What We Already Know About EIDLs

Before outlining the new requirements for EIDLs, let’s go over what hasn’t changed. You can borrow up to $2 million, your interest rate will be 3.75%, and the maximum term is 30 years. Like standard business loans, your terms will be based on cash flow and other factors that can affect your capacity to repay the loan. The first monthly payment you make will be deferred a full year from the promissory note’s date. There are no fees, including prepayment penalties, and collateral is not required.

Unlike traditional SBA Loans, EIDLs cannot be accessed through banks and other third-party lenders. Instead, you must apply directly through the SBA’s website.

What Are The New Requirements for EIDLs?

Before the CARES Act, eligible businesses had to prove that they could not obtain loans or credit from other sources and did not have enough cash or credit to cover operational expenses independently. This highly restrictive requirement has now been waived. Thus, someone with an existing credit line could still be approved for an EIDL.

While EIDLs have traditionally only been available for registered entities (LLCs, corporations), they can now be accessed by sole proprietors, tribal businesses, cooperatives, and even independent contractors. One requirement that hasn’t changed is that EIDLs are only available for businesses with up to 500 employees.

Potential borrowers also previously had to provide their tax returns, and approval was largely based on their cash flow and general financial standing. Thanks to the CARES Act, both of these requirements have been waived as well. Approval decisions are now primarily based on the applicant’s personal credit score. This is expected to shorten the loan approval process dramatically. You can even be approved for EIDLs with previous bankruptcies on your record.

If you apply for an EIDL under $200,000, you can be approved without a personal guarantee.

What Are The New Provisions for EIDLs?

Arguably the most noteworthy new provision of EIDLs is the availability of $10,000 emergency cash grants. If your application is approved, you can request an advance of up to $10,000 of your borrowing amount that must be distributed within three days. If your application is denied, you can still request an advance of up to $10,000.

Here’s where it gets interesting: even if your original EIDL application is denied, the entire amount can be forgiven if it is used for any of the following purposes: covering payroll, compensating employees on paid leave, covering increased costs related to supply chains, or mortgage or lease payments. Essentially, the grant can be forgiven if you can safely claim that Covid-19 caused your business to lose revenue. This means you get the money and don’t have to pay any of it back.

The deadline for the emergency grants is December 30, 2020.

