts, business credit cards, installment loans, and revolving accounts associated with your company.

So, how long does it take for tradelines to appear

Chime is a financial technology company that offers personal banking services through a user-friendly mobile platform. While it offers banking features similar to traditional banks, it is not a bank. Instead, it partners with FDIC-insured institutions: The Bancorp Bank and Stride Bank. This partnership ensures account holders receive the same level of deposit insurance as they would with a traditional

A business bank account is a financial account used to manage a company’s funds. Unlike a personal checking account, a business account separates personal and professional finances, essential for accurate recordkeeping, tax reporting, and liability protection.

ChexSystems is a consumer reporting agency governed by the Fair Credit Reporting Act. It collects data on closed bank accounts, unpaid overdraft fees,

A commercial loan could refer to any business loan, or it might specifically refer to larger loans for enterprise-level businesses. In either case, it’s essential to know the types of commercial lending available, such as term loans, lines of credit, and equipment financing.

The specific purposes for which you need the funds largely dictate which loan you should get. A

Most lenders require a personal guarantee for loans that don’t have collateral. But signing one means that the lender can come after your personal assets if the business defaults on the loan.

You might be wondering if there are business loan options that don’t have a personal guarantee requirement so you can protect your valuable assets. While your options are

As a small business owner, you have many equipment financing options. While it’s good to have options, finding the best lender for your specific needs can be daunting.

The information in this guide can act as a starting point for researching the best lender options. You can also apply to a business lending marketplace, which will match you with the

Payroll factoring is a viable way for a business owner to avoid paying their employees late. It helps keep your business legally compliant while maintaining high employee satisfaction.

However, you should be prepared for the extra costs. It’s not a permanent solution in most cases and should be used to help overcome temporary working capital issues.

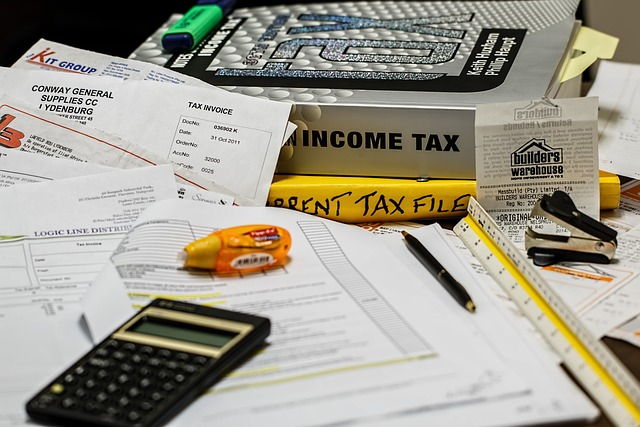

Looking at your gross revenue compared to your after-tax income can be jarring. However, there are actions you can take to help reduce your taxes and keep more of your hard-earned money in your pocket.

This guide provides tips and strategies for effective tax planning and saving money. We should note that the following is for informational purposes only and