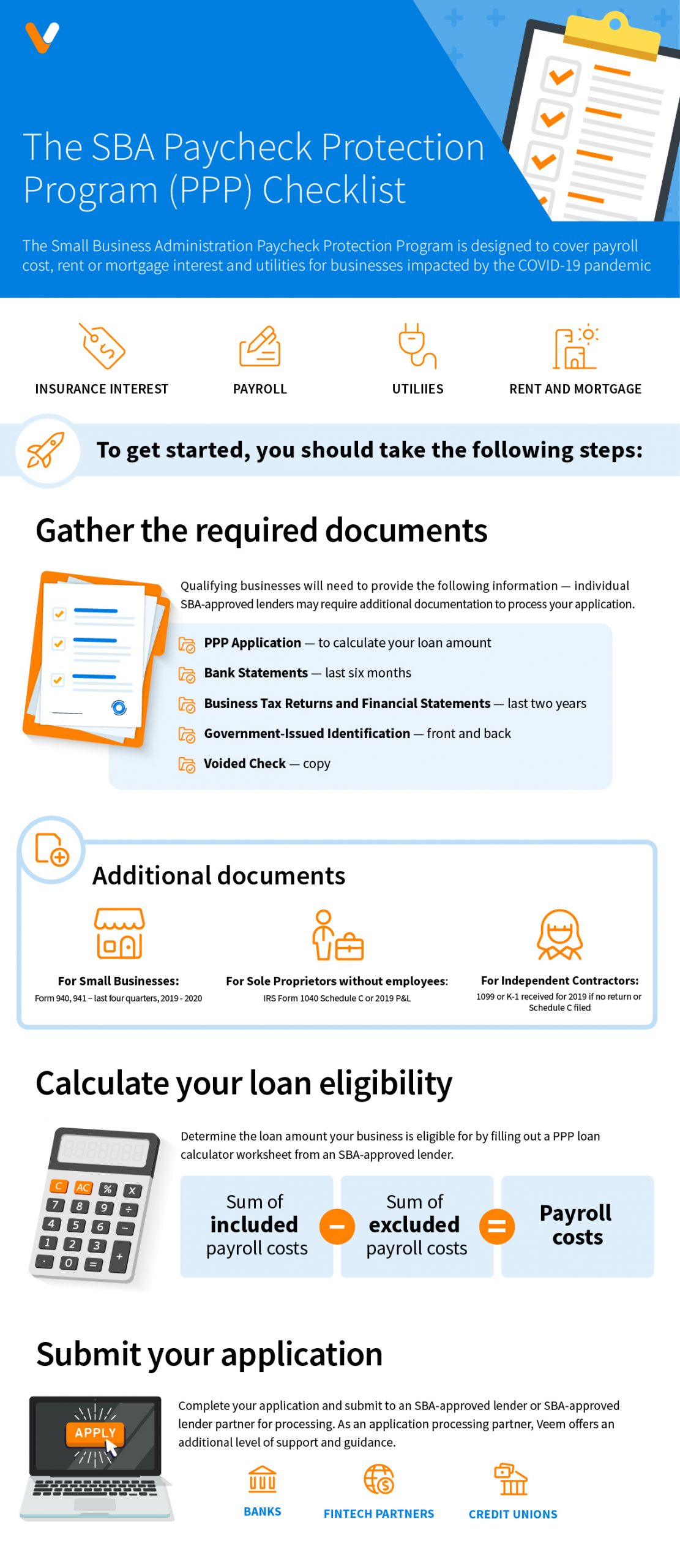

What Is The SBA’s Paycheck Protection Loan Program?

Since EIDLs can only be accessed through one source, the SBA is already flooded with applications. It’s unclear how long it will take them (on average) to approve and distribute funding. Applicants may have to wait at least three weeks to learn whether or not they’ve been approved.

Thankfully, the CARES Act’s Paycheck Protection Loans will be available through banks and other third-party lenders. According to Forbes, the SBA is currently working with approximately 1,800 lenders who will soon offer the program. The goal is for loans to be approved and distributed in just a few business days.

As for requirements, Paycheck Protection Loans are available for businesses with up to 500 employees, and your business must have been in operation before February 15, 2020. Sole proprietors, independent contractors, and virtually self-employed individuals are eligible.

There are no fees (including prepayment penalties, and there is no need for a personal guarantee or collateral.

The maximum borrowing amount is $10 million. However, most businesses can only receive up to 2.5 times their average monthly payroll costs for the one year before the loan is distributed. The maximum interest rate is 4%, and the maximum term length is ten years.

Like EIDLs, Paycheck Protection Loans are designed for businesses looking to cover payroll, rent, utilities, medical leave, and other operational expenses. You can also use the funds to make interest payments on other debts incurred before February 15, 2020. In other words, applicants must clarify that they will not use the funds for expansion-related investments, like marketing campaigns, renovations, or purchasing an additional property.

Can Paycheck Protection Loans Be Forgiven?

Part of the loan may be specific if it and as income to you and if conventional during the first eight weeks after distribution. You must also spend this portion of the loan to cover rent payments, utility bills, health insurance premiums, or payroll for employees who make less than $100,000 per year. The rent and utility payments must go towards leases and services arranged before February 15, 2020.

However, there are several additional, fairly complicated requirements you must meet to qualify for forgiveness.

First, you must maintain the same average number of employees for the first eight weeks after the loan was distributed as you did from February 15, 2019, to June 30, 2019, or from January 1, 2020, to February 15, 2020. You can still have part of your loan forgiven if you don’t meet this requirement, but the portion will be reduced.

Your forgiven portion will also be reduced if you decrease the compensation for employees who make under $100,000 by more than 25% compared to what they made the previous quarter.

But, if you decreased employee compensation from February 15, 2020, to April 26, 2020, your forgiven portion won’t be reduced if you rehire employees you laid off or restore compensation to its previous amount by June 30, 2020.

As we said, these provisions for loan forgiveness are very confusing. We strongly recommend confirming with your accountant before assuming you qualify for forgiveness.

The application deadline for Paycheck Protection Loans is June 30, 2020.

Is There a Credit Check For Paycheck Protection Loans?

The SBA is yet to clarify whether there will be a minimum credit score requirement for Paycheck Protection Loans. But, given the importance of credit score for obtaining EIDLs, it’s safe to assume there will be a credit check for these loans as well. The SBA’s most popular loan, the 7(a) Loan, currently requires a FICO SBSS score. Unlike an individual credit score, a FICO SBSS score factors in all owners’ personal credit with 20% or more ownership, the business’s credit score, and the business’s general financial standing. Still, it’s unclear whether the credit check for Paycheck Protection Loans will involve your personal credit or FICO SBSS score.

Can I Still Qualify With No Employees?

Sole proprietors, independent contractors, and other self-employed individuals can qualify for Paycheck Protection Loans. But if you have zero employees, you must provide additional documentation that may include payroll tax filings and 1099 forms. Sole proprietors must also provide documentation of income and expenses.

Can Franchises Qualify For Paycheck Protection Loans?

Franchises with multiple locations may be eligible, even if they collectively have more than 500 employees. However, the loan would likely go to individual locations, as opposed to the franchisor. Any business currently receiving assistance from a Small Business Investment Company (SBIC) can also be approved with over 500 employees.

Can New Businesses Qualify For Paycheck Protection Loans?

If your business did not begin operating until after June 30, 2019, you could apply for an amount based on your average total monthly payroll costs from January 1, 2020, to February 29, 2020. Then, multiply that number by 2.5.

The only “new” businesses that are not eligible are those that began operations after February 15, 2020. This requirement was designed to prevent people from starting new companies with money from either of the two programs (EIDL and Paycheck Protection Loans).

What About Seasonal Businesses?

If you have a seasonal business, you can apply for 2.5 times your payroll from February 15, 2019, to June 30, 2019.

When Do You Start Making Payments?

Financial institutions must defer payments for a minimum of six months and a maximum of one year, including interest. This means you don’t have to make payments for at least six months to one year.

What Does Payroll Include?

Another extremely confusing aspect of Paycheck Protection Loans is the criteria for determining borrowing amounts. We’ve established that most businesses can apply for 2.5 times their average monthly payroll costs for the past 12 months before the loan was distributed.

But what does monthly payroll include? Is this just the employee’s salary, or their benefits as well? What if several employees went on vacation during these 12 months?

Let’s clear this up by listing which costs can and cannot be factored into monthly payroll costs. According to the CARES Act, payroll includes:

- Salary, wage or similar compensation,

- Payment of cash tips or equivalent

- Payment for vacation, parental, family, medical, or sick leave;

- Allowance for dismissal or separation;

- Provisions of group health care benefits, including insurance premiums;

- Payment of any retirement benefit;

- Payment of State or local tax assessed on the compensation of employees; plus

- The sum of payments of any compensation to or income of a sole proprietor or independent contractor that is a wage, commission, income, net earnings from self-employment, or similar compensation and that is in an amount that is not more than $100,000 in 1 year, as prorated for the covered period;

On the other hand, payroll does not include:

- The compensation of an individual employee over an annual salary of $100,000, as prorated for the covered period;

- Certain taxes imposed or withheld during the time period

- Any compensation of an employee whose principal place of residence is outside the United States;

- Qualified sick leave wages for which a credit is allowed under section 7001 of the Families First Coronavirus Response Act (Public Law 116–6 127);

- ‘Qualified family leave wages for which a credit is allowed under section 7003 of the Families First Coronavirus Response Act (Public Law 116–12 127);

What Do Utilities Include?

In addition to payroll costs, another primary purpose of Paycheck Protection Loans is covering utility bills. According to the CARES Act, utilities can include electricity, gas, water, transportation, telephone, and internet services. To qualify, your business must have been receiving services before February 15, 2020.

Can I Apply For Both Loans?

The only businesses that can receive both EIDLs and Paycheck Protection Loans are those that are currently using an EIDL for purposes unrelated to Covid-19. An example would be using an EIDL to recover from damage sustained from floods or tornadoes. Aside from this scenario, the answer is no. Businesses cannot receive EIDLs and Paycheck Protection Loans.

Other Provisions of The CARES Act

The CARES Act also includes a payroll tax credit of up to 50% of wages, but only for certain businesses. To qualify, your business’s operations must have been fully or partially suspended by government order, or your gross receipts for a recent quarter must have fallen at least 50% compared to the same quarter last year.

Businesses cannot receive the tax credit as well as Paycheck Protection Loans. As for EIDLs, it’s probably safe to assume that the same rule applies to the previous section. You can only receive an EIDL and the tax credit if the EIDL is being used for purposes unrelated to Covid-19.

Which Documents Do I Need To Apply?

The SBA hasn’t clarified which specific documents are needed to apply for Paycheck Protection Loans. But based on the required documents for traditional SBA 7(a) Loans, business owners looking to apply for Paycheck Protection Loans should probably prepare the following:

- Financial statements – interim 2020 income statement and balance sheet and full-year 2019 income statement and balance sheet

- Tax returns – last three (3) years of federal returns for business

- 2019 payroll information

- Current organizational documents – such as Bylaws, Articles, and Operating Agreements

- General liability insurance information

- Current building lease and any amendments

What If I Need Funding Right Now?

EIDLs and Paycheck Protection Loans are logical funding solutions for several reasons. As long as you have a high credit score, both options are effortless to qualify for, especially compared to traditional SBA 7(a) Loans. Second, they offer low interest rates, longer terms, and no fees. Lastly, many traditional and non-traditional lenders have reportedly paused funding or are only lending to certain industries.

However, some business financing companies are still working with businesses from virtually all industries. Their products may be just as easy to qualify for as EIDLs and Paycheck Protection Loans.

Also, even though Paycheck Protection Loans will soon be available at thousands of lenders, they are not available at all of those lenders right this moment. If your small business needs funding as quickly as possible, it may be in your best interest to consider other options.

Business Line of Credit

Regardless of the economy’s state, business lines of credit are usually one of the most accessible sources of funding. Business lines of credit require less documentation than business term loans, and you can be approved with rocky cash flow and subpar personal credit. Some companies can even approve and distribute lines of credit in under 24 hours.

Unlike business term loans, you only have to make payments when you borrow funds. However, the full credit line is always available. Most business lines of credit are also revolving. This means your balance replenishes every time you pay back what you borrowed the previous month.

This makes a business line of credit a sensible option for businesses that haven’t seen their revenue plummet just yet but want to prepare for this unfortunately probable scenario. Due to the uncertainty lying ahead, you have to provide recent bank statements before drawing from your credit line. You may also have a brief waiting period before you are approved to draw funds at all.

Short Term Financing

For many lenders and business financing companies, short-term financing may be their most accessible product for the coming months. This makes sense because of the lower degree of risk. Short-term financing products tend to have higher interest rates and terms as short as just three or four months.

The economy may improve dramatically throughout that time frame. Thus, short-term financing could bridge a gap in cash flow until more advantageous funding options become available. You could also use short-term funding to maintain operations while adapting to the new climate (i.e., hiring more delivery drivers, marketing your online ordering capabilities, etc.).

Since longer terms carry more risk, some companies may only be offering short-term financing at the moment, even if you have stellar personal credit and cash flow. In this case, however, you may be offered much lower rates than you’d expect from short-term financing. Don’t be surprised if most companies you speak to aren’t willing to extend terms over one year for any customers.

Small Businesses: Don’t Give Up

While business financing products are definitely harder to come by these days, that doesn’t mean you should stop looking. Even if your longtime funding partner has temporarily paused funding, they should still be able to point you in the direction of other viable options. What helps a great deal is knowing which product makes the most sense for your needs. As long as you continue your search, you will eventually find a company already working with other businesses facing the same dilemma as you.